Bitcoin experienced the second-strongest January in its history — and the best since 2013 — rising nearly 40% amid wide reports that institutional investors were back on board.

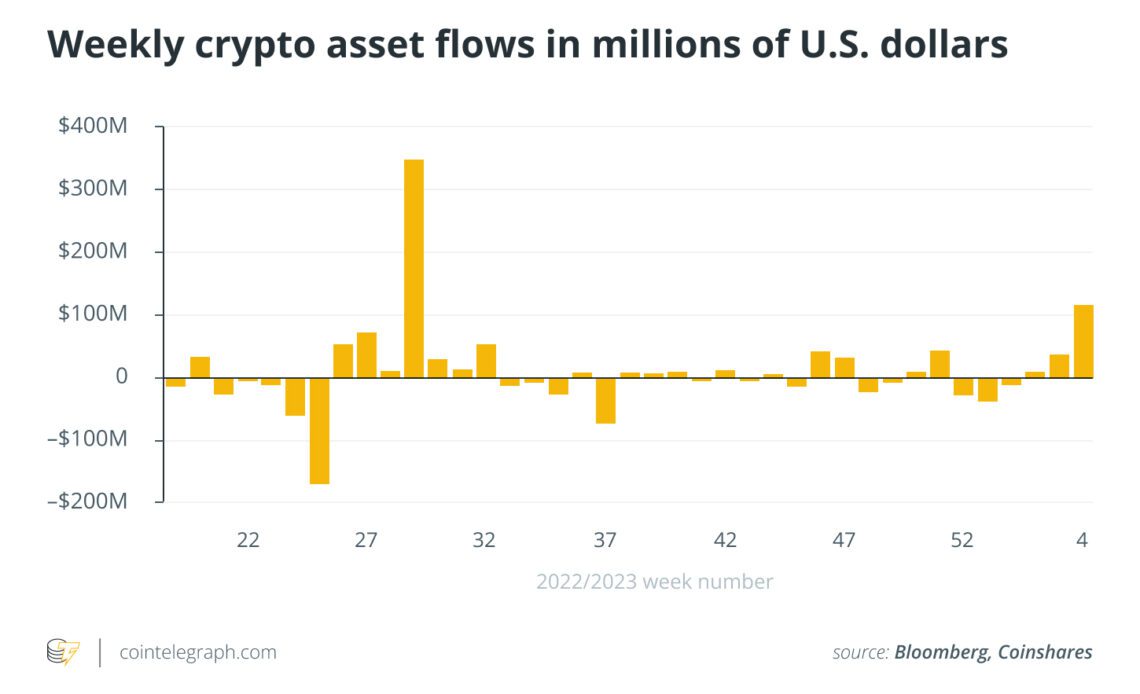

Zhong Yang Chan, head of research at CoinGecko, told Cointelegraph that there were “net institutional inflows into digital asset funds in January 2023, particularly in the last two weeks, with Bitcoin the largest beneficiary.”

Meanwhile, a Jan. 30 CoinShares blog noted that the total assets under management in digital asset investment products — a good gauge of institutional participation — had risen to $28 billion, led by Bitcoin (BTC), which was up 43% from November 2022’s low point in the current cycle.

The reasons for this bullishness varied depending on whom one asked, ranging from macro factors like a pause in inflation growth to more technical reasons like a squeeze on BTC short sellers. Elsewhere, a research report from Matrixport noted that institutional investors are “not giving up on crypto,” further suggesting that as much as 85% of Bitcoin buying in January was the result of U.S. institutional players. The cryptocurrency services provider added that many investors had used the U.S. Jan. 12 Consumer Price Index print “as a confirmation signal to buy Bitcoin and other crypto assets.”

Almost all gains were during U.S. market hours

But how did Matrixport come to attribute up to 85% of monthly BTC growth to U.S. institutional investors? As the Singapore-based firm explained in its recent market overview: “The most astonishing statistic is that almost all of the +40% year-to-date rally in Bitcoin has happened during US market hours. […] That’s 85% of the Bitcoin move.” Matrixport continued:

“We have always worked with the assumption that Asia is driven by retail investors, and the US is driven by institutional investors.”

So, if Bitcoin’s market price rises during U.S. market trading hours but falls during Asian trading hours, as seemed to be happening in January, can one assume that U.S. institutional investors were buying Bitcoin while Asian retail traders were selling it — a sort of yin-and-yang action? Apparently so. During U.S. trading hours, “institutions, aka ‘stable hands,’” were taking advantage of the dips, added Matrixport.

Recent: State of play: Decentralized domain services reflect on industry progress

Is this really what drove BTC’s price upward in January? “In my personal opinion, the assumption that Asian retail…

Click Here to Read the Full Original Article at Cointelegraph.com News…