Bitcoin mining, once known as one of the most profitable businesses, is now going through a rough patch. Amid rising global inflation, increasing energy prices, the crypto winter, and a competitive environment, Bitcoin miners are finding it difficult to remain in business.

While some of the lesser-known names have already closed their operations, leading players are forced to sell their BTC assets to keep the operations going. Bitcoin miners, known for their ‘HODL’ strategy, have now started dumping their digital assets. According to the data published by CoinMetrics, Bitcoin miners collectively own approximately 800,000 coins, a number that is 300% more than the collective Bitcoin holdings of MicroStrategy, Tesla, Galaxy Digital, and Square.

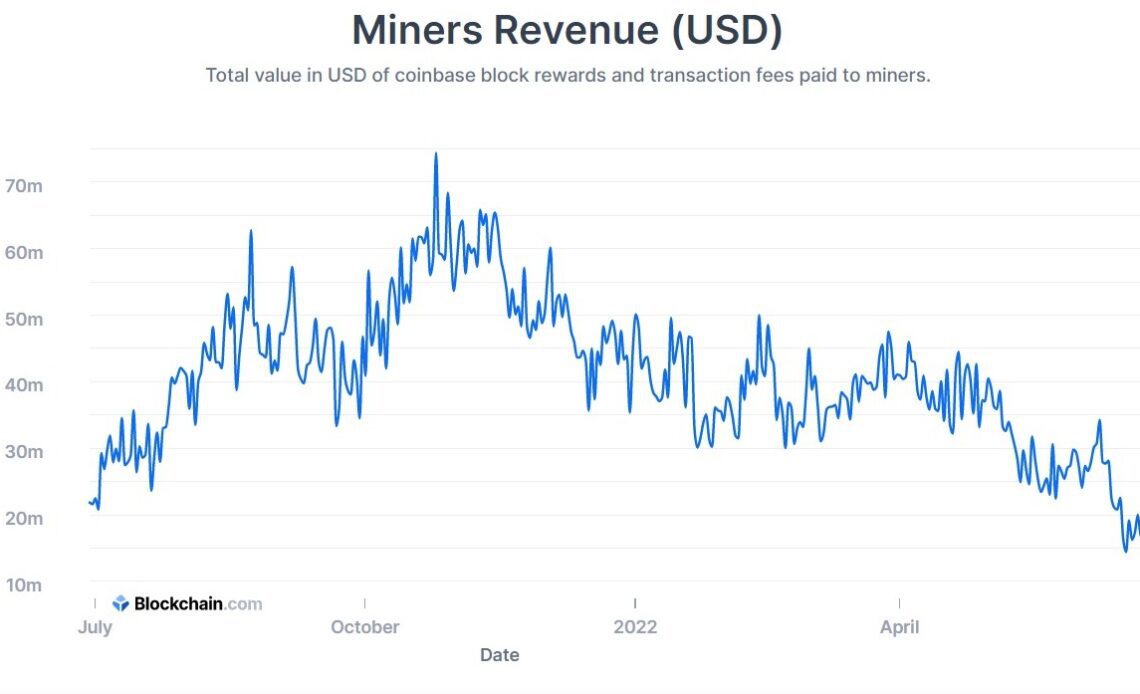

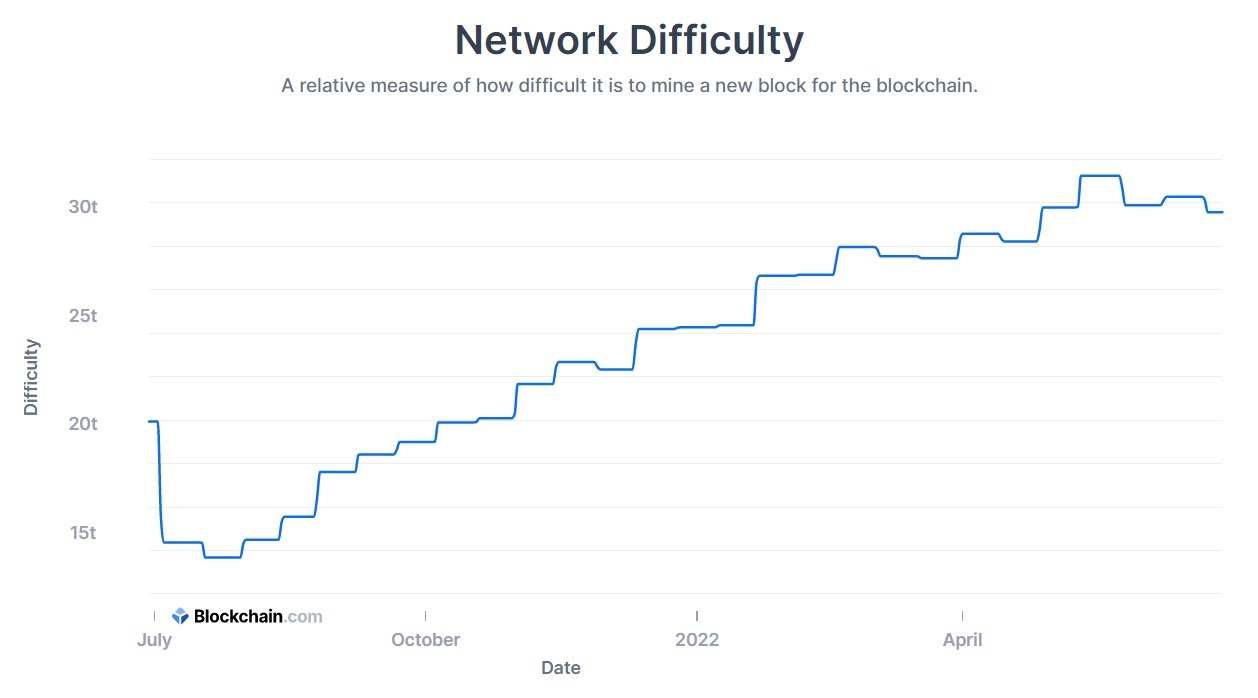

Electricity prices across the US, home to some of the world’s largest mining companies, have increased sharply in the past few months. The price of Bitcoin on the other hand has dropped by almost 70% in the last seven months. These two factors have caused a major drop in the profitability of BTC miners. According to Bitinfocharts, the profitability of Bitcoin miners has slumped by more than 80% since November 2021. During the same period, the network difficulty has climbed substantially.

The Game of Survival

The recent scenario across the crypto market is making it difficult for leading BTC miners to survive without ‘adjusting’ their ‘HODL’ strategy. Islam Shazhaev, CEO of OneBoost, said that selling Bitcoin at a loss is still a better option to survive than leaving the crypto mining industry.

“With rising energy costs, crypto miners will typically have to spend more money to keep their rigs online. This creates a challenging situation as many have to put up their BTC holdings for sale to cover costs. Selling their Bitcoin at this time will imply a massive loss on the part of the miners, particularly the older ones considering prices are still trading well below $25,000. Still, it may help them stay in business for as long as the entire industry will cruise back into profitability. With the current situation, miners will rather sell at a loss than quit mining…