Inflation came down a lot faster than most investors and analysts anticipated, reaching 3% in June. The recession that most analysts predicted is nowhere to be seen, according to the 3.6% unemployment rate nearing a 50-year low and the S&P 500 Index showing a 19% gain year-to-date.

While the current market performance may lead investors to believe that a recession has been avoided, there are three metrics that have been able to consistently predict recessions over time. These leading economic indicators are key economic variables that tend to move ahead of changes in overall economic activity, providing an early warning system for changes in the business cycle. Let’s dig into three of these indicators and explain how investors can interpret them.

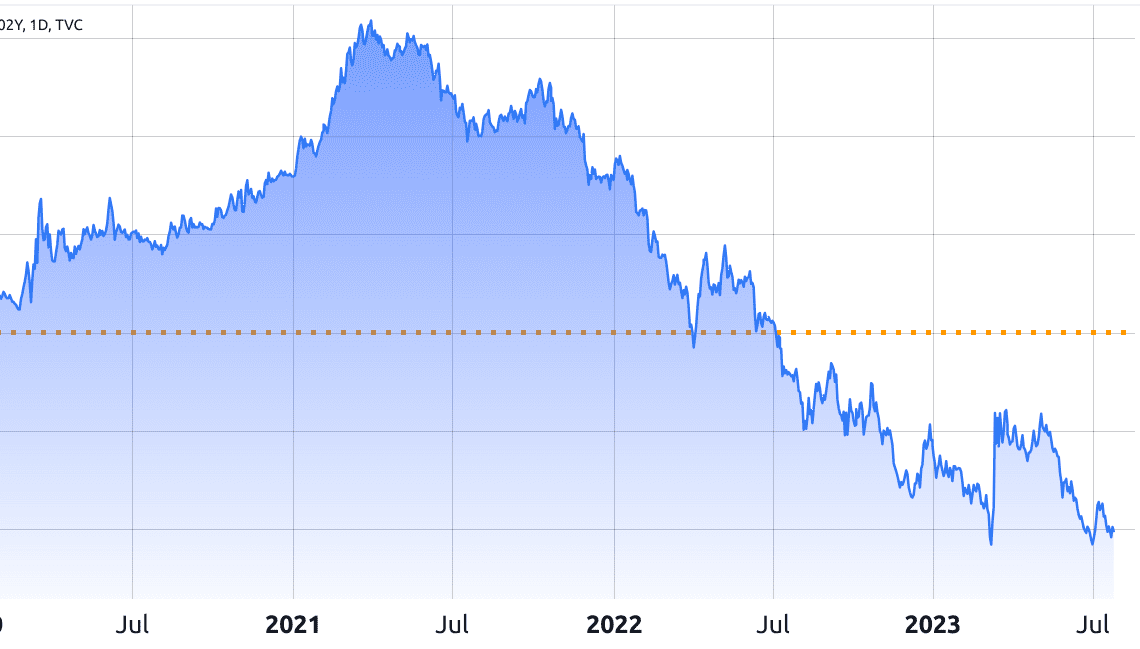

Yield curve inversion

The yield curve represents the relationship between short-term and long-term interest rates on government bonds. Normally, long-term bonds have higher yields than short-term bonds to compensate investors for the risk of holding their money for a more extended period.

Historically, an inverted yield curve has often preceded recessions. This indicator suggests that investors are worried about the near future and expect interest rates to fall due to a potential economic slowdown.

The two-year Treasury yield is currently 3.25%, while the 10-year Treasury yield is 2.95%, typical of periods ahead of a recession. However, that has been the case since September 2022, and historically there’s a nine- to 24-month lag before the economic contraction takes place.

