A popular crypto analyst believes the pre-halving rally for Bitcoin (BTC) is still in the beginning stages.

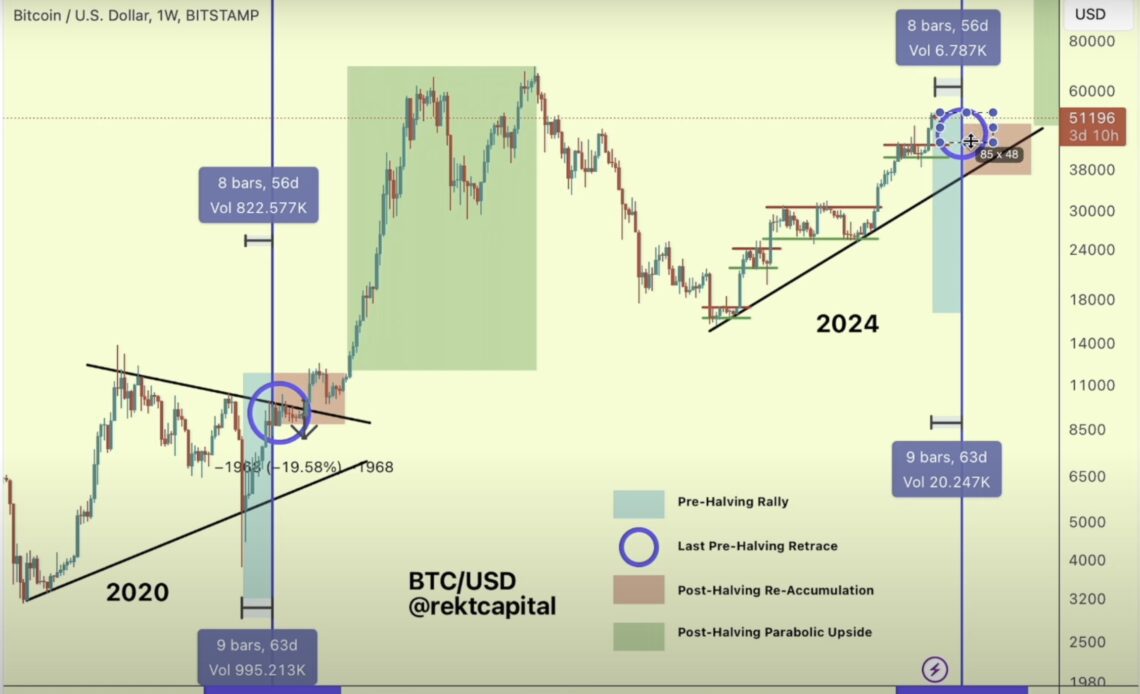

Pseudonymous crypto trader Rekt Capital tells his 57,300 YouTube subscribers that based on historical patterns, Bitcoin’s pre-halving rally may extend for weeks longer.

Bitcoin’s halving is scheduled to occur in April when BTC miners’ rewards are cut in half.

Says Rekt Capital,

“The main takeaway here is that this pre-halving rally has only just begun technically speaking, and it’s a little bit too soon to talk about a last pre-halving retrace. This pre-halving retrace tends to occur a few weeks before the halving event. And so that just means that we might have a few weeks left, whether it’s still just hovering at the highs for a few more weeks, re-accumulation at highs before the retest or the retrace or maybe we see a little bit more limited upside before that retrace occurs.”

The trader thinks that a conservative estimate for a Bitcoin correction before the halving event could be a decline between 15% and 20%.

“Generally speaking, we should see at least two to three weeks more of upside, three weeks in general – so whether that’s upside or re-accumulation at its highest, whether it’s limited upside as well. Still, we’re not yet in the last pre-halving retrace phase. And when we’re talking about retracement periods, in 2020 it was a 19% retrace…

But in 2016 we saw… 29% if we’re just taking into account the candle bodies. So anything between 19% to 30% is something we could expect at this point in the cycle.

And then this cycle itself, maybe you want to be a little bit more conservative and just say 15% or 20%. Whatever this retrace turns out to be, it’s going to be the last pre-halving retrace, and it’s going to be the last bargain-buying opportunity before we transition into this post-having re-accumulation period which will take place after the halving and will last quite a substantial amount of time.”

Bitcoin is trading for $50,767 at time of writing, a slight decrease in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…