On the surface, institutional adoption of digital assets is

thriving. The fact that multiple major firms like HSBC and BlackRock are

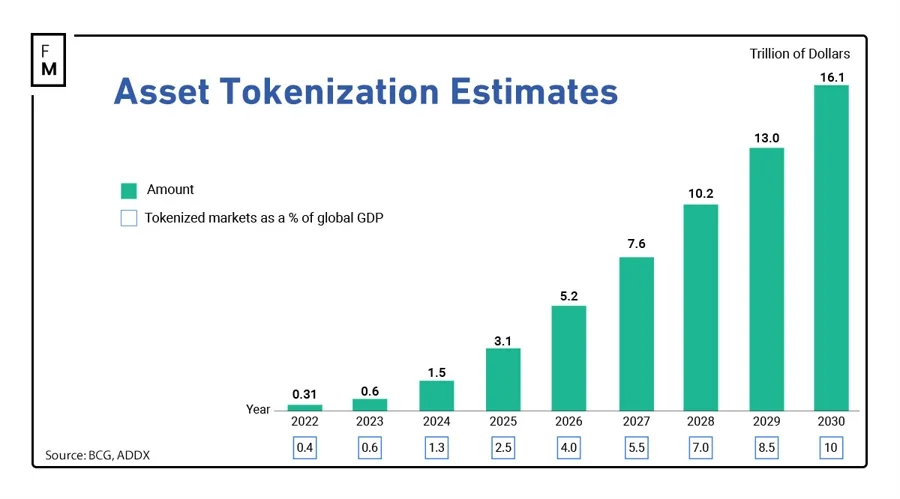

beginning to offer tokenized products is a testament. One recent projection

even suggested that by 2030 the tokenized asset market could go as high as $16.1

trillion.

Institutional participation has long been viewed as a

necessary step for a larger mainstream adoption of digital assets, so the

market is excited to welcome these new products. While this all sounds

overwhelmingly positive, there is unfortunately still a significant hurdle that

will need to be addressed before we see any broader acceptance and usage of digital assets:

siloed liquidity.

Now, there are many different blockchain networks that, in

most cases, don’t easily share resources. This ranges across public networks,

private networks and sidechains, all of which struggle to move assets between

them.

For example, JP Morgan has their

own private blockchain, named Onyx. While JP Morgan is a massive, global firm

and can certainly offer its customers services on this chain, it is still

effectively walled off from larger public networks like Ethereum, as well as

other institutional ones.

Compare this situation to the adoption of the internet

around thirty years ago. It didn’t really take off until we had one “World Wide

Web” that allowed access to all services via a single portal with no need to

understand internet

protocols. The whole of Web3 needs to work in just the same way to become

functional for business.

Real World Asset Tokenization is poised to revolutionize asset financing by bringing liquidity into even the most illiquid markets and opening the doors for new retail investors to participate.

Experts predict a $16 trillion market for tokenized assets by 2030. pic.twitter.com/aFsCqM1qhB

— Pepesso (@0xPepesso) April 7, 2024

Challenges and Considerations in Web3 Asset Transfers

In an attempt to address such issues, firms like Deutsche Bank

have begun experimenting with ways to connect different institutional networks,

and they are doing so via the creation of “bridges.”

Bridges aren’t entirely new to Web3, and they act as

third parties that can transfer assets between different networks. However,

there are some catches. Generally, bridging is a relatively expensive process

to perform, usually incurring fees on both chains.

Furthermore, bridges are controlled by centralized

operators, making these single points of failure among the most…