Coinbase won approval to offer cryptocurrency derivative trading to U.S. retail customers, fueling much hope and momentum to the $2.1 trillion cryptocurrency derivative market.

Coinbase’s approval arrived following a significant decline in derivative trading volume due to economic uncertainties, regulatory struggles, and a reduction in risk from high wealth accounts and retail traders.

Derivative trading, such as futures, options, and others, has dominated the cryptocurrency market since 2014 as investors snap at the opportunity to place bets with little investment for a higher percentage return. A large percentage of the derivative market is influenced by retail traders, fueled by manic meme-stock trading and social media trends on platforms such as X, YouTube and Reddit.

Although heavily favoured by institutional investors, who have maintained a fair, open position in the derivative market, Bitcoin exchange-traded funds (ETFs) make up a large share of traded assets.

Futures and options trading have had a fair share in the derivative market, but the recent dominance of copy trading is often cited as a key reason for the high volume of the derivative market over the past few months. Copy trading is slowly evolving into a big tool for retail traders looking to explore the derivative market, as many of these traders favour automated trading over spot or manual trading.

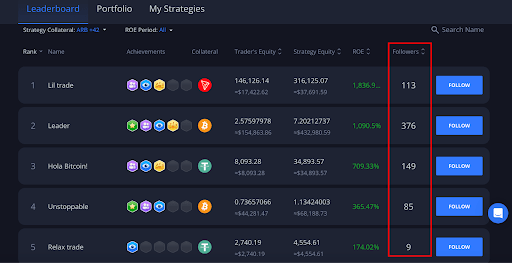

The data from Margex highlights much attention shifting to copy trading as a new strategy for retail traders looking to increase their profitability while leveraging an experienced trader to produce great profit returns with a profit share automated for both the user and pro trader.

Copy Trading And Gen Z Influence On The Derivative Market

Copy trading involves users replicating the trading strategies of expert traders. This method allows users to diversify their portfolios, minimize risk, and increase their profitability in the financial market while trades are executed automatically and instantly.

The idea of copy trading is to enable users to benefit from the knowledge and skills of well-experienced traders. The users work to enhance their trading outcomes or build better trading or investment skills.

Research has shown that 44% of traders are copy traders, signifying an extreme surge of copy trading solutions in the last few years and is greatly influenced by the social age experiencing exponential growth as web3 technologies evolve.

Click Here to Read the Full Original Article at NewsBTC…