Ether (ETH) has seen a 36% year-to-date increase in its price in 2023 in U.S. dollar terms. This recovery, however, is modest given that ETH is currently trading 66% below its November 2021 peak of $4,870.

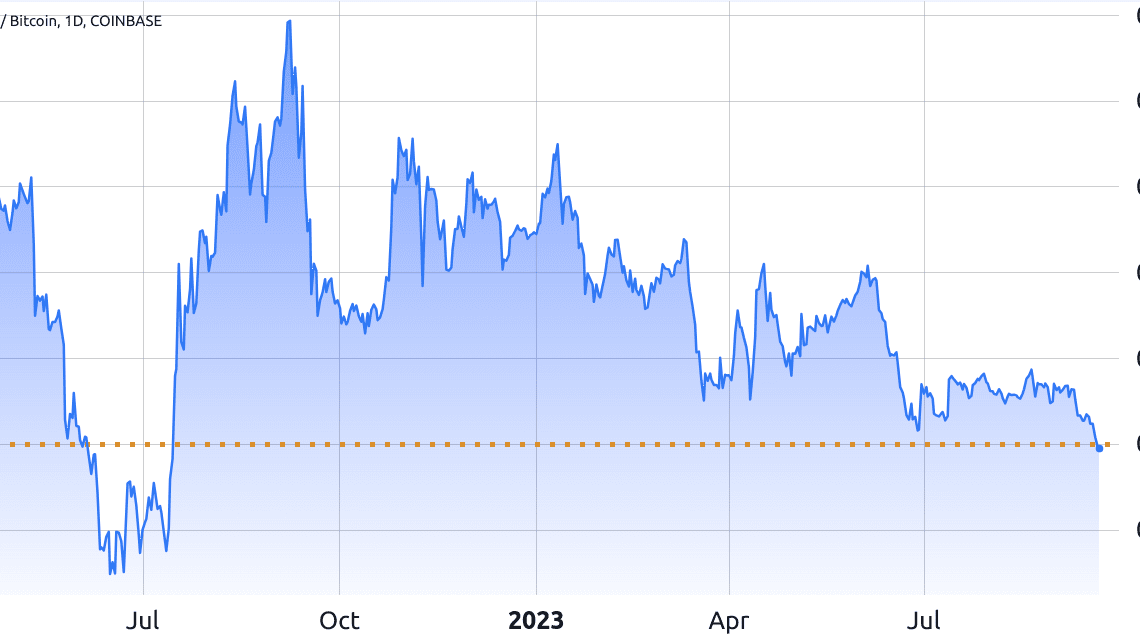

Ethereum vs. Bitcoin: 14-month downtrend and counting

Moreover, on Sept. 20, Ether reached its lowest levels against Bitcoin (BTC) in 14 months, breaching the critical 0.06 BTC support. This has raised questions among Ether investors about the factors behind this price decline and what it will take to reverse the trend.

ETH buyers placed their biggest hopes on protocol upgrades that significantly reduced the need for new coin issuance when the network transitioned to a Proof-of-Stake consensus mechanism.

These hopes were realized in mid-September 2022, resulting in an annualized issuance rate of just 0.25% of the supply. This transformation aligned with the Ethereum community’s vision of “ultrasound money.”

Furthermore, the subsequent Shapella upgrade on April 12 allowed for withdrawals from the native staking protocol, addressing a major concern for investors. Previously, both the 32 ETH deposits and the yield from participating in the network consensus were locked up indefinitely.

Confidence among Ethereum enthusiasts grew as these significant hurdles were crossed with minimal issues. They anticipated that the price of Ether would surpass $2,000, a prediction that came true on April 14.

However, this optimism was short-lived, as ETH’s price promptly fell back to the same $1,850 level just a week later.

Notably, instead of witnessing a net withdrawal, Ethereum staking experienced a net inflow of 3.1 million ETH in the 30 days following the Shappela upgrade, surpassing even the most optimistic expectations.

Given that the Ethereum network’s planned developments have generally been on track, albeit with the customary delays, investors now need to explore other potential catalysts for reversing the current…

Click Here to Read the Full Original Article at Cointelegraph.com News…