Bitcoin setting a new all-time high and breaking above $72,000 is a significant milestone for the market. Riding the wave of increased institutional interest in spot Bitcoin ETFs, it smashed through the $68,000 ceiling established in November 2021 after a brief correction to $59,000 and seems to be gearing up for more gains this week.

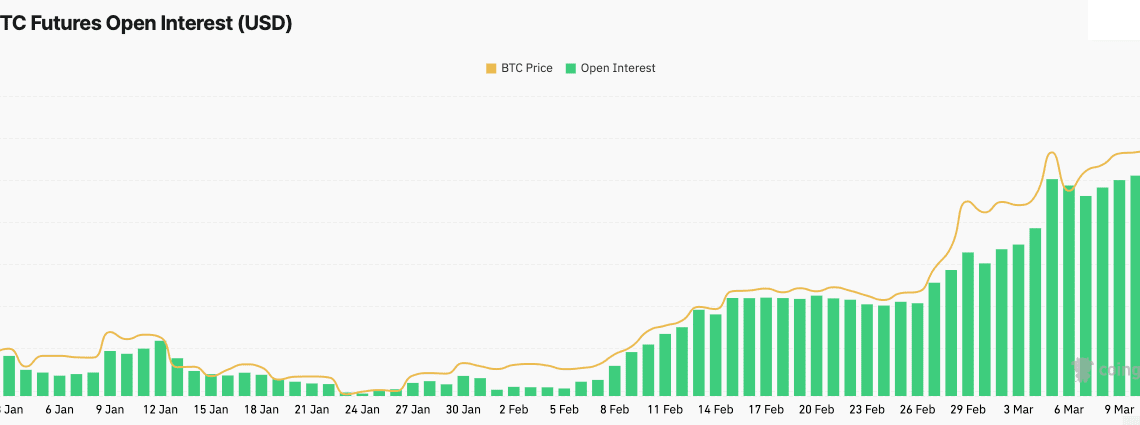

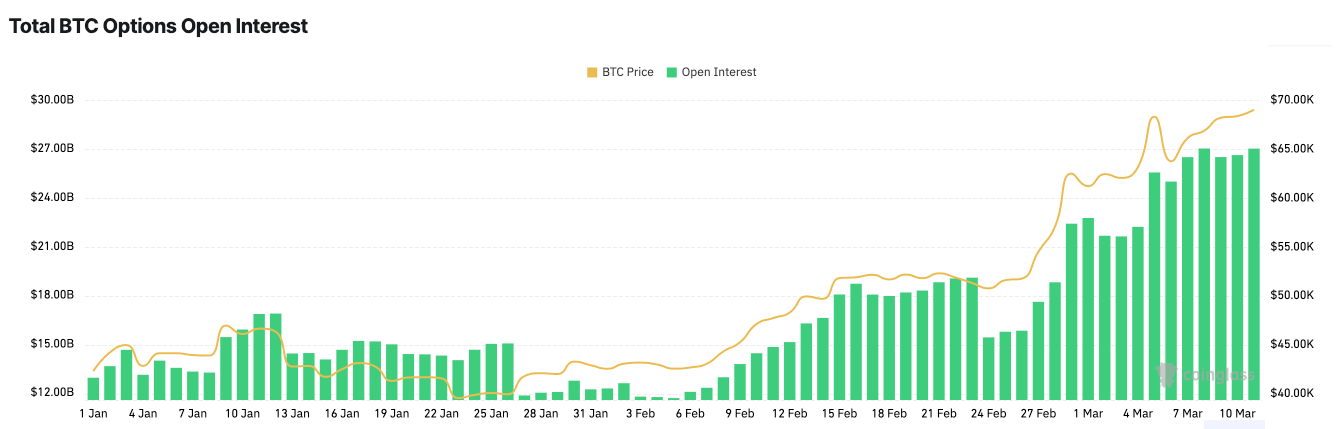

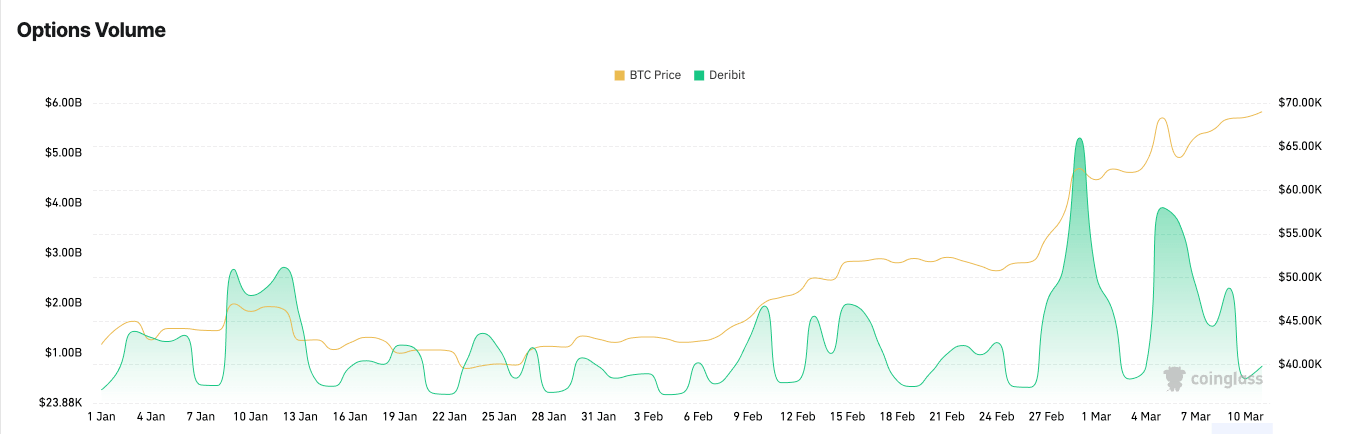

This week, the potential for more volatility is seen in the derivatives market, which peaked as Bitcoin touched $71,400. Since the beginning of the year, Bitcoin futures and options markets have seen unprecedented growth, with open interest reaching new highs on Mar. 11. Analyzing open interest is crucial for understanding market health and trader expectations. While spikes in open interest always follow price volatility, the intensity of the spikes can be a telling sign of just how leveraged the market is.

Futures open interest reached its all-time high of $33.48 billion in the early hours of Mar. 11 — almost double the $17.20 billion it posted on Jan. 1.

Options open interest reached their all-time high on Mar. 8 with $27.02 billion. A foothold seems to have been established at above $27 billion, with open interest remaining stable at $27.01 by Mar. 11. This is a significant increase from the $12.93 billion in open interest at the beginning of the year.

The growth in open interest shows a rapidly increasing appetite for derivatives. Futures and options provide traders with sophisticated strategies that allow them to hedge their positions and speculate on price movements.

The dominance of call options, with open interest and volume percentages consistently favoring calls over puts (61.66% vs. 38.34% for open interest and 59.43% vs. 40.57% for volume), shows an overwhelmingly bullish outlook among traders. This means that most of the market is speculating on further price increases.

Significant spikes in options volume on Deribit around key dates show the derivative market’s reactive nature to Bitcoin’s price movements. Data from CoinGlass showed notable spikes in volume on Feb. 29 ($5.30 billion) and Mar. 5 ($3.91 billion), correlating with periods of intense price volatility.

Bitcoin breaking through important…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…