In the dynamic landscape of cryptocurrency transactions, Rabbit Swap introduces a novel swap approach aimed at enhancing the efficiency and potential benefits of cross-chain swaps for users.

At the heart of Rabbit Swap’s strategy is its commitment to managing a vast network of liquidity sources.

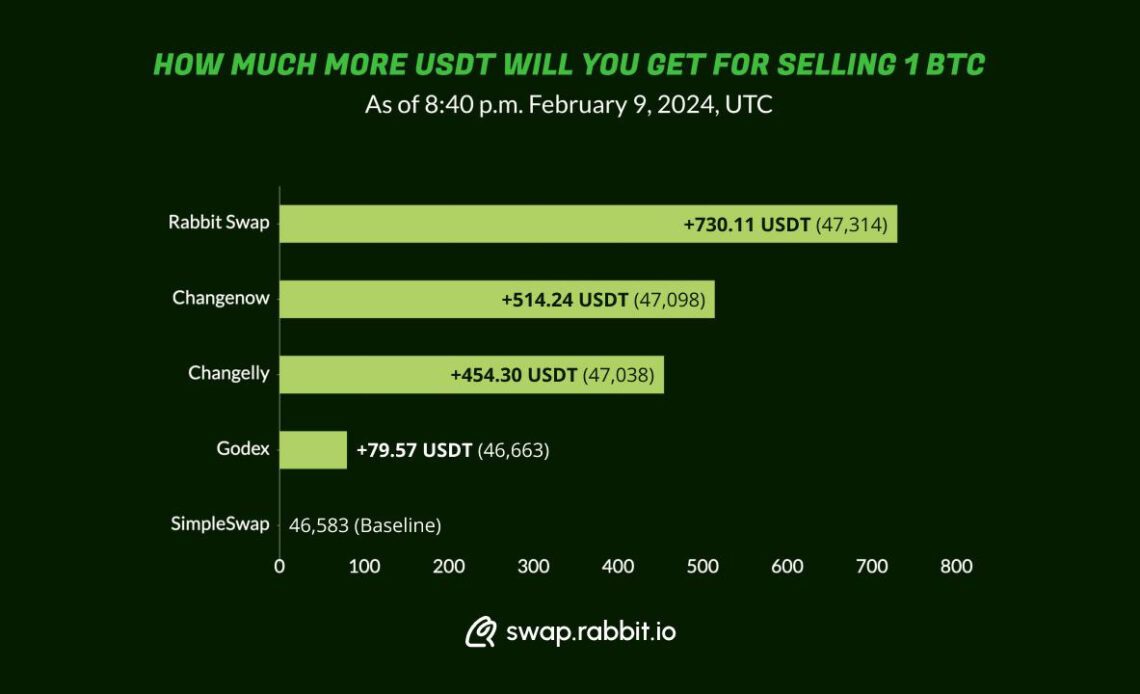

This approach not only guarantees the most competitive swap rates based on selected pairs and amounts but also eliminates swap limits altogether.

The main challenge for most crypto exchanges lies in finding and managing liquidity so that each time somebody wants to swap some asset, the exchanger should be able to buy it for another asset and preferably cover all possible amounts from very small to very large.

Developers basically have three possible liquidity sources.

- Maintaining its own or third-party centralized liquidity

- Relying on traditional trading platforms’ APIs

- Developing a decentralized algorithm that allows the community to provide their liquidity

Each method has its own pros and cons. Maintaining its own or third-party centralized liquidity involves developing an advanced AMM (Automated Market Maker) system.

Traditional trading platforms rely on a classic order book model, where buy and sell orders are matched based on price and time.

In contrast, AMMs automate the process, using algorithms to set prices in a liquidity pool, eliminating the need for order books.

This model facilitates continuous and automatic rebalancing of asset ratios, ensuring liquidity even in the absence of direct buyers and sellers.

Relying on traditional trading platforms’ APIs leads to compromises on the variety of available swap pairs.

While finding platforms that support mainstream pairs like BTC/USDT is straightforward, the real challenge comes with less common pairs such as SHIB/DOGE.

Creating a decentralized algorithm that enables community members to contribute their liquidity is an attractive approach.

It’s decentralized, driven by community engagement and offers mutual benefits.

However, the complexity lies in crafting an algorithm sophisticated enough to balance all assets securely and equitably.

A significant hurdle is incorporating highly volatile assets, as their inherent unpredictability makes it difficult to offset volatility with swapping fees alone.

To address every possible need, ensure limitless swaps and maintain the most competitive rates, the Rabbit team has designed a solution that combines various methods…

Click Here to Read the Full Original Article at The Daily Hodl…