Bitcoin (BTC) starts a new week in a price range that frustrates traders and leaves little to the imagination — what next?

After precious little activity over the weekend, the largest cryptocurrency lacks direction, and even macroeconomic triggers have failed to shift the status quo.

At around 10% below the $30,000 mark, BTC/USD is treading water, and despite calls for a further correction, market participants are dealing with a tiny active trading range.

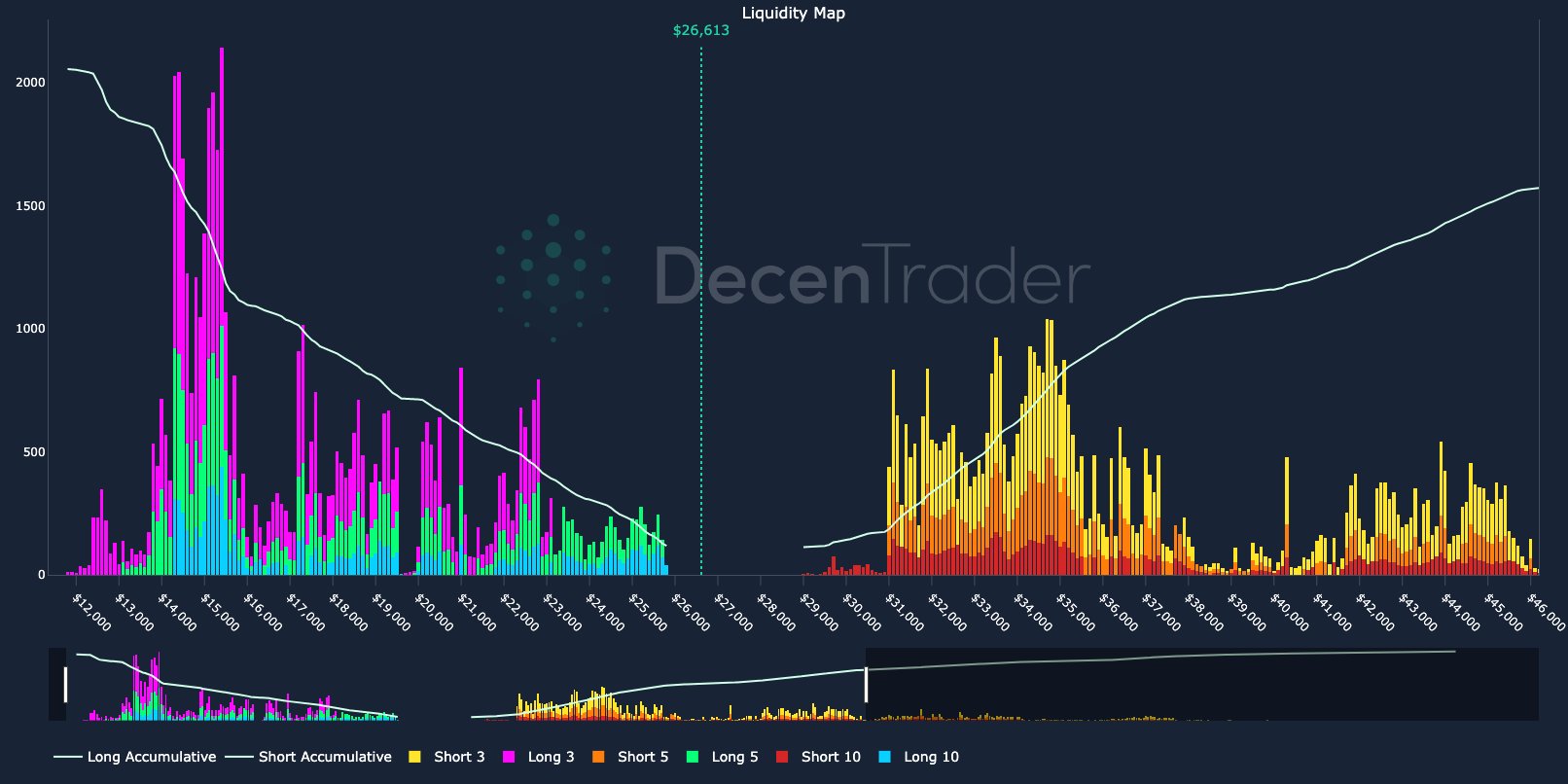

Liquidity is there to be taken above and below, but so far, only a tease of a liquidity sweep has materialized.

The coming days have some potential macro surprises in store, but analysts agree it will take a significant shift in the data to crack a stubborn Bitcoin.

Elsewhere, on-chain signals are also characteristic of a consolidation period following the rapid gains seen in Q1.

Cointelegraph looks at the landscape regarding BTC price action to see what could disrupt the trend — or lack of it — this week.

Where’s the liquidity?

Bitcoin spot price performance is giving traders a headache — not because of volatility, but the lack of it.

In what feels like an unusual state of events, BTC/USD is acting within a range of only a few hundred dollars, with nothing that has been able to change the mood.

Even last week’s remarks from Jerome Powell, chair of the United States Federal Reserve, were not enough to send Bitcoin definitively higher or lower.

Traders are thus increasingly on the sidelines waiting for cues.

“If we lose $26,600 and close on a 4 hour candle closure i will look to short. Bears took us to support, but can they now take us and close below,” Crypto Tony summarized to Twitter followers on the day.

The small range just below $27,000 has been Bitcoin’s home since May 13. Outside, both long and short liquidity lies in wait.

According to data from trading suite DecenTrader, a move to $25,800 is all it would take to spark some form of cascade.

“Dips keeping being aggressively longed on Binance, as shown by the Long/Short ratio,” it revealed.

“Typically we see this kind of price action flush out a lot of these traders as prices chops about. The long Liquidity starts at $25,800.”

Others eyed historical patterns, with Stockmoney Lizards drawing comparisons to Bitcoin’s behavior after the 2015 bear market.

post bear market similarities pic.twitter.com/vWseKsPlki

— Stockmoney…

Click Here to Read the Full Original Article at Cointelegraph.com News…