Ether’s (ETH) price retested $1,780 after the news of the U.S. Securities and Exchange Commission suing cryptocurrency exchanges Binance and Coinbase but it’s not preposterous to suggest that Ether bulls should be more than happy that its price did not break below the 67-day support.

The SEC actions are actually a double-edged sword for Ethereum and on crypto Twitter, some analysts attributed the bounce in Ether as a result of it not being listed as a security in either of the cases brought against Binance and Coinbase. For instance, the SEC explicitly mentioned BNB, Solana (SOL) and Cardano (ADA), which are direct competitors to Ethereum’s smart contract processing capabilities.

However, as noted by analyst Jevgenijs Kazanins, Ether’s omission does not mean that it has the green light from the SEC.

SEC did not mention #ETH in the list of tokens that it considers to be securities when suing Coinbase and Binance. Could it be that the SEC is working on a separate lawsuit targeting Ethereum Foundation?

— Jevgenijs Kazanins (@jevgenijs) June 6, 2023

Kazanins raises the question of whether the SEC could be targeting the Ethereum Foundation in a separate lawsuit. For now, the idea is a mere unfounded speculation, but it certainly has merit given that SEC chairman Gary Gensler refused to answer questions about Ethereum’s status before the U.S. House Financial Services Committee in April 2023.

In the meantime, what we can focus on is Ether’s price action, network data and other data which impacts investor sentiment and price in the short-term.

Ethereum Dapps get a slight boost

TVL measures the deposits locked in Ethereum’s decentralized applications, which have been in a downtrend since mid-March. The indicator reached a 14.35 million ETH bottom on June 3, but bounced back to 14.6 million ETH by June 6, according to DefiLlama.

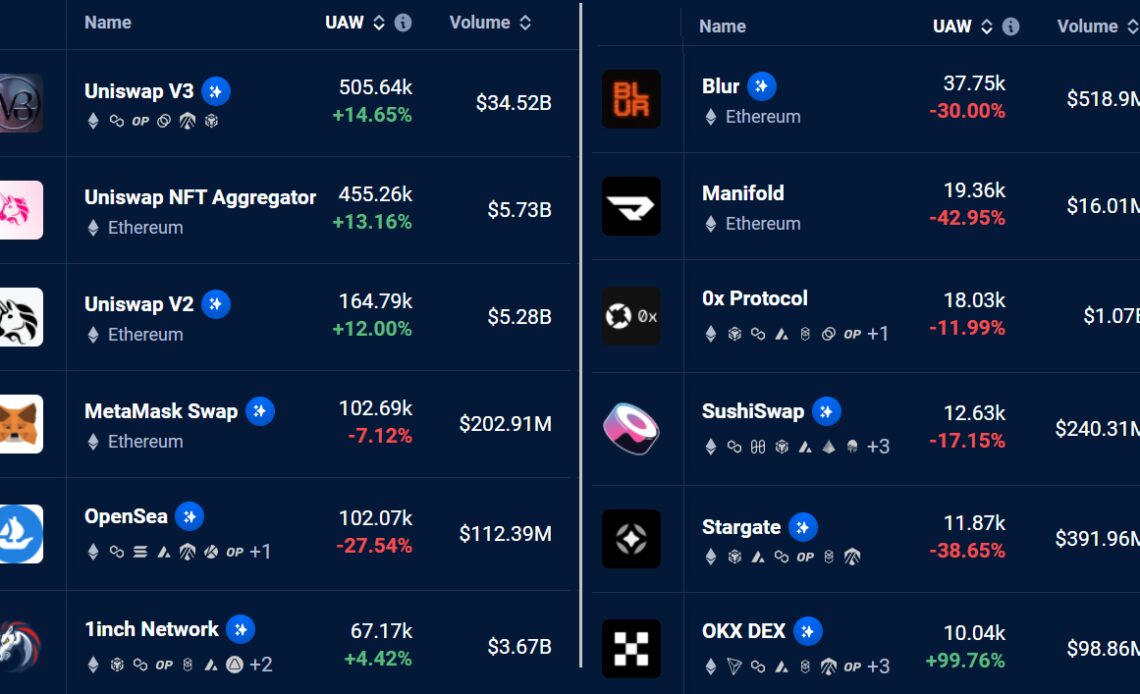

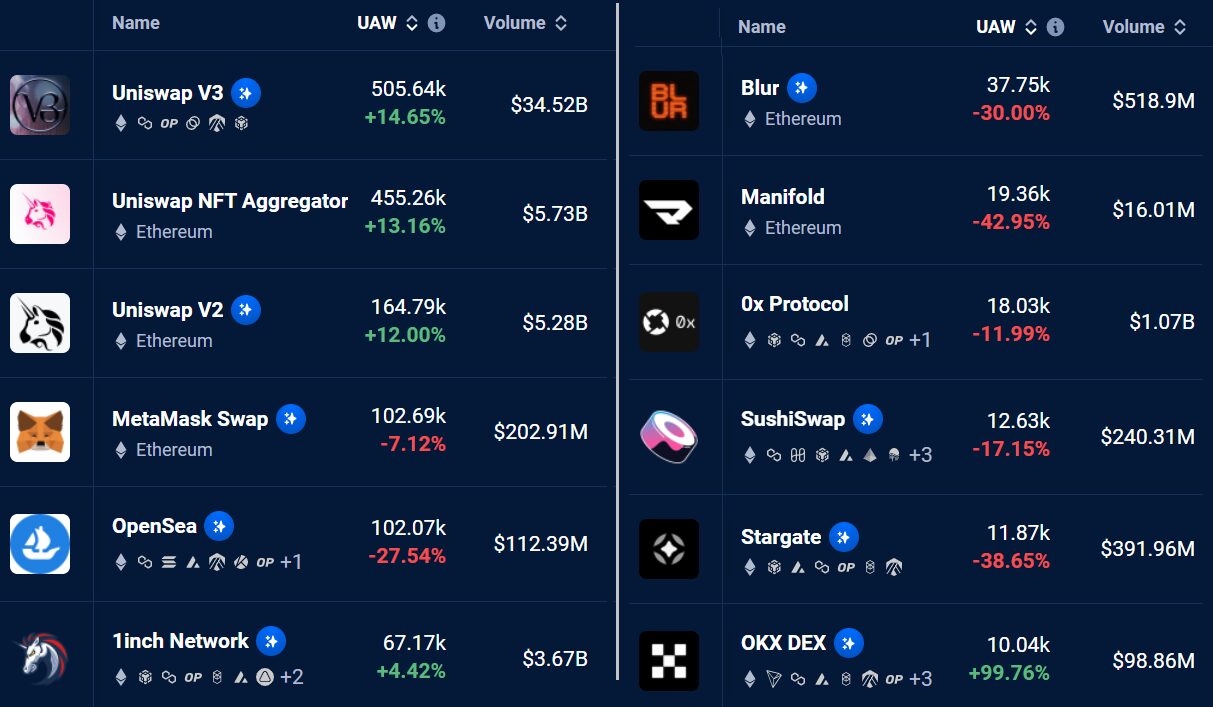

The number of active addresses interacting with decentralized applications (DApps) is also in a slump. Over the last 30 days, the top 12 DApps running on the Ethereum network saw a 4% increase in active addresses, even though the average transaction gas fee remained above $6.5.

If investors fear that Ether has higher odds of breaking below the $1,800 support, it should be reflected in the ETH futures contract premium and increased costs for protective put options.

Ether derivatives metrics even as regulations ramped up

Ether quarterly futures are popular among whales and arbitrage…

Click Here to Read the Full Original Article at Cointelegraph.com News…