Bitcoin (BTC) bulls laid most of their options at $24,500 and higher for the March 3 options expiry, and given the recent bullishness seen from BTC, who can blame them? On Feb. 21, Bitcoin price briefly traded above $25,200, reflecting an 18% gain in eight days. Unfortunately, regulatory pressure on the crypto sector increased and despite no effective measures being announced, investors are still wary and reactive to remarks from policymakers.

For instance, on Feb. 23, U.S. Securities and Exchange Commission Chair Gary Gensler claimed that “everything other than Bitcoin” falls under the agency’s jurisdiction. Gensler noted that most crypto projects “are securities because there’s a group in the middle and the public is anticipating profits based on that group.”

March 1 comments from two U.S. Federal Reserve (FED) officials reiterated the necessity for even more aggressive interest rate increases to curb inflation. Minneapolis FED President Neel Kashkari’s and Atlanta FED President Raphael Bostic’s comments also decreased investors’ expectations of a monetary policy reversion happening in 2023.

The stricter stance from the macroeconomic and crypto regulatory environment caused investors to rethink their exposure to cryptocurrencies. Nevertheless, Bitcoin’s price decline practically extinguished bulls’ expectation for a $24,500 or higher options expiry on March 3, so their bets are unlikely to pay off as the deadline approaches.

Bulls were “rug pulled” by negative regulatory remarks

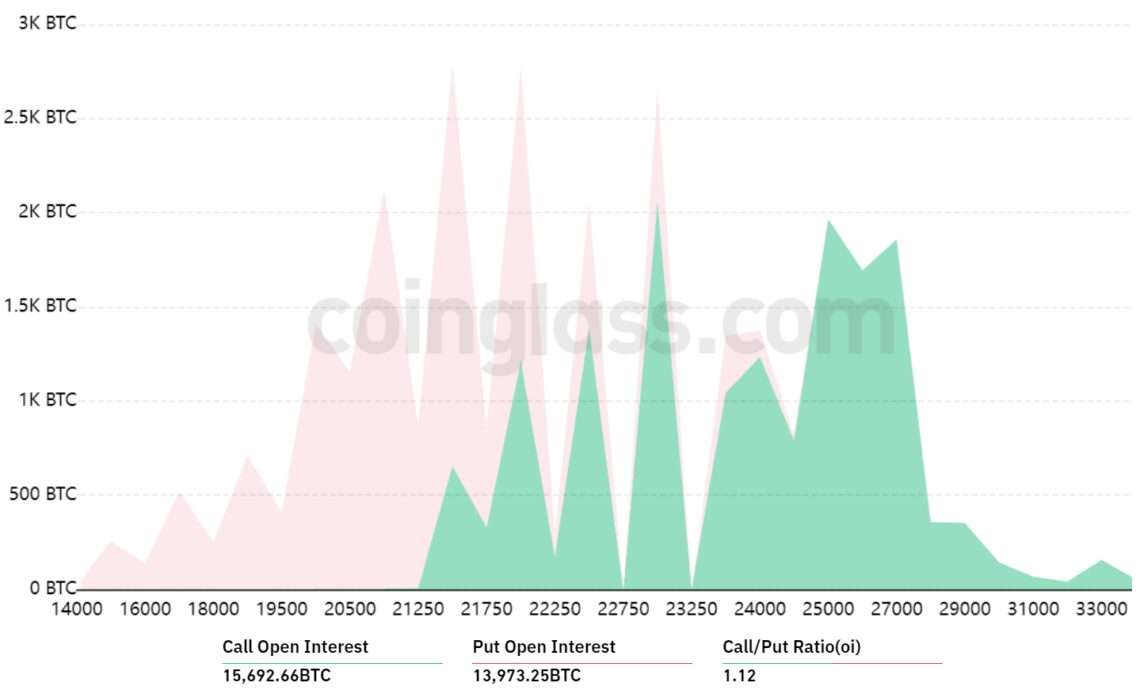

The open interest for the March 3 options expiry is $710 million, but the actual figure will be lower since bulls became overconfident after Bitcoin traded above $25,000 on Feb. 21.

The 1.12 call-to-put ratio reflects the imbalance between the $400 million call (buy) open interest and the $310 million put (sell) options. However, the expected outcome is likely much lower regarding active open interest.

For example, if Bitcoin’s price remains near $23,600 at 8:00 am UTC on March 3, only $50 million worth of these call (buy) options will be available. This difference happens because the right to buy Bitcoin at $24,000 or $25,000 is useless if BTC trades below that level on expiry.

Bears have set their trap below $23,000

Below are the four most likely scenarios based on the current price action. The number of options contracts available on March 3 for call (bull) and put (bear) instruments varies, depending on the…

Click Here to Read the Full Original Article at Cointelegraph.com News…