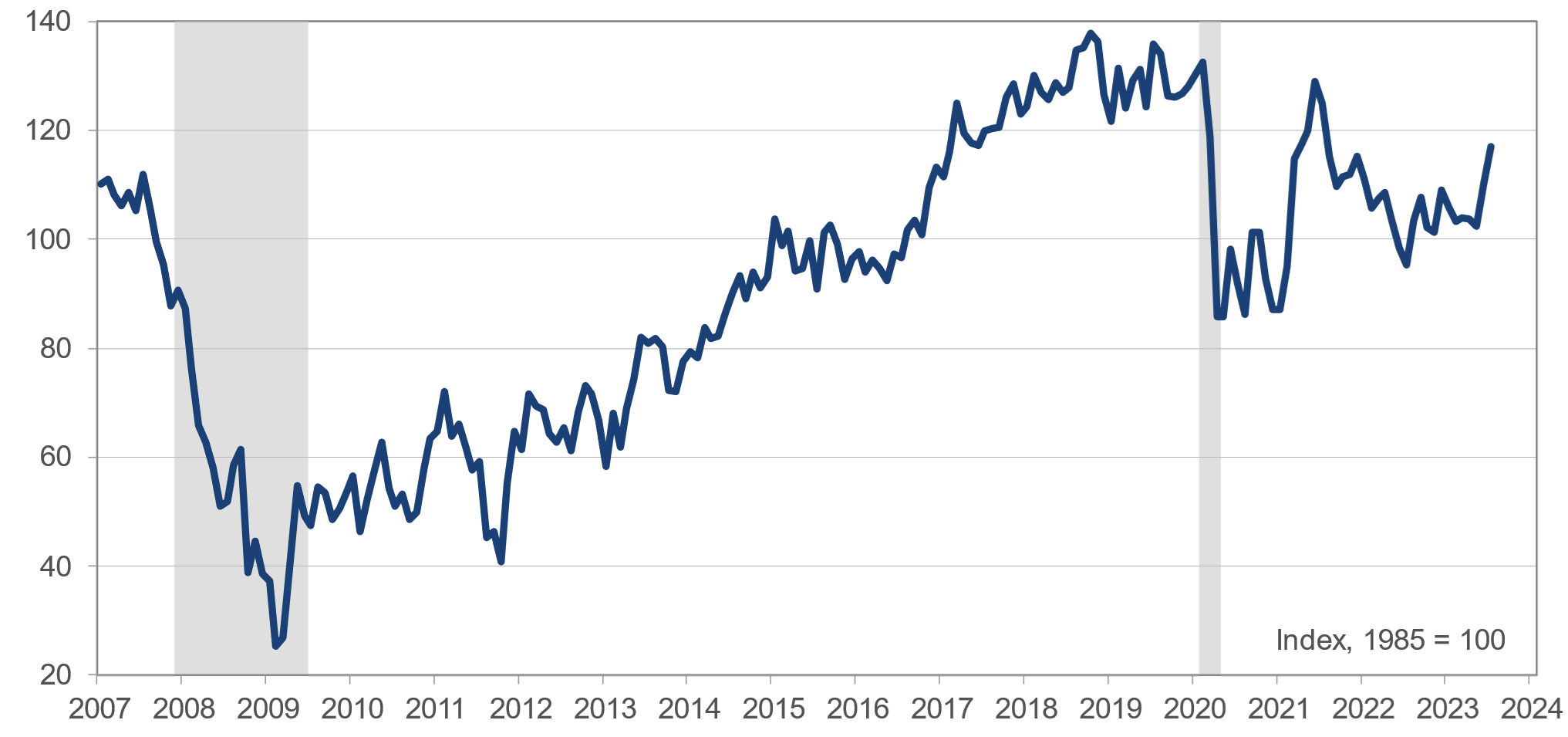

Leading economic indicators (LEI)

The Conference Board, a nonprofit research organization, compiles a set of economic indicators known as the leading economic indicators (LEI). These indicators include a variety of data points, such as building permits, stock prices, consumer expectations, average weekly hours worked and more.

When these indicators start to decline or show a pattern of negative movement, it can signal an impending recession. The consumer confidence index for July hit a reading of 117, the highest level in two years. Moreover, according to The Conference Board, the probability of a recession in the next six months is 25%, down from 30% in June.

Purchasing managers’ index (PMI)

The purchasing managers’ index (PMI) is based on five major indicators: new orders, inventory levels, production, supplier deliveries…

Click Here to Read the Full Original Article at Cointelegraph.com News…