In a recent YouTube video, Michaël van de Poppe, a highly respected figure in the crypto analysis sphere, disclosed his top 5 altcoin picks for 2024. Van de Poppe, known as founder of Eight Global, emphasized the importance of a balanced approach over speculative bets on lesser-known altcoins. He stated, “I don’t believe in getting into very small altcoins to maximize the risk. Compounding your returns with a proper strategy benefits in the long run.”

Ethereum (ETH) – The Primary Crypto Choice

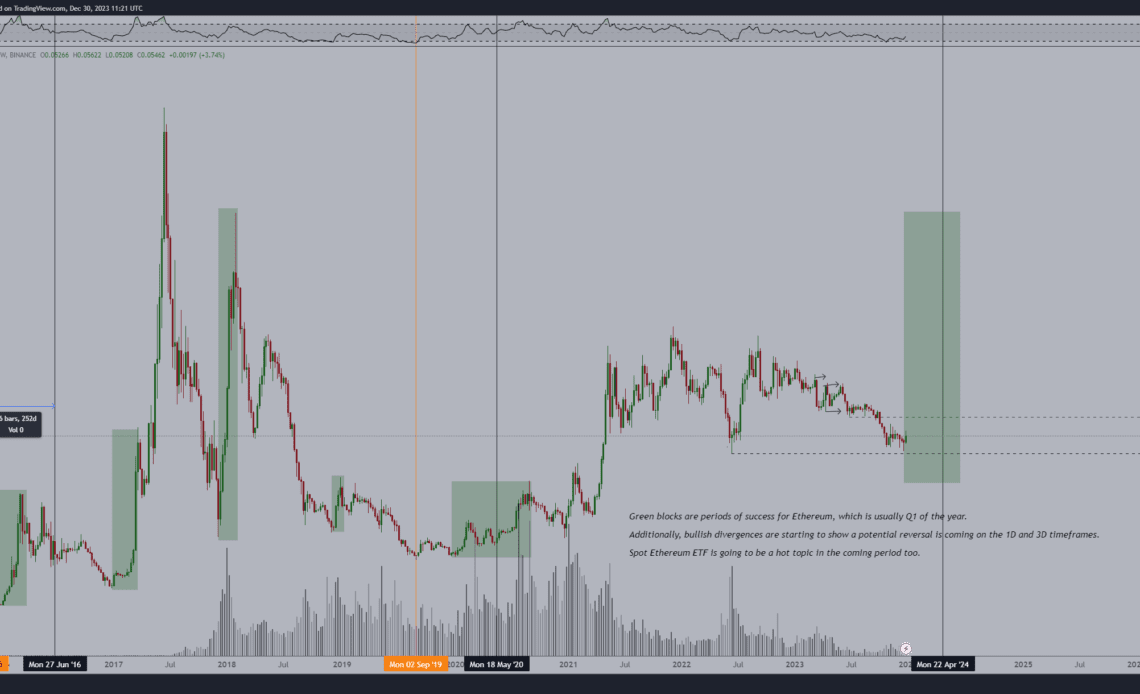

Van de Poppe’s foremost recommendation is Ethereum. The crypto analyst rationalizes this choice by pointing out the crowded space Bitcoin currently occupies, suggesting a shift of focus to altcoins. He articulated, “Bitcoin has been seeing a lot of upside already [caused by the spot ETF hype] … it’s getting a little bit overcrowded and I think the upside is relatively capped.”

He added that Ethereum is currently bottoming out against Bitcoin. “I think that Ethereum is undervalued at this point because there is a deflationary system involved.” His belief in Ethereum stems from its fundamental growth and the deflationary aspect of its economic model.

With regards to the 3-day ETH/USDT chart, he commented: “Ethereum holds a crucial level at $2,150 and is ready to continue the upwards path. Likely, we’ve bottomed on the ETH/BTC pair and have peaked on the Bitcoin dominance.”

Scalability Solutions – Arbitrum and Optimism

Delving deeper into the Ethereum ecosystem, van de Poppe highlighted the importance of scalability solutions. He sees Arbitrum as an attractive crypto investment, especially given its current stage and potential for growth.

“Arbitrum has not much price action yet, which is tricky, but can give you a very interesting investment thesis,” he explained, underscoring its upward trend against Bitcoin. “Retest at $0.98 did work, continuation towards $1.35 as well and even further. Some beautiful S/R flips, I think $1.40-1.45 should hold and we can continue to $2,” he stated.

Optimism is his second scalability solution choice, albeit with a cautionary note on its recent substantial run. Van de Poppe recommends a dollar-cost averaging strategy for Optimism, noting “the hype is already substantial here… buying a portion on every 10 cents that’s dropping to make sure that you get a nice average entry.”

Chainlink (LINK) – The Dark…

Click Here to Read the Full Original Article at NewsBTC…