Bitcoin (BTC) starts a new week just under $22,000 as bulls fail to reclaim lost ground in February.

After some modest volatility towards the weekly close, BTC/USD is still near three-week lows as a new status quo enters with $22,000 as resistance.

The largest cryptocurrency stands at the beginning of an important week of macroeconomic data, however, with plenty of opportunities for volatility to return.

These come first and foremost in the form of the U.S. Consumer Price Index (CPI), the January print for which will be released on Feb. 14.

Other data prints will follow throughout the week, and analysts are keenly eyeing crypto markets’ response, along with that of the U.S. dollar.

Within Bitcoin circles, whales are taking the opportunity to buy at current levels, data shows, in a glimmer of hope for those hoping that the 2023 Bitcoin price recovery may continue.

At the same time, a formidable new chart event is causing discomfort for some — can Bitcoin avoid significant downside as its first ever weekly “death cross” confirms?

Cointelegraph takes a look at these issues and more in the weekly digest of potential Bitcoin market triggers for the week ahead.

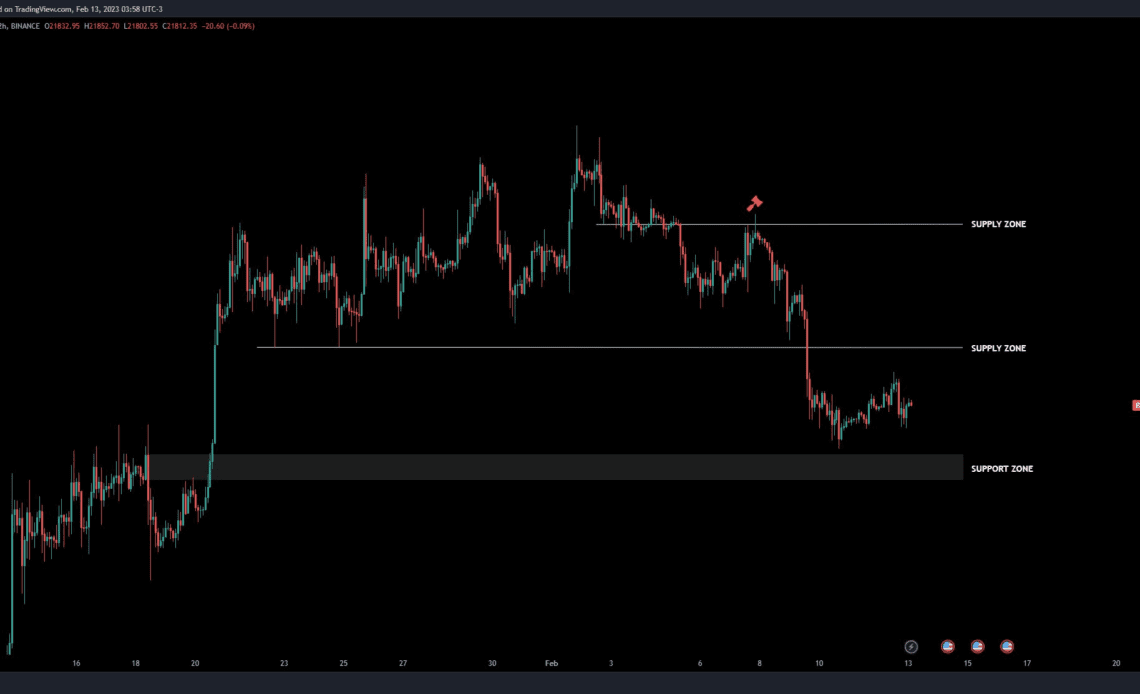

Bitcoin confirms weekly chart “breakdown”

