Amid the latest bankruptcy case filed by FTX Trading Ltd., U.S. regulators want to crack down on crypto exchanges, and a class action lawsuit has been issued against former FTX CEO Sam Bankman-Fried (SBF) and 12 celebrities. However, this is not FTX’s and Alameda Research’s first rodeo with the U.S. court system and financial investigations. After FTX launched in 2019 and following the release of the exchange token FTT, FTX and Alameda faced a lawsuit filed on November 2, 2019, that accused the companies and executives of engaging in racketeering practices and crypto market manipulation.

2019 Lawsuit Accused FTX and Alameda Execs of Breaking Racketeering Laws and ‘Aiding and Abetting Price Manipulation’

FTX, Alameda Research, Sam Bankman-Fried (SBF), and the firm’s associated executives have been in the spotlight for two weeks after Alameda Research’s balance sheet was leaked and Binance’s CEO Changpeng Zhao (CZ) mentioned Binance was dumping all of its FTT tokens. Now FTX Trading Ltd. and more than 130 associated companies have filed for Chapter 11 bankruptcy protection and the firms are currently being investigated by authorities from various jurisdictions.

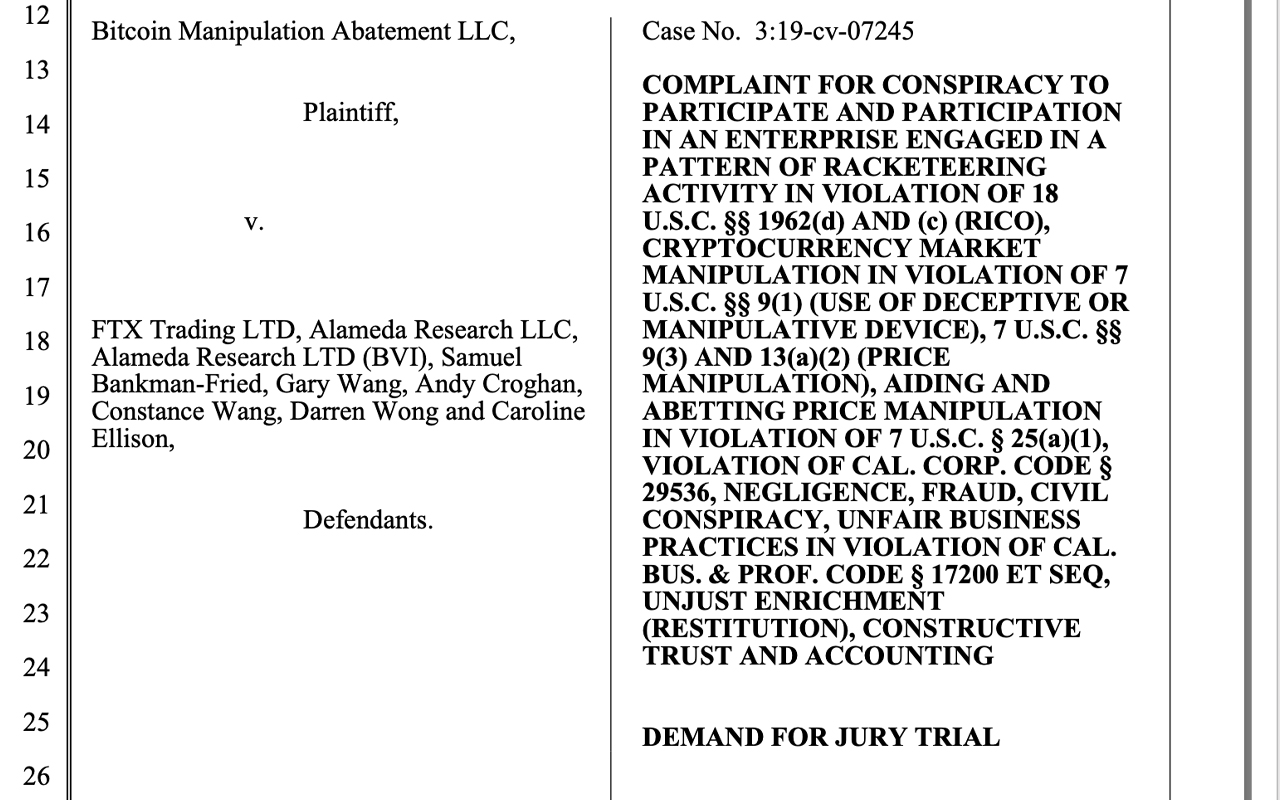

While investigators polish off their magnifying glasses and lawyers prep their written defenses, a lot of people are unaware that FTX was accused of racketeering, selling unregistered securities, and crypto market manipulation three years ago. The lawsuit filed on Nov. 2, 2019, was registered by attorneys for Bitcoin Manipulation Abatement LLC (BMA).

The lawsuit accused FTX, Alameda Research, SBF, Gary Wang, Andy Croghan, Constance Wang, Darren Wong, and Caroline Ellison of engaging in breaking racketeering laws and “aiding and abetting price manipulation.” Interestingly, the lawsuit says that FTX was allowed to thrive thanks to “Alameda’s unlicensed over-the-counter (OTC) money transmitting business.”

The lawsuit alleged that the “racketeering activity exceeded $150,000,000, which were misappropriated from numerous cryptocurrency traders.” The evidence BMA highlights in the lawsuit is an alleged attempt by Alameda to manipulate the bitcoin futures market, and more specifically the Binance SAFU futures market.

According to BMA, on Sept. 15, 2019, 255 bitcoins were dumped on the BTC futures market in a “two-minute time interval.” BMA further claims that SBF changed his residence location on online profiles from Berkeley California to Hong Kong after the Sept….

Click Here to Read the Full Original Article at Bitcoin News…