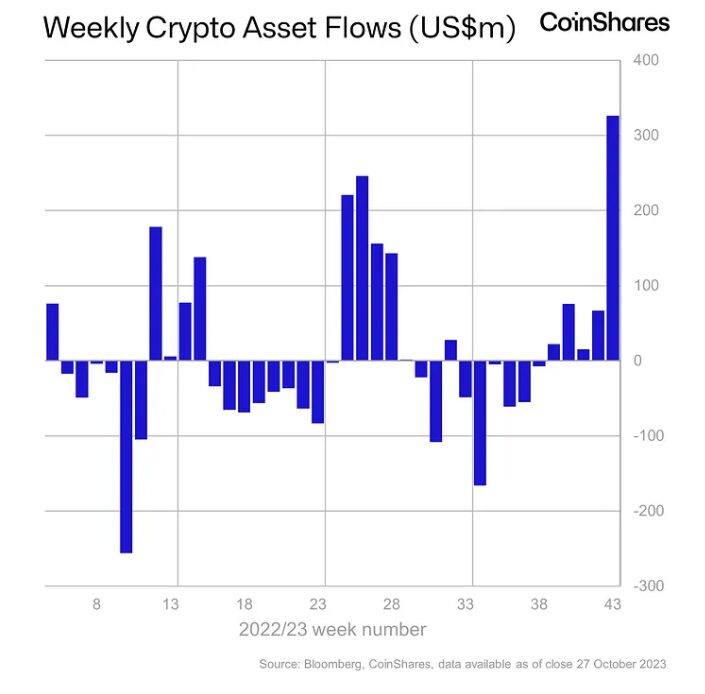

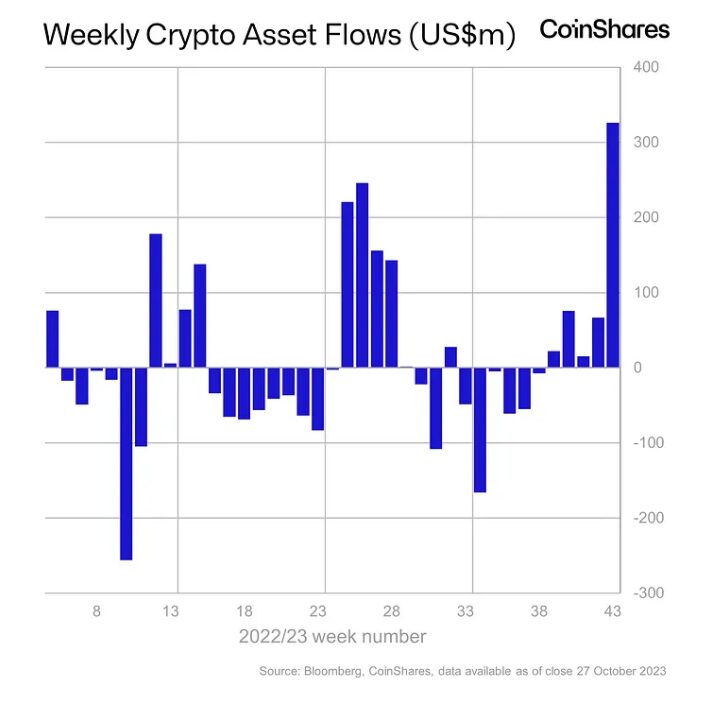

Crypto exchange-traded products (ETPs) saw their largest weekly inflows in more than a year, according to an October 30 report from asset management platform Coinshares. Inflows were $326 million for the week ending October 27, dwarfing the $66 million recorded over the previous week.

Digital asset investment products saw inflows of US$326m, the largest single week of inflows since July 2022!

These numbers are due to what we believe was rising optimism from investors that the US SEC is poised to approve a spot-based Bitcoin ETF in the US.

– #Bitcoin –… pic.twitter.com/AbgsgjcaOz

— CoinShares (@CoinSharesCo) October 30, 2023

ETPs are investment funds whose notes or shares are designed to track the price of a particular asset. In the case of crypto ETPs, they usually track the price of large market-cap cryptos such as Bitcoin (BTC) or Ether (ETH). Some investors prefer to get exposure to crypto prices through funds rather than holding these assets themselves, as shares of these funds can be held in a traditional brokerage account.

An ETP “inflow” occurs when the fund’s price rises faster than its underlying asset, which causes the fund to buy the asset. This is generally seen as bullish for the underlying asset. By contrast, an “outflow” occurs when the fund has to sell the asset because the prices of their notes or shares are declining relative to their target, which is usually seen as bearish.

According to CoinShares’ report, weekly inflows for the week ending October 27 were $326 million. This was the highest since July 2022, 15 months ago. It was also the fifth straight week of ETP inflows.

Related: Gary Gensler’s Bitcoin ETF position is ‘inconsistent’… says Gary Gensler

According to Coinhsares, one possible explanation for the sudden rise in inflows could be “rising optimism from investors that the U.S. Securities and Exchange Commission is poised to approve a…

Click Here to Read the Full Original Article at Cointelegraph.com News…