Global markets are going through a tough period — including the cryptocurrency market. But judging by talk from the peanut gallery, it seems like some observers haven’t received the memo.

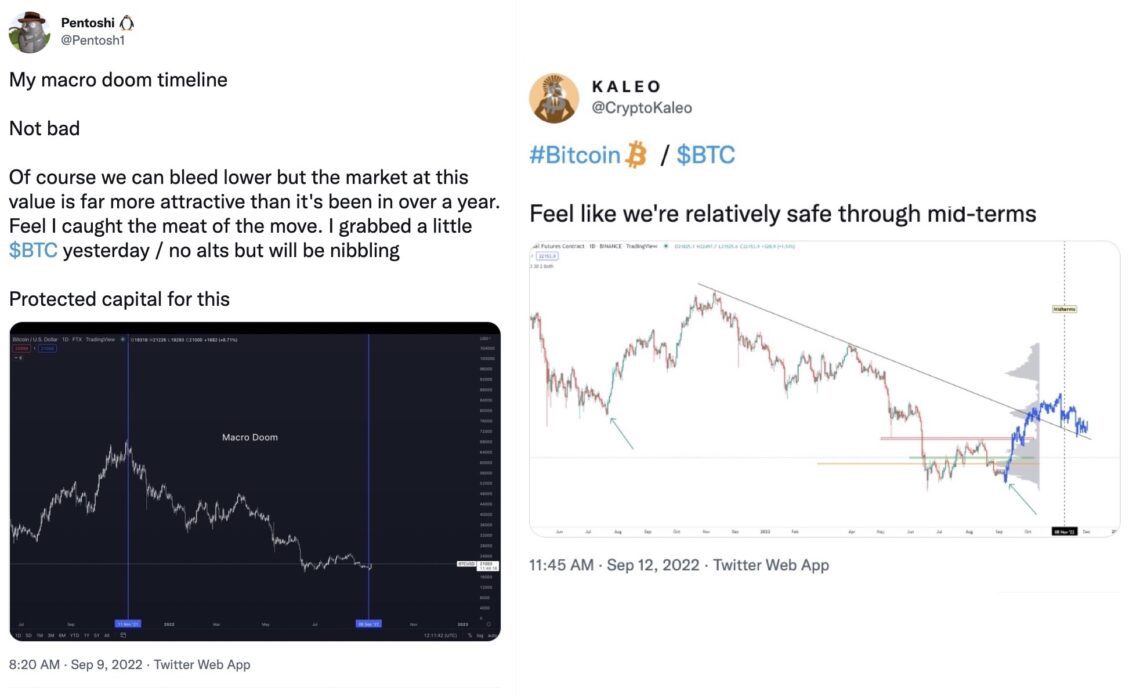

“Feel like we’re relatively safe through mid-terms,” Twitter’s “CryptoKaleo” — also known simply as “Kaleo” — wrote in a Sept. 12 tweet to his 535,000 followers, referring to the United State’s November mid-term elections. The prediction was accompanied by a chart indicating his belief that Bitcoin’s (BTC) price would surge to $34,000 — a 50% gain from its roughly $20,000 level as of last week — before the end of the year.

“Of course we can bleed lower,” fellow pseudonymous Twitter mega-influencer Pentoshi wrote in a Sept. 9 missive to his 611,000 followers. “But the market at this value is far more attractive than it’s been in over a year. […] I grabbed a little $BTC yesterday / no alts but will be nibbling.”

Those assessments come from the “respectable” observers — those who have periodically been correct in the past. One gentleman in my inbox today — a Charlie Shrem looking to sell his “investing calendar” — assured readers that a “major crypto ‘run-up’ could begin tomorrow.” Look further and it isn’t hard to find even more bullish prognostications, like the prediction that Bitcoin is on the cusp of a 400% surge that will bring it to an all-time high price of $80,000 and market capitalization of $1.5 trillion — $500 billion more than the value of all the silver on Earth.

It’s good to see the optimism running rampant, even if it is mostly among influencers looking for engagement and paying customers. Unfortunately, macroeconomic headwinds indicate the reality is a little darker — perhaps a lot darker.

FedEx last week underscored the possibility that economic conditions might worsen with its announcement that it had fallen $500 million short of its first-quarter revenue target. “These numbers — they don’t portend very well,” CEO Raj Subramaniam wryly noted in an interview with CNBC. His comments, which included a prediction that the numbers represented the beginning of a global recession, prompted a 21% end-of-week crash in his company’s stock price that took the wider market along for the ride.

Related: What will drive crypto’s likely 2024 bull run?

In response to the economic doldrums, FedEx said it was planning to take measures including the closure of 90 locations by the end of the year. The good…

Click Here to Read the Full Original Article at Cointelegraph.com News…