On Jan. 17, 2023, FTX Trading Ltd. and affiliated debtors updated the public and detailed that the firm’s current administrators have discovered $5.5 billion of liquid assets to date. Top-level executives, including the new FTX CEO and chief restructuring officer, John J. Ray III, met with the bankruptcy case’s committee of unsecured creditors to share the news.

FTX Uncovers $5.5 Billion in Liquid Assets Through ‘Herculean Investigative Effort’

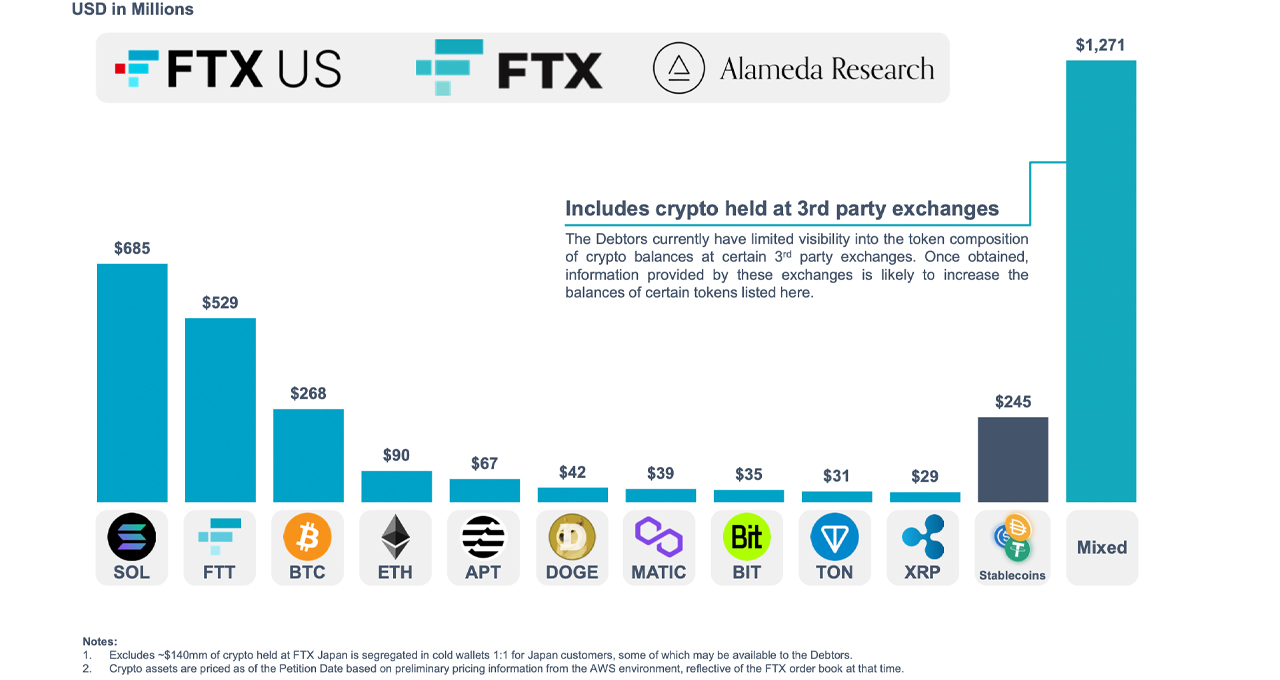

FTX has discovered $5.5 billion in liquid assets, according to a press statement released at 2:40 p.m. Eastern Time, Tuesday. The debtors, including FTX CEO John J. Ray III, announced that the team identified the funds through a “herculean investigative effort.” The company’s press release details that the team found $3.5 billion in cryptocurrency assets, $1.7 billion in cash deposits and roughly $3 million in securities.

The press release further noted that the FTX team discovered $323 million was lost to unauthorized third-party transfers before the Chapter 11 bankruptcy filing was registered on Nov. 11, 2022. Furthermore, $426 million “was transferred to cold storage under the control of the Securities Commission of The Bahamas,” the debtors’ statement details.

FTX debtors disclose that crypto assets currently held by FTX executives and the restructuring teams are also held in cold storage. “We are making important progress in our efforts to maximize recoveries, and it has taken a Herculean investigative effort from our team to uncover this preliminary information,” Ray explained in the update. “We ask our stakeholders to understand that this information is still preliminary and subject to change. We will provide additional information as soon as we are able to do so.”

FTX Debtors Investigate Historical Transactions, Including Voyager and Blockfi Deals, and $93M in Political Donations

The presentation shared with the committee of unsecured creditors is also attached to the FTX press release, and it notes that an investigation “confirmed shortfalls at both international and U.S. exchanges.” Furthermore, the investigation “uncovered the mechanics behind how Alameda Research had the ability to borrow without collateral effectively unlimited amounts from customers.” The debtors’ report insists that a “small group of…

Click Here to Read the Full Original Article at Bitcoin News…