In a recent blog post, ETC Group’s Head of Research, Andre Dragosh, provided a comprehensive analysis of the current state of the crypto market. Dragosh’s findings shed light on the market’s performance dynamics, profit-taking activity, and derivative trends.

High-Risk Appetite In Crypto Market

According to Dragosh’s analysis, crypto assets showcased their resilience as they outperformed traditional assets like equities, supported by a significant repricing in monetary policy expectations and short futures liquidations at the beginning of last week.

However, this outperformance encountered some limitations in the short term due to stronger-than-expected US jobs data, which began to dampen the recent rally. The US non-farm payroll growth and unemployment rate surpassed consensus estimates, leading to a reversal in US Treasury yields and a decrease in overall risk appetite across traditional financial markets.

Notably, altcoin outperformance gained momentum during the period, with Avalanche (AVAX) and Cardano (ADA) returning over 50% each. Among the top 10 crypto assets, Avalanche, Cardano, and Polkadot (DOT) stood out as the relative outperformers.

According to Dragosh, this surge in altcoin outperformance compared to Bitcoin (BTC) indicates a “high-risk appetite” within the crypto market. On the other hand, on-chain data for Bitcoin suggests that investors are increasingly taking profits, evidenced by the rising number of coins in profit being sent to exchanges.

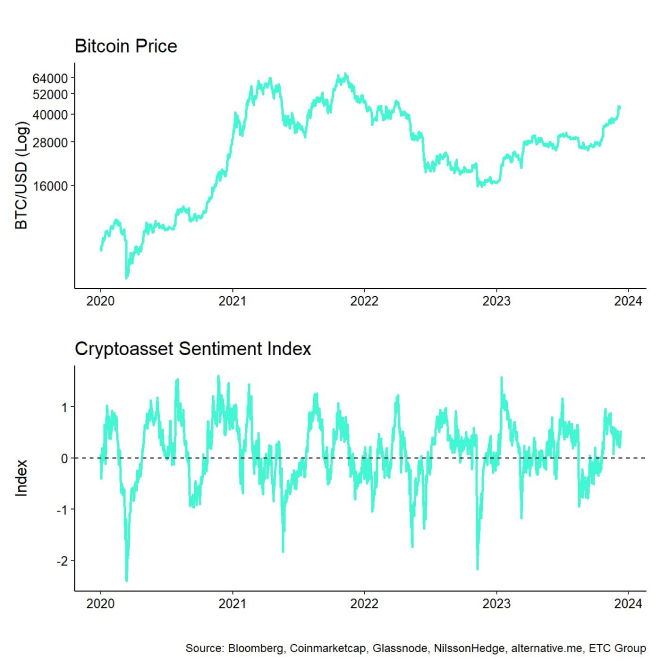

ETC Group’s in-house Crypto Asset Sentiment Index remained relatively elevated compared to the previous week, indicating positive market sentiment. However, major reversals to the downside were observed in the Crypto Dispersion Index and the BTC 25-delta 1-month option skew.

The Crypto Fear & Greed Index continued to reside in “Greed” territory, reflecting ongoing market optimism. Although ETC Group’s Cross Asset Risk Appetite (CARA) measure declined slightly, it remained in positive territory, signaling a decrease in risk appetite in traditional financial markets.

Performance dispersion among digital assets decreased compared to the previous week but remained relatively high. This implies that correlations among crypto assets have decreased, and investments are driven by coin-specific factors, highlighting the importance of diversification among digital assets.

Short-Term…

Click Here to Read the Full Original Article at NewsBTC…