The Ethereum (ETH) to Bitcoin (BTC) ratio (ETH/BTC) is a pivotal metric, offering insights into the relative strength and market dominance of the two largest cryptocurrencies. Representing the value of one Ethereum in terms of Bitcoin, the ratio serves as a critical tool for investors and analysts to gauge the comparative performance and sentiment towards these digital assets.

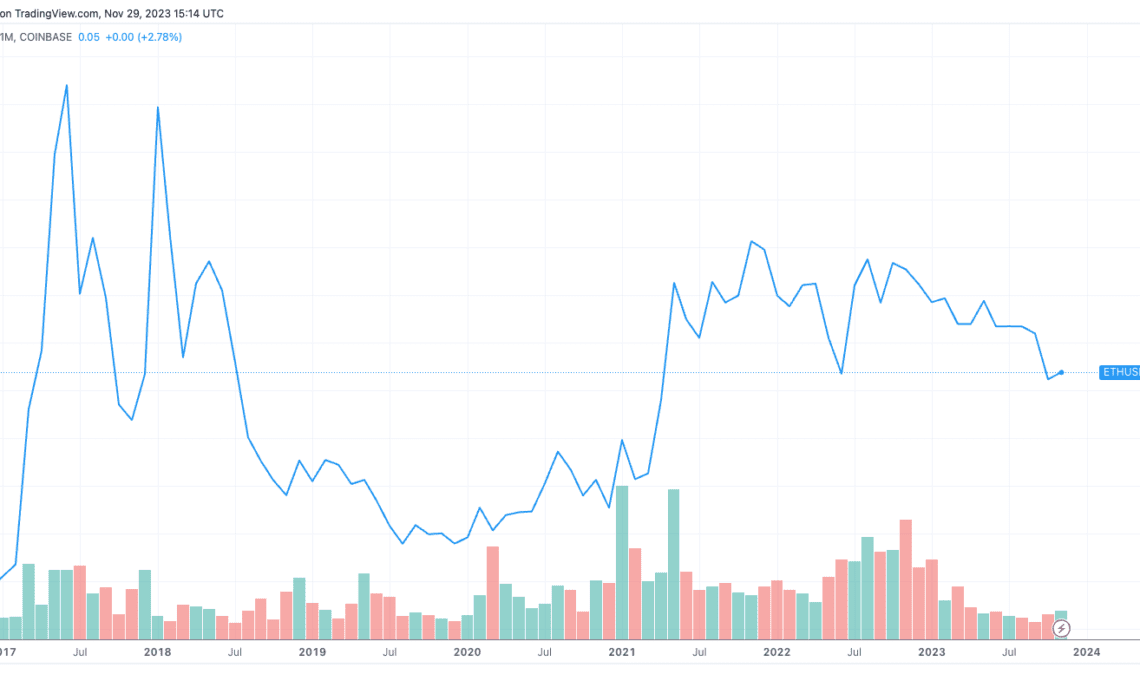

Historically, the ratio has experienced significant fluctuations. It reached its all-time high in June 2017, when Ethereum’s value significantly overshadowed Bitcoin’s. Conversely, Dec. 2016 saw the ratio reach its all-time low, reflecting a time when Ethereum’s value dropped significantly compared to Bitcoin.

However, the overall volatility of this ratio, measured by the standard deviation of its historical closing prices, is relatively moderate. This is indicative of the often parallel price movements of BTC and ETH, as they typically mirror each other’s market trends.

The synchronized movement of BTC and ETH is a defining factor in the observed stability of the ETH/BTC ratio. When both cryptocurrencies experience similar bullish or bearish trends, their ratio maintains equilibrium, underscoring the interdependence in their market movements. This phenomenon is a testament to the correlated nature of the crypto market, where major currencies often share similar market sentiments and external influences.

From Jan. 2020 to Oct. 2022, the ETH/BTC ratio saw an uptrend, attributed mainly to the anticipation surrounding the Merge — Ethereum’s transition to a Proof-of-Stake consensus mechanism. This significant upgrade in Ethereum’s blockchain was viewed as a pivotal step towards enhancing its efficiency and scalability, potentially increasing its value relative to Bitcoin.

However, after Oct. 2022, the ratio exhibited a downward trend. This decline could be a market correction following the high…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…