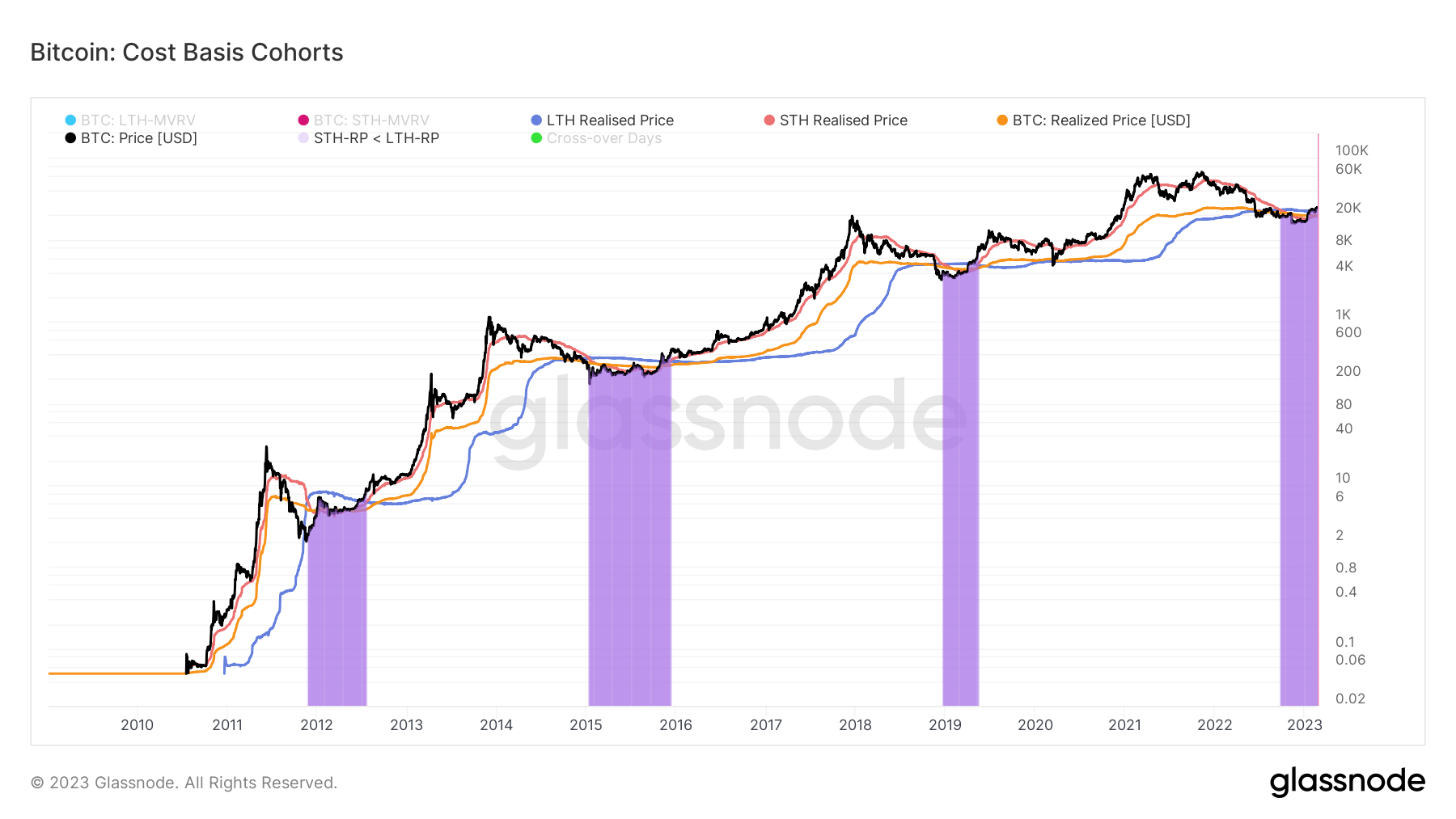

Realized price is a metric often used to determine market movements in bear and bull markets. Defined as the value of all Bitcoins at the price they were bought divided by the number of circulating coins, realized price effectively shows the cost-basis of the network.

Dividing the network into cohorts can help us reflect the aggregate cost basis for each major group owning Bitcoin. Long-term holders (LTHs) and short-term holders (STHs) are the two primary cohorts driving the market — LTHs are all addresses that held BTC for longer than 155 days, while STHs are addresses that held onto BTC for less than 155 days.

The LTH-STH cost basis ratio is the ratio between the realized price for long-term and short-term holders. Given the historically different behaviors LTHs and STHs exhibit, the ratio between their realized prices can illustrate how the market dynamic is shifting.

For example, an uptrend in the LTH-STH cost basis ratio is seen when STHs realize more losses than LTHs. This shows that short-term holders are selling their BTC to LTHs, indicating a bear market accumulation phase led by LTHs.

A downtrend in the ratio shows that LTHs are spending their coins faster than STHs. This indicates a bull market distribution phase, where LTHs sell their BTC for profit, which STHs buy up.

An LTH-STH cost basis ratio higher than 1 indicates that the cost basis for LTHs is higher than the cost basis for STHs. This has historically correlated with late-stage bear market capitulations that turned into bull runs.

2011

During Bitcoin’s first bear market in 2011, the STH realized price went below the LTH realized price. This trend reversal marked the beginning of a bear market which started on Nov. 22, 2011 and lasted until Jul. 17, 2012.

Long-term holders accumulated BTC throughout the bear market, dollar-cost averaging (DCA) and bringing their cost-basis down. Buying during suppressed prices created a new influx of short-term holders that pushed Bitcoin’s price up. This increase in STH accumulation caused the STH realized price to rise, increasing the overall cost-basis of the network with it.

2015

The 2015 bear market followed a similar pattern. On Jan. 8, 2015, the STH realized price dropped below the LTH realized price, triggering a bear market that lasted until Dec. 08, 2015.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…