Bitcoin’s (BTC) 43% rally between March 10 and March 20 surprised options traders and this is proven by the minimal14% of the $1.12 billion open interest set to expire on April 7 being placed at $28,000 and higher.

The positive price movement can be partially attributed to an increase in commodity demand, as investors perceive risks in the central bank’s emergency funding programs, as injecting liquidity causes inflationary upward pressure.

According to Urban Angehrn, CEO of the Swiss Financial Market Supervisory Authority (FINMA), if Credit Suisse had not been rescued, “many other Swiss banks would probably have faced a run on deposits.” Angehrn added that, “there was a high probability that the resolution of a global systemically important bank would have led to contagion effects and jeopardized financial stability in Switzerland and globally.”

Investors’ appetite for commodities vastly increased after the U.S. Treasury Department reportedly discussed the possibility of expanding the Federal Deposit Insurance Corporation (FDIC) insurance for bank deposits on March 21. Oil prices measured by the WTI have rallied 23.5% since March 20, and gold broke above $2,000 on April 5 — its highest daily close since Aug. 2020.

An unexpected shockwave on a $33 trillion asset class that was previously thought to be a safe haven for inflation could have benefited the commodity sector as well. Morgan Stanley Wealth Management has issued a warning about the commercial real estate market, predicting trouble with refinancing.

According to the bank’s report, the sector has been hard hit by increases in remote work and corporate layoffs, resulting in vacancy rates reaching a 20-year high. As a result, investment bank strategists predict a 40% drop in commercial real estate prices and state that “more than 50% of the $2.9 trillion in commercial mortgages will need to be renegotiated in the next 24 months when new lending rates are likely to be up by 350 to 450 basis points.”

Bitcoin bulls may have benefited from increased demand for inflation protection, but some may have squandered the opportunity by placing size bets of $30,000 or higher.

Bulls placed 85% more bets, which did not translate to victory

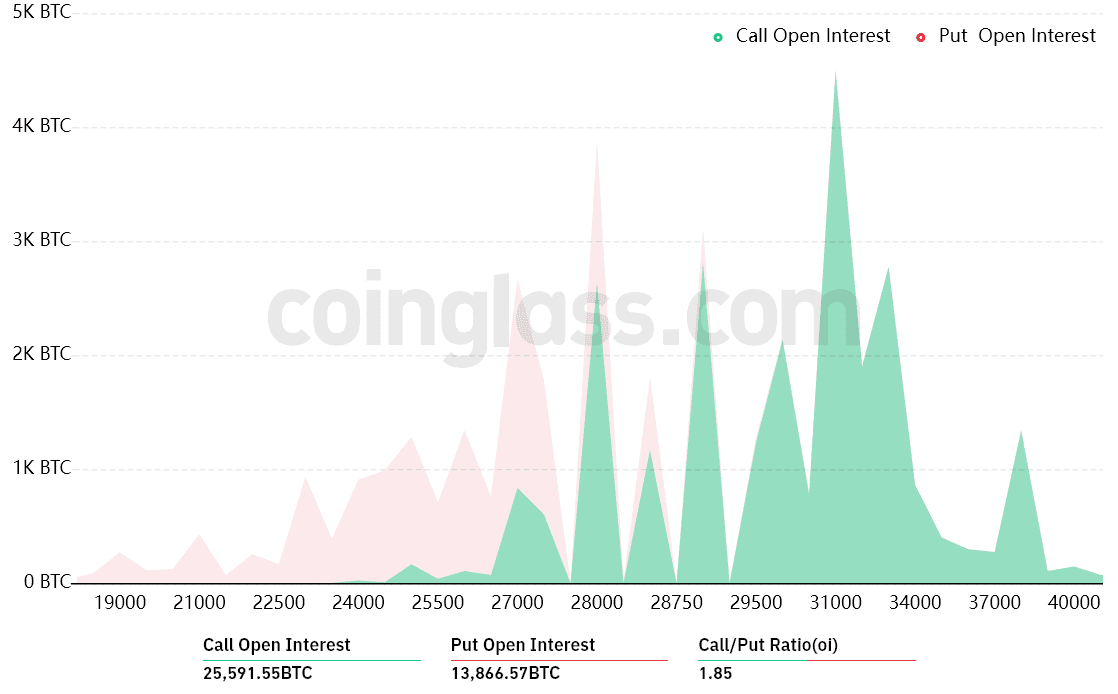

The weekly BTC options expiry has $1.2 billion in open interest, but the actual figure will be lower because bulls have concentrated their bets on Bitcoin price trading above $29,000.

The 1.85 call-to-put ratio…

Click Here to Read the Full Original Article at Cointelegraph.com News…