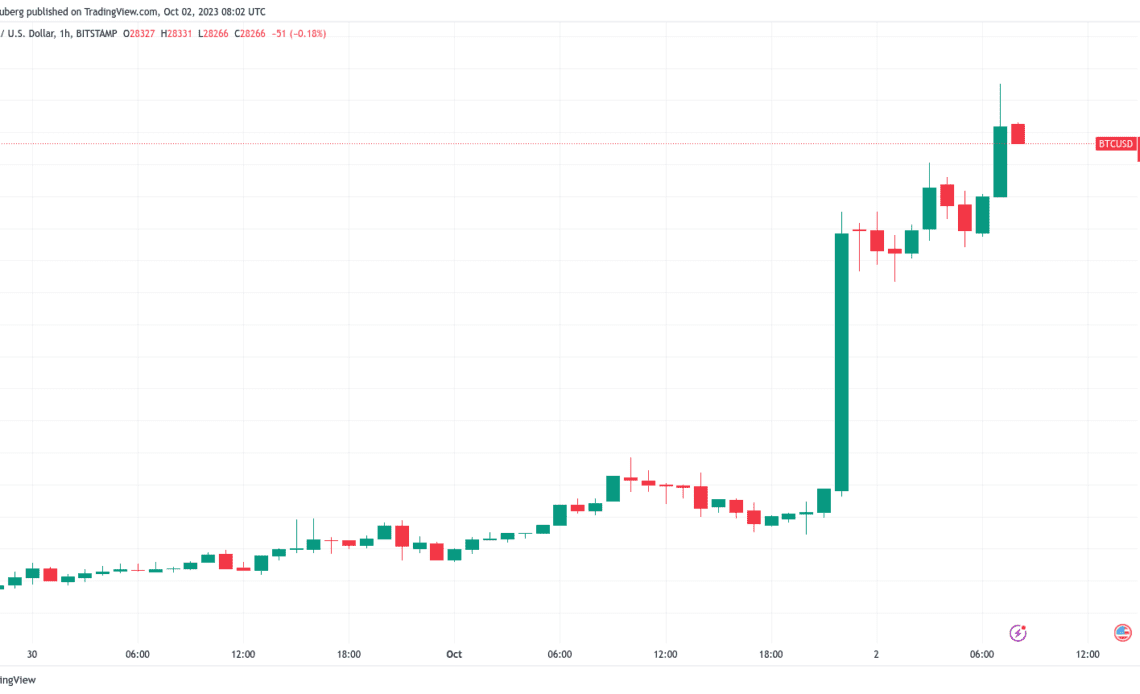

Bitcoin (BTC) starts a new week, a new month and a new quarter with a firm bullish move past $28,000.

The largest cryptocurrency greets “Uptober” in style with its best weekly close since mid-August — what lies in store next?

After mixed BTC price action in September, market participants were prepared for a potentially volatile monthly close, but in the end, this ended up in bulls’ favor.

With October frequently the sight of tangible BTC price gains, excitement is thus brewing over what might happen in the coming weeks.

Macro triggers may not hold the answer immediately, as October begins with a quiet phase for United States macro data, with the government averting a shutdown at the last minute.

Bitcoin fundamentals are not yet echoing the spike in spot price, meanwhile, with mining difficulty due to in fact decrease at its next automated readjustment on Oct. 2.

Cointelegraph takes a look at these topics and more in the weekly digest of BTC price catalysts lying in wait.

Bitcoin bulls acknowledge BTC price reversal risk

In the run-up to the Oct. 1 weekly close, Bitcoin had already cleared the end of the September monthly candle — with little by way of overall volatility.

That all changed as the week ended, with a sudden growth spurt taking BTC price action to just shy of $28,000. In the hours that followed, new local highs of $28,451 appeared on Bitstamp.

Since the start of Oct. 1, the largest cryptocurrency is up over 5%, data from Cointelegraph Markets Pro and TradingView confirms.

The move provided Bitcoin’s highest weekly close since mid-August, canceling out the weaker performance seen since.

“Bitcoin back up to $28,000,” Michaël van de Poppe, CEO and founder at MNTrading, told X subscribers on the day.

“Might fully retrace, but the trend is clearly upwards. Every consolidation of Bitcoin will be a period where altcoins are starting to follow the path of Bitcoin. This quarter will be fun!”

Popular trader Skew likewise flagged the potential for a comedown, using exchange order book trends as proof.

“Pretty wide orderbook here in terms of available / resting liquidity,” he explained on the day.

“Bigger price reaction comes out of this imo Increasing ask liquidity on spot orderbooks; implies greater volume needed by spot takers to clear $28K – $29K (Market structure shift).”

He added that the impetus to decide where…

Click Here to Read the Full Original Article at Cointelegraph.com News…