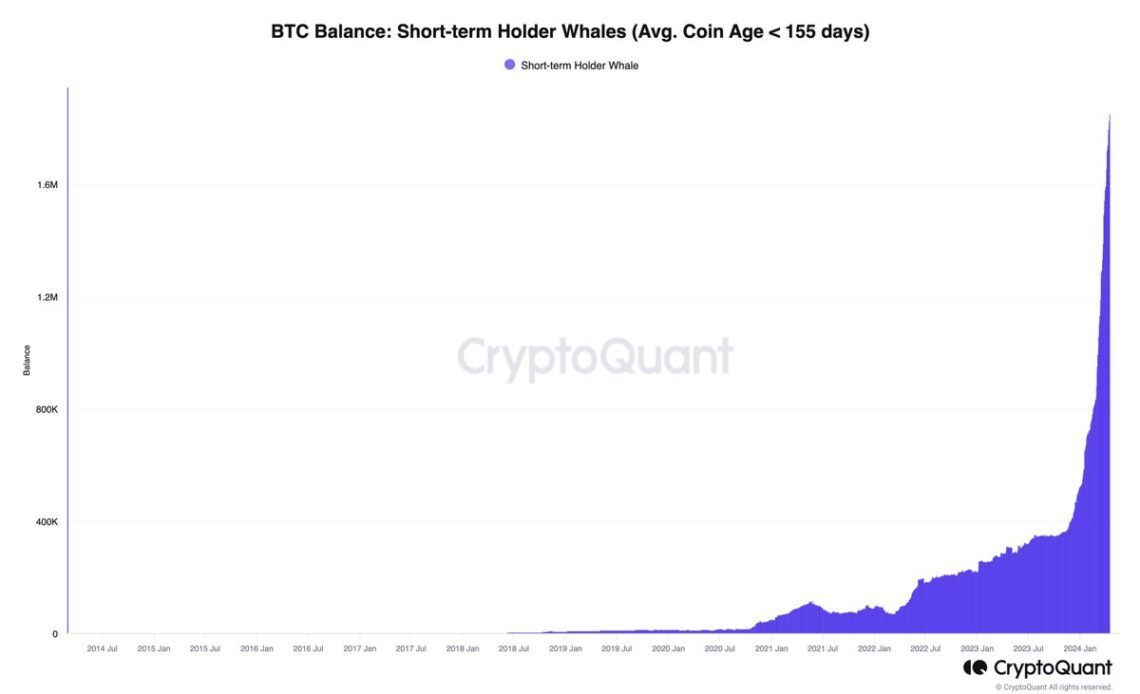

Newly created Bitcoin whales reportedly hold a record amount of BTC to the point of controlling 9% of the total supply of coins.

Ki Young Ju, CEO of blockchain analytics firm CryptoQuant, shares data showing that short-term holder Bitcoin whales have become one of the primary cohorts of entities.

Short-term holders are defined as those who have been holding their coins for less than 155 days.

“New Bitcoin whales now hold 9% of the circulating supply, totaling 1.8 million BTC, including spot ETFs.”

