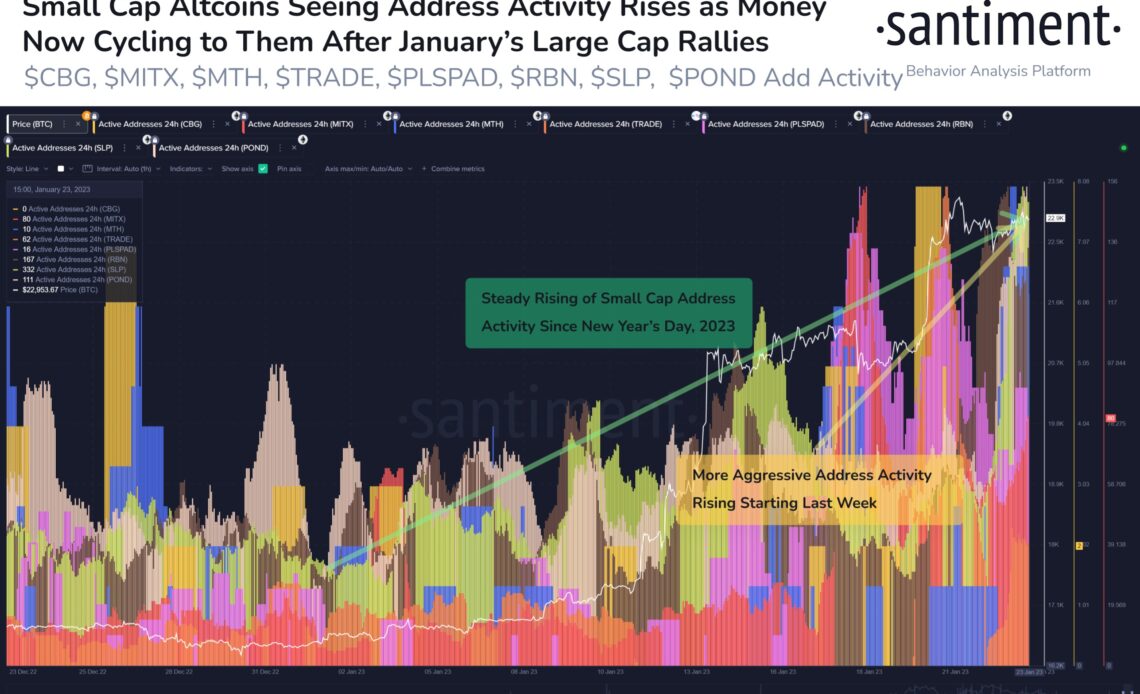

Money is now cycling to a handful of low-cap altcoins after large-caps saw a price bounce across the first three weeks of January, according to Santiment.

Crypto analytics firm Santiment notes that Ribbon Finance (RBN), Smooth Love Potion (SLP) and Marlin (POND) all are seeing a rise in address activity.

“With large caps like Solana, Cardano, & Polkadot drawing impressive return headlines the first 3 weeks of January, money now appears to be cycling to small caps. Active addresses are up big for CBG, MITX, MTH, TRADE, PLSPAD, RBN, SLP, & POND.”

Ribbon Finance, a suite of decentralized finance (DeFi) protocols that aim to help users access crypto-structured products, is trading at $0.261 at time of writing. The 194th-ranked crypto asset by market cap is up more than 29% in the past seven days.

Smooth Love Potion, a token used within the Axie Infinity (AXS) ecosystem to earn rewards and purchase creatures in the online battling game, is trading at $0.00288 at time of writing. The 240th-ranked crypto asset by market cap is up more than 9% in the past week.

Marlin, an open protocol offering network infrastructure for decentralized internet and DeFi, is trading at $0.00959 at time of writing. The 320th-ranked crypto asset by market cap is up nearly 12% in the past week.

In terms of large-cap assets, Santiment notes that Bitcoin’s (BTC) two largest transactions since December occurred on January 5th, right before the top crypto began a surge that took it from around $16,800 all the way to $23,000 this past weekend. BTC is trading at $22,652 at time of writing.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney