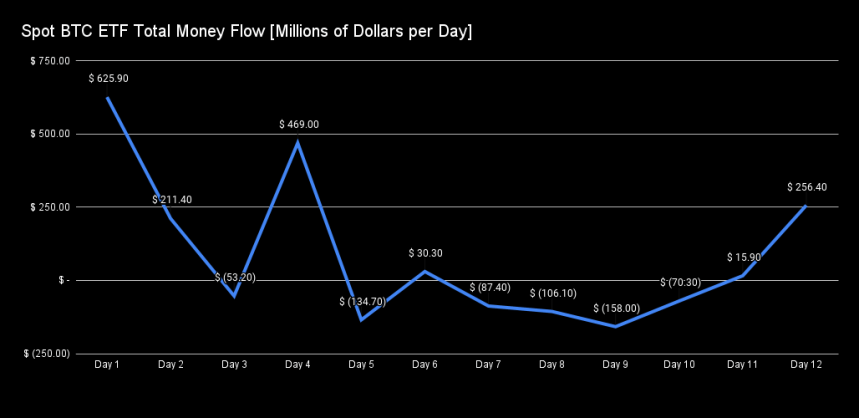

Bitcoin has witnessed a positive turn of events as it reclaimed the $43,000 mark on Tuesday, thanks to a significant reduction in selling pressure from asset manager Grayscale. The reversal in Bitcoin ETFs during day 12 of trading has seen more inflows than outflows. Fidelity and Blackrock recorded a combined $400 million across their Bitcoin ETFs under the ticker names FBTC and IBIT, respectively.

Bitcoin ETFs Record Third-Largest Money Day

According to market expert James Mullarney, Grayscale Bitcoin Trust (GBTC) has experienced a noticeable reduction in selling pressure, as reflected by the slowing down of GBTC selling.

Day 12 of trading showed a substantial inflow compared to outflow, marking the third-largest money day ever in net money flow, bringing in $256 million.

Mullarney further states that adding new Bitcoin ETFs has contributed to a net positive of $1 billion in ETFs, with an estimated 25,000 Bitcoin added to the market. The new Bitcoin ETFs now hold a total of 150,000 BTC in aggregate.

Miners Sell Most Coins Since May 2023

Despite these positive developments with Bitcoin ETFs, there is an ongoing increase in selling pressure from miners. A recent CryptoQuant report reveals that miners have sold the most coins since May 2023.

The flow of coins from miner wallets to spot exchanges reached its highest value since May 16, 2023, with over 4,000 Bitcoin amounting to approximately $173 million in selling pressure.

Although miners have increased their selling activity, CryptoQuant asserts that the market has absorbed this pressure “calmly”. It is important to note that the reserves in mining portfolios have remained at the same level since the beginning of January.

CryptoQuant highlights that it is crucial to consider that these actions do not necessarily indicate a “dump” by miners. The firm concluded:

It is true that there were several interactions with exchanges during this period, some quite significant, but this does not correspond to a “dump” on the part of these entities. Furthermore, it is necessary to be careful when reading messages like “miners are dumping coins”, this analyzes may not take into account the return of these coins to miners’ wallets.

New All-Time High For Bitcoin After November?

Renowned crypto…

Click Here to Read the Full Original Article at NewsBTC…