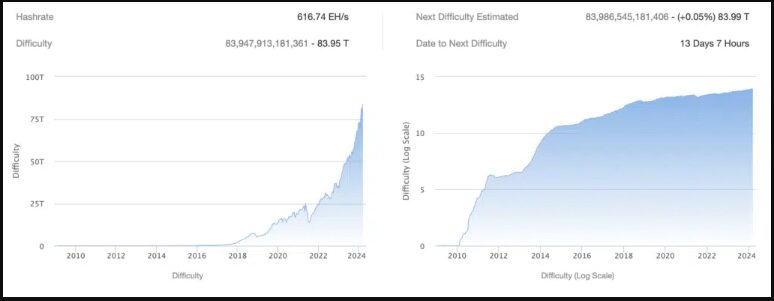

The winds of change are blowing through the Bitcoin landscape. On March 14th, 2024, the network witnessed a monumental shift – mining difficulty skyrocketed to a record-breaking 84 trillion hashes. This unprecedented challenge coincides with another significant event on the horizon: the Bitcoin halving slated for April.

According to BTC.com, the rate has risen by nearly 5.80% since the previous modification. The mining hashrate for the original coin has also peaked, indicating that more people are now participating in the mining process. At present, the value stands at 617 EH/s.

Source: BTC.com

Bitcoin Mining: The Difficulty Dilemma

Mining Bitcoin is no easy feat. Miners compete to solve complex cryptographic puzzles, and the difficulty of these puzzles adjusts based on the overall network hash rate. As more miners join the network, the difficulty increases to ensure a steady block production rate (roughly 1 block every 10 minutes).

This recent surge in difficulty signifies an influx of new miners, likely drawn by Bitcoin’s recent price rally that saw it peak at a staggering $73,800 on the same day.

The Halving Effect

The upcoming halving event in April throws another variable into the equation. Every four years, the block reward for miners – the amount of Bitcoin earned for successfully mining a block – is cut in half.

This economic policy is a cornerstone of Bitcoin’s design, aiming to control inflation and maintain scarcity over time. The last halving in May 2020 witnessed a significant price increase in the following months, and many analysts believe the upcoming halving will follow suit.

BTCUSD weakens today and trades at $68,178: TradingView.com

Here’s the logic: with the supply of new Bitcoins being halved, the existing ones become relatively more scarce, potentially driving the price up due to increased demand.

A Balancing Act For Miners

Despite the rising difficulty, the potential for Bitcoin’s price to appreciate after the halving could incentivize miners to weather the storm. This economic incentive is bolstered by the recent spike in mining rewards, which reached nearly $79 million

This suggests that even with the increased difficulty, miners are still reaping substantial profits due to the high Bitcoin price. However, the long-term sustainability of this model is debatable.

As difficulty continues to climb, the energy consumption required for mining will also rise. It raises concerns about the…

Click Here to Read the Full Original Article at NewsBTC…