Macroeconomic expert George Gammon believes a second wave of bank failures is on the horizon.

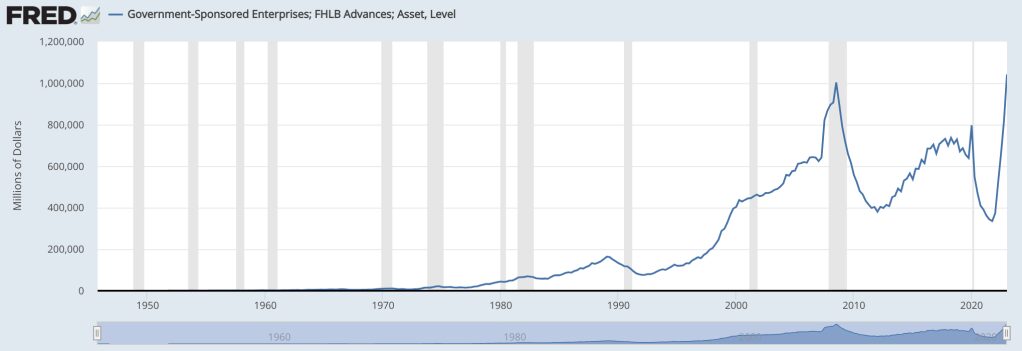

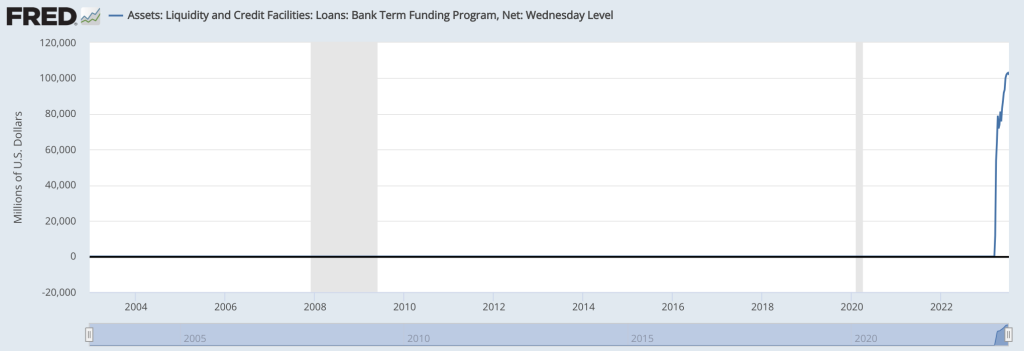

In a new update to his 480,000 YouTube subscribers, Gammon points to a parabolic burst of bank borrowing from America’s Federal Home Loan Bank (FHLB) system and the newly formed Bank Term Funding Program (BTFP) as major indicators that signal more banking failures are on the way.

“When these troubled banks need liquidity, their first option, because it’s way cheaper, is going to be the marketplace. The repo market as an example.

But they’re very sophisticated lenders… so [banks] go to their next best option, which would be the FHLB, but they really hesitate to do that because although it’s this stealth bailout it is very expensive and the terms quite often are very draconian…

But then let’s say you’re so bad that [the FHLB doesn’t] even want to do business with you, what do you do? Well before you wave the white flag, you’ve got to go right down here and go to the ultimate lender of last resort, and that would be the Federal Reserve. You’d try to access a facility such as this new BTFP.”

Gammon says latest stats from the Federal Reserve Economic Data (FRED) system, which show sharp and ongoing rises in borrowing from both the FHLB and BTFP, signal the banking crisis is far from over.

“We know that the banking crisis is far from over because of the chart of the advances of the FHLB is still extremely high and going even higher. We can also combine this with the BTFP being extremely high and it hasn’t come down yet.”

The final metric to watch is the Federal Reserve’s discount window, which is an emergency lending program designed to offer banks short-term loans.

If and when the discount window spikes again, says Gammon, banks turning to that program will essentially be signaling to the market that they are absolutely bust.

“How we kind of time when we get the next wave of this crisis is by combining those two [FHLB and BTFP] charts with a chart of the discount window.

And once you see that shoot up you know that over the next few weeks over the next few months it’s very likely that you see more of these banks, go bust possibly taking us into an environment that is very similar or even worse than the global financial crisis.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price…

Click Here to Read the Full Original Article at The Daily Hodl…