David Lawant, Head of Research at FalconX, a digital assets prime brokerage with trading, financing, and custody for leading financial institutions, recently offered an analysis on X (formerly Twitter) regarding the evolving role of Bitcoin halvings in market dynamics. This analysis challenges the traditional view that halvings directly and significantly affect Bitcoin’s price, instead highlighting a broader economic and strategic context that might be influencing investor perceptions and market behavior more profoundly.

The Miner’s Diminishing Impact On Bitcoin Price

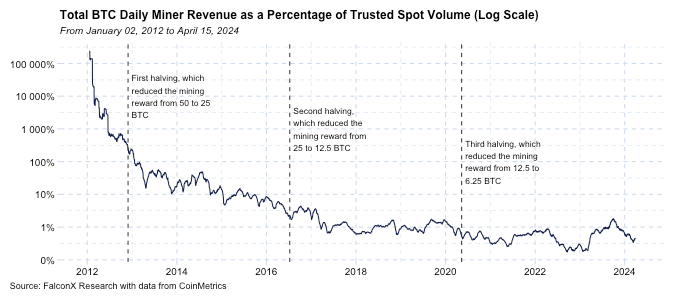

Lawant begins by addressing the changing impact of Bitcoin miners on market prices. He presents a detailed chart comparing the total mining revenue to the Bitcoin spot traded volume from 2012 onwards, clearly marking the dates of the three previous halvings. This data reveals a significant shift: “The most crucial chart for comprehending halving dynamics is the one below, not the price chart. It illustrates the proportion of total mining revenue compared to BTC spot traded volume since 2012, with the three halving dates marked.”

In 2012, total mining revenue was multiples of the daily traded volume, highlighting a time when miners’ decisions to sell could have significant impacts on the market. By 2016, this figure was still a notable double-digit percentage of daily volume but has since declined. Lawant emphasizes, “While miners remain integral to the Bitcoin ecosystem, their influence on price formation has notably waned.”

He elaborates that this reduction is partly due to the increasing diversification of Bitcoin holders and the growing sophistication of financial instruments within the cryptocurrency market. Furthermore, not all mining revenue is immediately impacted by halving events—miners may choose to hold onto their rewards rather than sell, affecting the direct impact of reduced block rewards on supply.

Lawant connects the timing of halvings to broader economic cycles, proposing that halvings do not occur in isolation but alongside significant monetary policy shifts. This juxtaposition increases the narrative impact of halvings, as they underscore Bitcoin’s attributes of scarcity and decentralization during periods when traditional monetary systems are under stress.

“Bitcoin halving events tend to occur during critical monetary policy turning points, so the narrative fit is…

Click Here to Read the Full Original Article at NewsBTC…