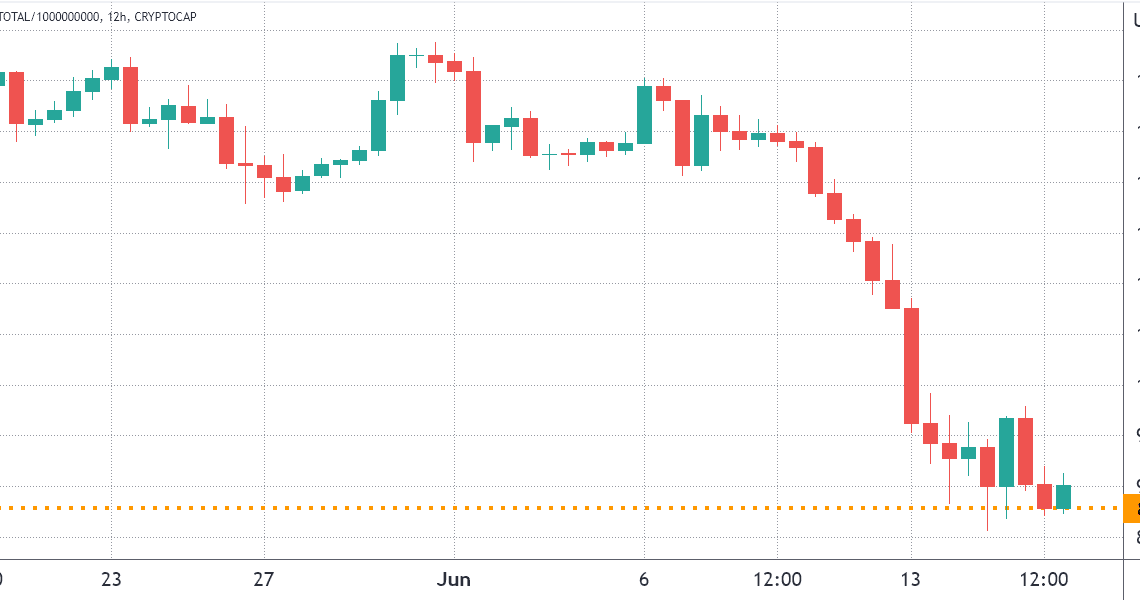

The total crypto market capitalization fell off a cliff between June 10 and June 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction.

Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance.

Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S. Federal Reserve raised interest rates by 75 basis points on June 15, the largest hike in 28 years. The central bank also initiated a balance sheet cut in June, aiming to reduce its $8.9 trillion positions, including mortgage-backed securities (MBS).

Venture firm Three Arrows Capital (3AC) has reportedly failed to meet margin calls from its lenders, raising high major insolvency red flags across the industry. The firm’s heavy exposure to Grayscale Bitcoin Trust (GBTC) and Lido’s Staked ETH (stETH) was partially responsible for the mass liquidation events. A similar issue forced crypto lending and staking firm Celsius to halt users’ withdrawals on June 13.

Investors’ spirit is effectively broken

The bearish sentiment was clearly reflected in crypto markets as the Fear and Greed Index, a data-driven sentiment gauge, hit 7/100 on June 16. The reading was the lowest since August 2019 and it was last seen outside the “extreme fear” zone on May 7.

Below are the winners and losers since June 10. Curiously, Ether was the only top-10 crypto to figure on the list, which is unusual during strong corrections.

WAVES lost another 37% after the project’s largest decentralized finance (DeFi) application Vires Finance implemented a daily $1,000 stablecoin withdrawal limit.

Ether dropped 34.5% as developers postponed the switch to a Proof of Stake consensus mechanism for another two months. The “difficulty bomb” will essentially cease mining processing, paving the way for the Merge.

AAVE traded down 33.7% after MakerDAO has voted to cut off the lending platform Aave’s…

Click Here to Read the Full Original Article at Cointelegraph.com News…