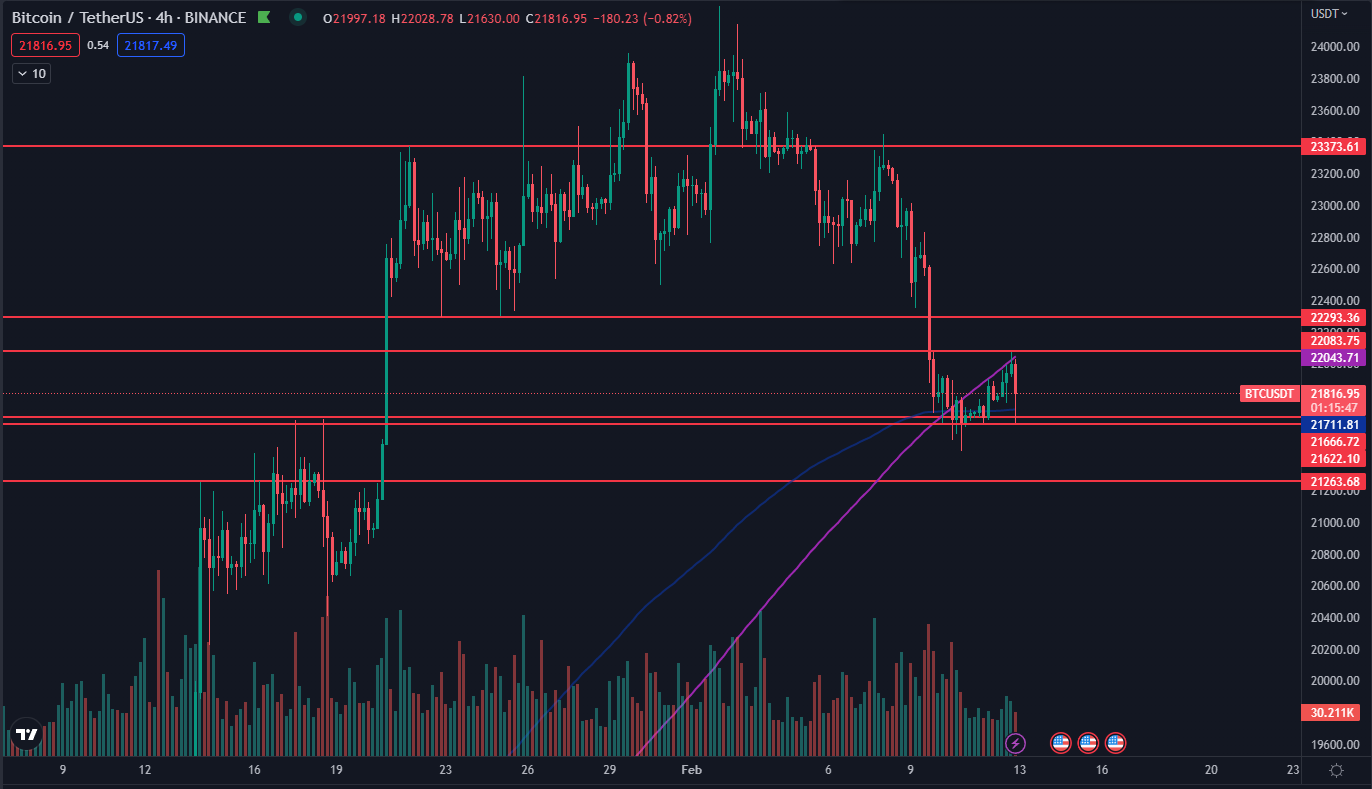

At around $21,800, the latest weekly close had few surprises in store for those on either side of the Bitcoin trade, data from Cointelegraph Markets Pro and TradingView shows.

Its lowest since mid-January, the event sealed a long-awaited retracement for BTC/USD after it spent January experiencing practically unchecked upside.

Now, attention is focusing on key support levels holding, these mostly in the form of long-term trend lines reclaimed as support during the January run-up.

In a fresh update for Twitter followers on Feb. 13, popular trader Crypto Tony confirmed that $21,400 was where the situation may get interesting.

“From there we can really assess whether the bulls have it in them to save the bears, or lead them to slaughter,” part of commentary read.

Zooming in, fellow account Daan Crypto Trades noted that BTC/USD sat between the 200-period and 400-period exponential moving average (EMA) on 4-hour timeframes.

“It looks like we will open up with a small gap below us as we speak. Overall just a choppy weekend for BTC with some alts popping. Waiting for CPI. Probably won’t make many actions before that,” he summarized.

A more formidable line…

Click Here to Read the Full Original Article at Cointelegraph.com News…