We only find out if something is anti-fragile when it either breaks or evolves from adversity; decentralized finance (DeFi) has been through a lot, but it has never been broken. Instead, it established itself as a Darwinian sandbox for battle-testing new and old concepts in finance, economics, governance and property rights for the digital economy.

But what really differentiates DeFi from traditional finance? One of the main differences is how (most, but not all) major protocols treat credit risk.

In the simplest terms, DeFi swaps credit risk for smart contract risk.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Credit risk is part of just about every financial asset in traditional markets, but not so in DeFi. Everything from mortgages to CME corn futures, German bunds and Amazon gift cards has an embedded credit component (and cost). In DeFi, however, your credit record is entirely irrelevant. Your borrowing power in AAVE, for example, is determined only by the value of the collateral you put in. If it falls beyond the threshold and the smart contract functions correctly, your position is liquidated. There is no recourse, no one to call, no place to explain your situation.

On-chain structured products: Full transparency without credit risk

DeFi’s set-up is straightforward for simple financial products, like overcollateralised lending. But how can we implement a zero-credit-risk model and full transparency for products with complex, non-linear payoffs like exotic options and structured products?

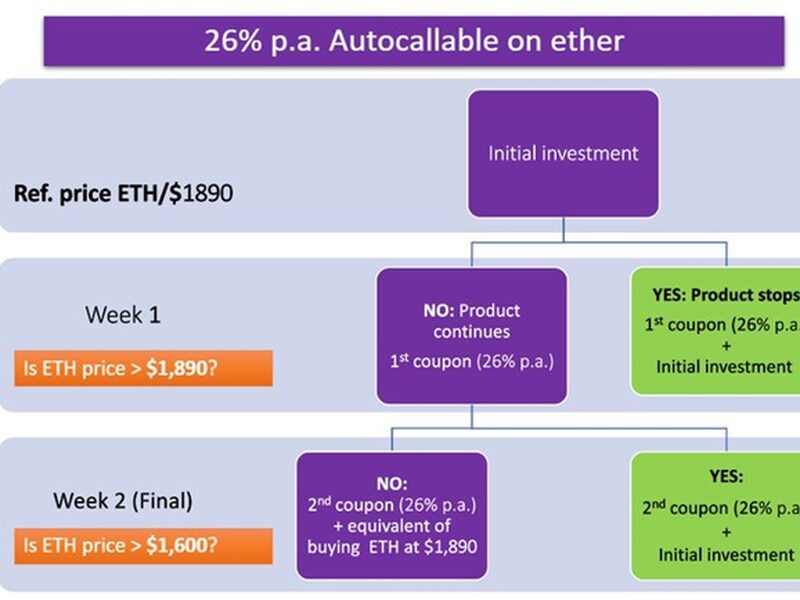

The answer is to place the full payoff on-chain. For example, the latest vault deployed by Ribbon Finance (rebranded as Aevo) reproduces a classic TradFi structured product – the autocallable – in a smart contract. You can see further details here, but the point is that a smart contract executes the product’s conditional payoffs (like “if-this-then-that” statements in code) into the correct address in a transparent way. But most importantly, once the vault is created, neither Ribbon nor the investor have the option to default – i.e., zero credit risk.

Structured products and exotic options are a great example of how DeFi can lean…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…