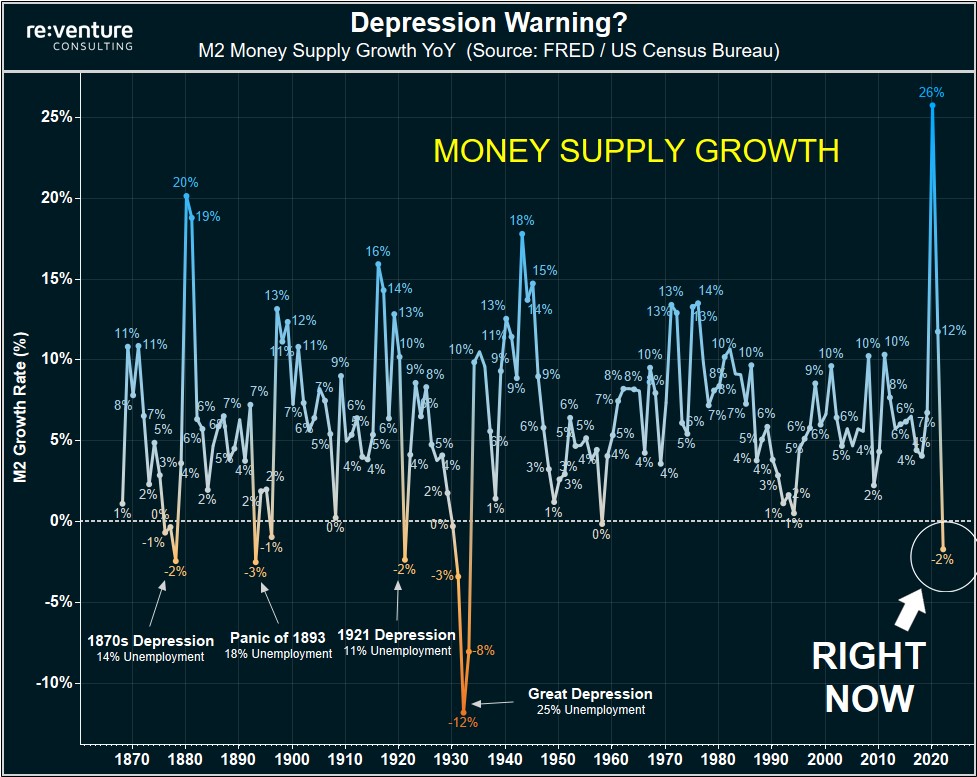

During the Covid-19 pandemic, central banks such as the U.S. Federal Reserve loosened fiscal and monetary policy. Now, these same financial institutions are seemingly engaging in quantitative tightening (QT) practices. According to Nick Gerli, CEO and founder of Reventure Consulting, “the money supply is officially contracting.” This has only happened four times in the last 150 years. Gerli warns that every time it occurs, a depression takes place with double-digit unemployment rates.

The Contraction of Money Supply and its Impact on the Economy

Several market analysts and economists are uncertain about the future of the economy, while many believe things will soon get worse due to significant inflation and failures in central planning. When the Covid-19 pandemic hit, the U.S. government and many other nation-states worldwide financed trillions of dollars in debt to sustain the economy. The debt has grown to colossal levels, and many believe it could sink several Western economies. Speculators insist that this will harm the dollar and that only hard assets will survive the fallout.

In a recent interview at the 2023 BMO Metals, Mining, & Critical Minerals Conference, Rob McEwen, executive chairman of McEwen Mining, said, “Hard assets will increase in value as the dollar drops in relative value to other currencies because governments are irresponsible. They steal from their citizens by printing excess money and borrowing in ways they shouldn’t … Look at the amount of debt most of the Western world has right now; it’s enormous.”

On March 8, 2023, Nick Gerli, CEO and founder of Reventure Consulting, warned that the money supply is contracting. ‘The money supply is officially contracting,’ Gerli said Wednesday. This has only happened four previous times in the last 150 years, and each time, a depression with double-digit unemployment rates followed.

The Reventure executive insists that when the money supply contracts while inflation rises, it creates a “nasty combination” because there are fewer dollars available to pay for higher prices, eventually leading to a deflationary crash.

Gerli added:

This is exactly what happened in the depression of 1921. (NOT the Great Depression). This occurred after WWI and the Spanish Flu. Where there were years of high inflation/money supply growth. And then…WHAM. 11%…

Click Here to Read the Full Original Article at Bitcoin News…