The FTX collapse continues to stoke fears of a contagion in the cryptocurrency space as investors wait to hear about businesses that may face the heat. One of the marquee names to come under the circle of suspicion is the Grayscale Bitcoin Trust (GBTC), which has seen its discount to Bitcoin’s (BTC) price reach record levels of about 50%.

Traders hate uncertainty and shy away from investing during these periods. That could be one of the reasons for a lack of buying interest in Bitcoin even after the sharp fall in its price. The Stock-to-Flow (S2F) model, which had seen its popularity soar during the bull phase, is coming under increasing criticism after the deviation between Bitcoin’s price and its projected price hit levels never seen before.

Does this suggest that the pessimism has reached an extreme or is it just that the S2F model is flawed?

During a bear phase, the general trend is down but there are always pockets of strength that may offer trading opportunities to long-only investors. However, rallies during bear markets are short-lived, hence traders may consider booking profits near strong resistance levels.

Let’s look at the charts of five cryptocurrencies that may attempt a rally in the near term.

BTC/USDT

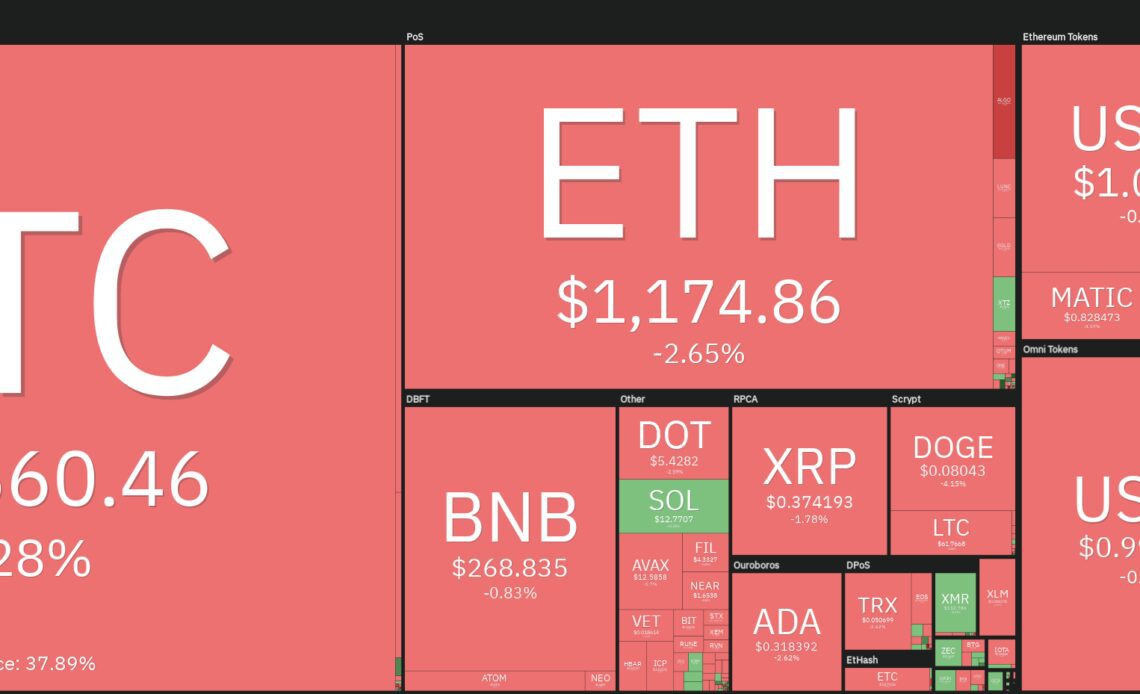

Bitcoin continues to trade inside the tight range between $16,229 and $17,190. Generally, periods of tight consolidation are followed by an increase in volatility.

The downsloping moving averages and the relative strength index (RSI) in the negative zone indicate that the path of least resistance is to the downside. If the price breaks below $16,229, the Nov. 9 intraday low of $15,588 may be threatened. A break and close below this support could signal the resumption of the downtrend. The next support on the downside is $12,200.

If bulls want to avoid a further decline, they will have to push and sustain the price above the breakdown level of $17,622. Such a move will suggest strong demand at lower levels. The pair could then climb to the psychological level of $20,000.

The BTC/USDT pair has been trading near the moving averages, which have flattened out. This suggests that the pair has entered a state of equilibrium as both the buyers and sellers are undecided about the next directional move.

However, this uncertainty is unlikely to continue for long. If the price plummets below $16,229, the selling pressure could…

Click Here to Read the Full Original Article at Cointelegraph.com News…