The Bitcoin market has witnessed a significant downturn, with prices plummeting below the $66,000 mark. This abrupt -5.6% price movement can be attributed to four major factors: a long liquidation event, a rising US Dollar Index (DXY), profit-taking by investors, and spot Bitcoin ETF outflows.

#1 Long Liquidations

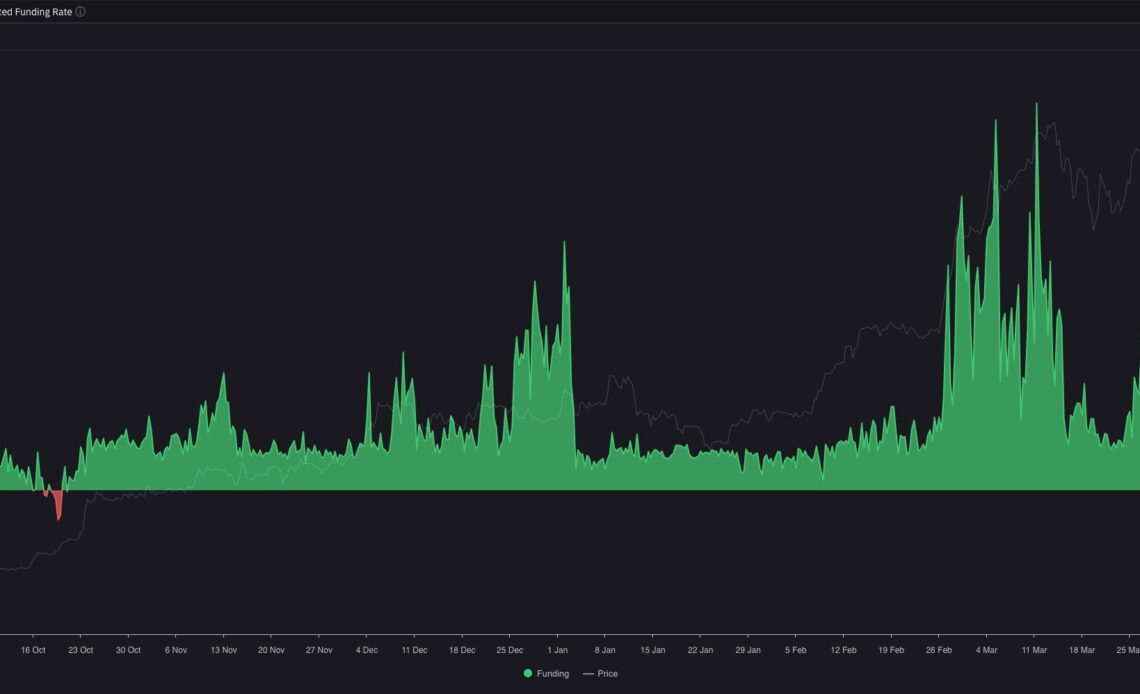

The main force leading to today’s downturn in Bitcoin’s price was a significant deleveraging event characterized by an unusually high level of long liquidations. Before the downturn, Bitcoin’s Open Interest (OI) Weighted Funding Rate was unusually high, indicating that leveraged traders were paying premiums to maintain long positions in anticipation of future price increases. This optimism, however, made the market vulnerable to sudden corrections.

Crypto analyst Ted, known as @tedtalksmacro on X (formerly Twitter), remarked, “Today was the largest long liquidation event since the 19th March.” He further elaborated on the effects of this correction by noting, “Nice reset in overall positioning today, even on just a 5% drop lower for Bitcoin… Next leg higher is loading I think.” This comment highlights the severity of the liquidations and suggests a potential rebound or restructuring within the market as it stabilizes.

Coinglass data reveals that over the last 24 hours, 120,569 traders were liquidated, amounting to $395.53 million in total liquidations, with $311.97 million being long positions. Bitcoin-specific long liquidations were at $87.42 million.

#2 DXY Puts Pressure On Bitcoin

With 105.037, the DXY closed at its highest level since November yesterday, evidencing a strengthening US dollar. Given Bitcoin’s inverse correlation with the DXY, the stronger dollar might have shifted investor preference towards safer assets, moving away from riskier investments like Bitcoin.

This correlation stems from the global market’s risk sentiment, where a rising DXY often signals a shift towards safer investments, detracting from riskier assets like Bitcoin. However, analyst Coosh Alemzadeh provided a counter perspective, suggesting through a Wyckoff redistribution schema that despite the DXY’s recent uptick, the next move could favor risk assets, potentially including Bitcoin.

#DXY ⬆️4 weeks in a row/broke out of its downtrend so consensus is that a new uptrend is starting yet risk assets are consolidating at ATH

Next…

Click Here to Read the Full Original Article at NewsBTC…