The head of blockchain analytics platform CryptoQuant says that Bitcoin (BTC) could dip to a “max pain” price range before the bull market is able to continue.

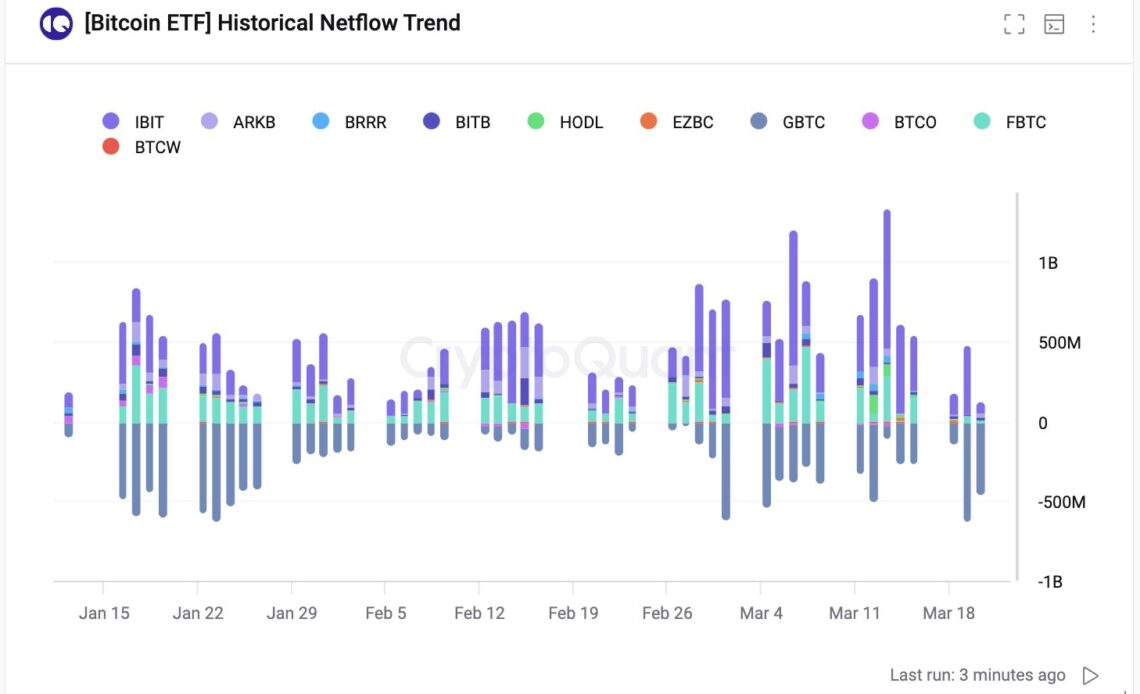

Ki Young Ju tells his 340,000 followers on the social media platform X that the net inflows of capital to spot Bitcoin exchange-traded funds (ETFs) have cooled off, suggesting that sellers may be taking over the market.

The analytics expert says that based on BTC’s historical price action, a maximum pain correction could pull Bitcoin down to $51,000.

“Bitcoin spot ETF netflows are slowing.

Demand may rebound if the BTC price approaches critical support levels.

New whales, mainly ETF buyers, have a $56,000 on-chain cost basis. Corrections typically entail a max drawdown of around 30% in bull markets, with a max pain of $51,000.”

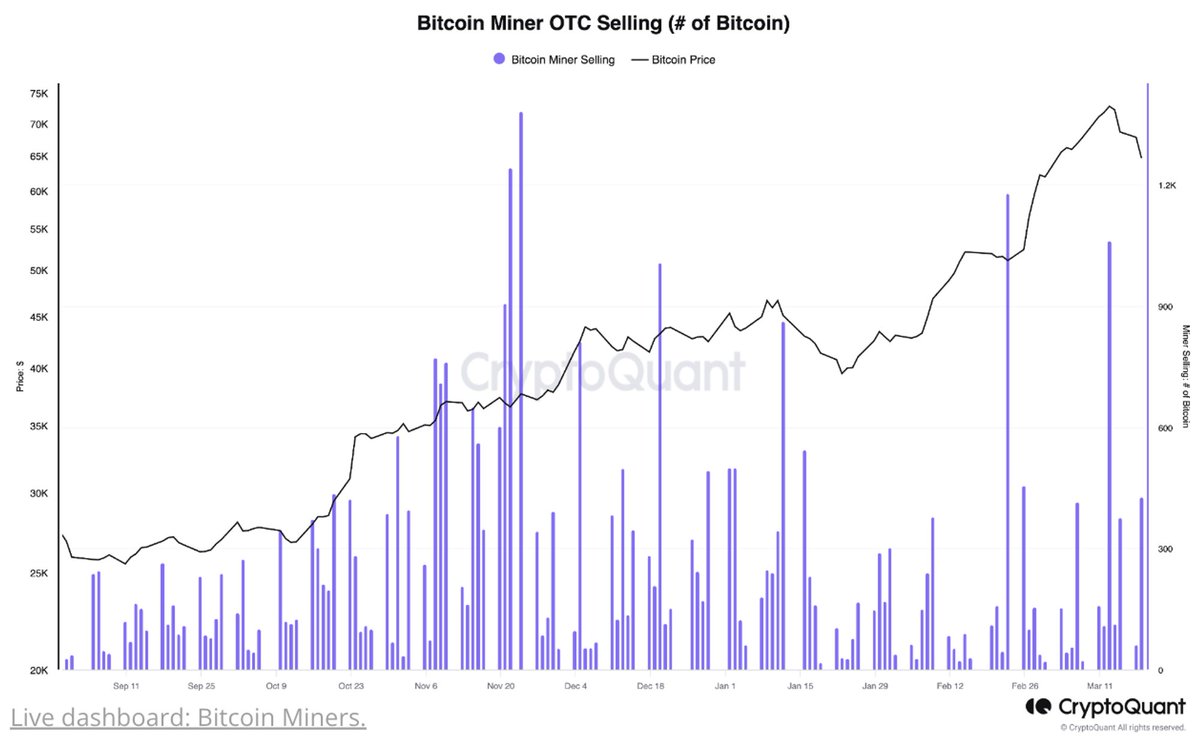

Supporting the idea that a more severe Bitcoin correction may be around the corner, CryptoQuant’s data also suggests that the larger holders of BTC – in this case miners – have started selling more aggressively.

“Large Bitcoin holders started selling more aggressively, and miners have also been offloading their holdings as prices have soared.”

CryptQuant’s data also shows that shorter-term holders are taking profits as well – at a rate not seen in nearly five years.

“BTC traders started to sell, taking advantage of high-profit margins. This selling behavior hasn’t been seen at this scale since May 2019.”

At time of writing, Bitcoin is trading for $67,184, up over 4% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Click Here to Read the Full Original Article at The Daily Hodl…