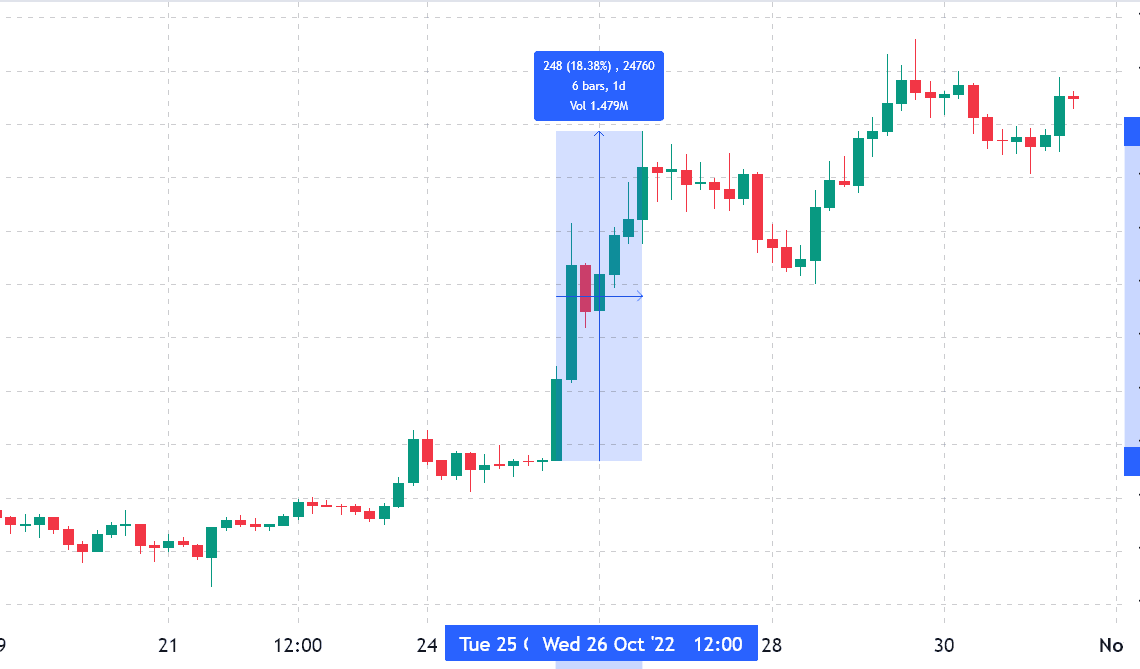

A $250 surprise rally took place between Oct. 25 and Oct. 26, pushing Ether (ETH) price from $1,345 to $1,595. The movement caused $570 million in liquidations in Ether’s bearish bets at derivatives exchanges, which was the largest event in more than 12 months. Ether price also rallied above the $1,600 level, which was the highest price seen since Sept. 15.

Let’s explore whether this 27% rally over the past 10 days reflects any signs of a trend change?

It is worth highlighting that another 10.3% rally toward $1,650 happened three days later on Oct. 29, and this triggered another $270 million of short seller liquidations on ETH futures contracts. In total, $840 million of leveraged shorts were liquidated in three days, representing over 9% of the total ETH futures open interest.

On Oct. 21, the market became optimistic after San Francisco Federal Reserve (FED) President Mary Daly mentioned intentions to step down the pace of interest rate hikes. However, the U.S. Central Bank’s previous tightening movement has led the S&P 500 stock market index to a 19% contraction in 2022.

Despite the 5.5% stock market rally between Oct. 20 and Oct. 31, analysts at ING noted on Oct. 28 that “we do indeed expect the FED to open the door to a slower pace through formal forward guidance, but it may not necessarily go through it.” Furthermore, the ING report added, “it could be that we get a final 50bp in February that would then mark the top. This would leave a terminal rate of 4.75% to 5%.”

Considering the conflicting signals from traditional markets, let’s look at Ether’s derivatives data to understand whether investors have been supporting the recent price rally.

Futures traders kept a bearish stance despite the $1,600 rally

Retail traders usually avoid quarterly futures due to their price difference from spot markets. Still, they are professional traders’ preferred instruments because they prevent the fluctuation of funding…

Click Here to Read the Full Original Article at Cointelegraph.com News…