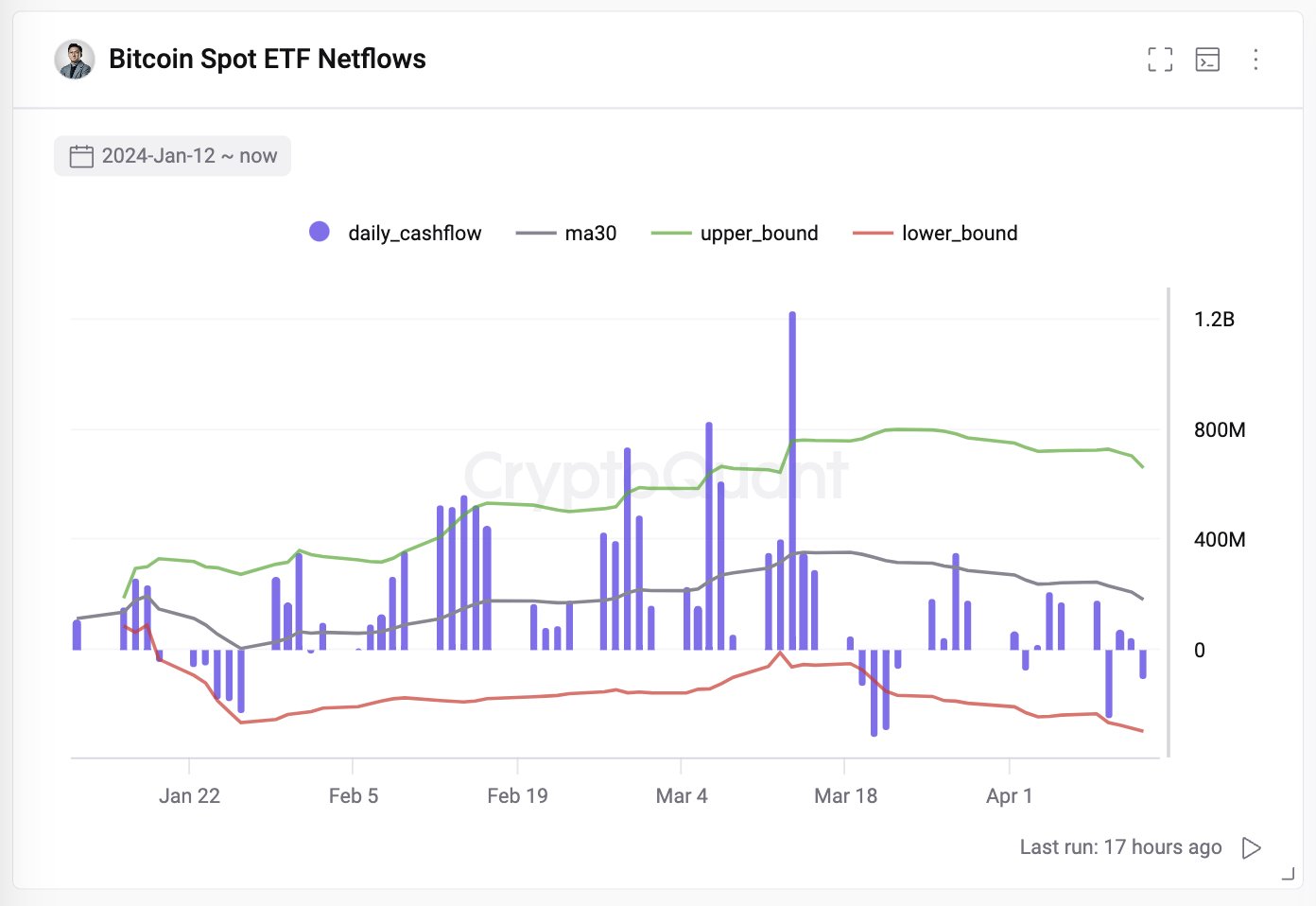

The CEO also says that despite a lull in demand for Bitcoin exchange-traded funds (ETFs), the accumulation of BTC on-chain remains “very active.”

“Bitcoin ETF demand has stagnated for 4 weeks, yet on-chain accumulation remains very active, even when excluding ETF settlement transactions.”

Bloomberg ETF expert James Seyffart notes that it’s standard for many ETFs – in fact, the vast majority – to have zero flows on any given day, as shares of the product will only be created if there’s a mismatch in supply in demand.

“Okay too many questions about Bitcoin ETFs and zero flows – a few quick thoughts:

1. On any given day, the vast majority of ETFs will have a flow number of ZERO – this is very normal. There are ~3,500 ETFs in the US. Yesterday 2,903 of them had a flow of exactly zero.

2. Shares are created or destroyed in creation units. This ONLY happens when there is a mismatch in supply in demand. And that mismatch has to be large enough to justify tapping the underlying market and a ~bigger mismatch than a creation unit.

3. Creation units are the lots that ETF shares are created and redeemed in. Every ETF can have a different sized creation unit. In the case of the spot Bitcoin ETFs they are blocks of shares ranging from 5,000 shares to 50,000 shares.

4. So, a creation or redemption will only happen if there is large enough mismatch in supply and demand AND the cost to make a market by doing that creation or redemption is lower than simply hedging and making markets the old fashioned way.”

At time of writing, Bitcoin is trading at $61,904, correcting from nearly $74,000.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…