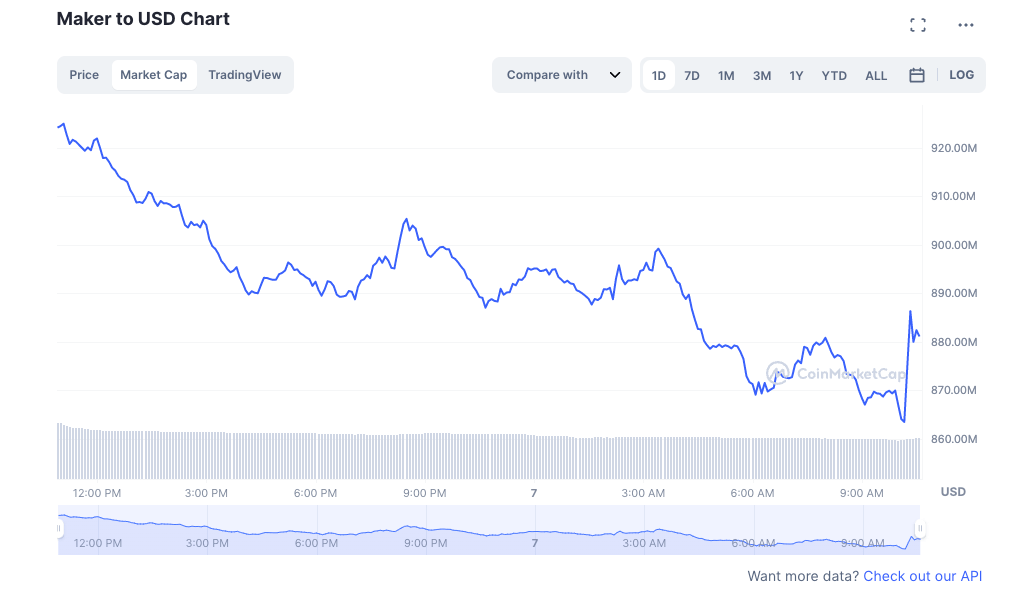

MakerDAO, the governance token behind the fourth largest stablecoin by market capitalization DAI, has decreased in trading volume by 37% and seen a 3.7% dip in token price over the last 24 hours.

The move follows significant changes proposed to Maker’s governance structure.

Following the Tornado Cash sanctions last year, Rune Christensen, the co-founder of MakerDAO, warned of a similar fate for the decentralized stablecoin platform.

In Christensen’s view, government authorities were bound to target MakerDAO sooner or later. A move that prompted the introduction of the Endgame plan to enhance censorship resistance.

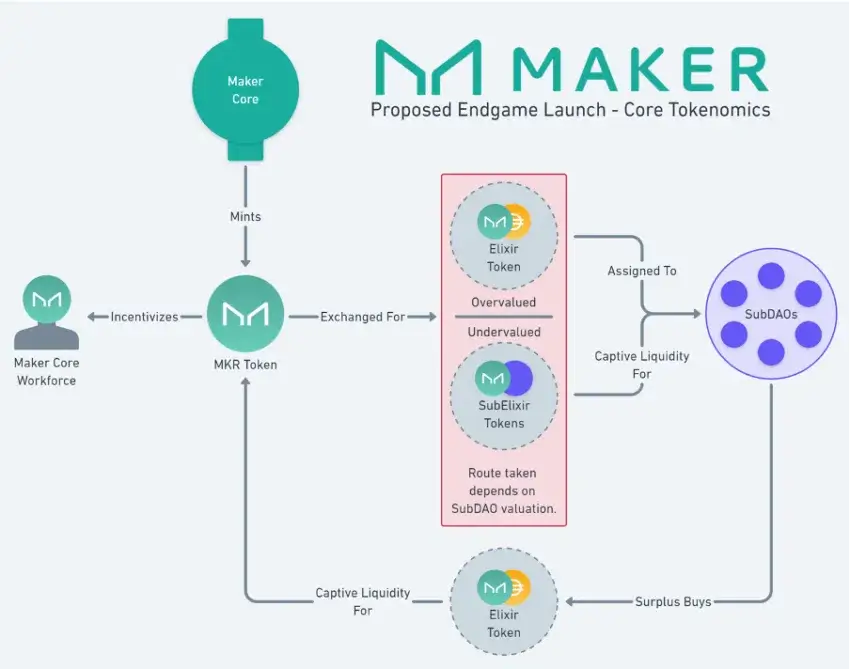

Maker’s Endgame proposal aims to strengthen its decentralized finance (DeFi) platform operating on the Ethereum blockchain allowing users can create and trade stablecoins backed by collateral in cryptocurrencies with the governance of the platform and its stability maintained by the native token (MKR).

MakerDAO unveils Endgame tokenomics

The new system proposes the division of the DAO into smaller units known as MetaDAOs, each with distinct tokens and objectives, while limiting centralized assets backing DAI to 25% and introducing negative interest rates to reduce liquidation risks.

Criticism of Maker’s plan

However, critics of the plan worry that it creates a potential algorithmic death spiral for DAI similar to what happened during the Terra/Luna UST collapse.

Hmm looks a lot like backing $UST with its governance token $LUNA.

Did @stablekwon secretly infiltrate @MakerDAO? https://t.co/3u6NzOMkPK

— Arthur Hayes (@CryptoHayes) February 24, 2023

MakerDAO’s Endgame Tokenomics draws comparisons to Terra’s Seigniorage Mechanism

Similar to MakerDAO’s Endgame Tokenomics, the Terra platform has employed a seigniorage mechanism to stabilize its stablecoins’ prices. This involves generating and destroying tokens in response to market demand, with new tokens created when the stablecoin’s value drops and removed when it rises.

Critics however were quick to label this mechanism a potential liquidity exit scam, enabling users to leave the ecosystem through DAI without selling their MKR tokens while retaining influence over the protocol’s governance.

Vitalik Buterin chimes in

Vitalik Buterin, the creator of Ethereum, has previously expressed concerns about the potential expansion of the DAI protocol’s attack surface as more types of collateral are accepted. The amount of…

Click Here to Read the Full Original Article at Stablecoins News | CryptoSlate…