A popular analyst believes that Bitcoin (BTC) and Ethereum’s (ETH) turnaround this year is likely to continue despite the recent correction in the broader crypto markets.

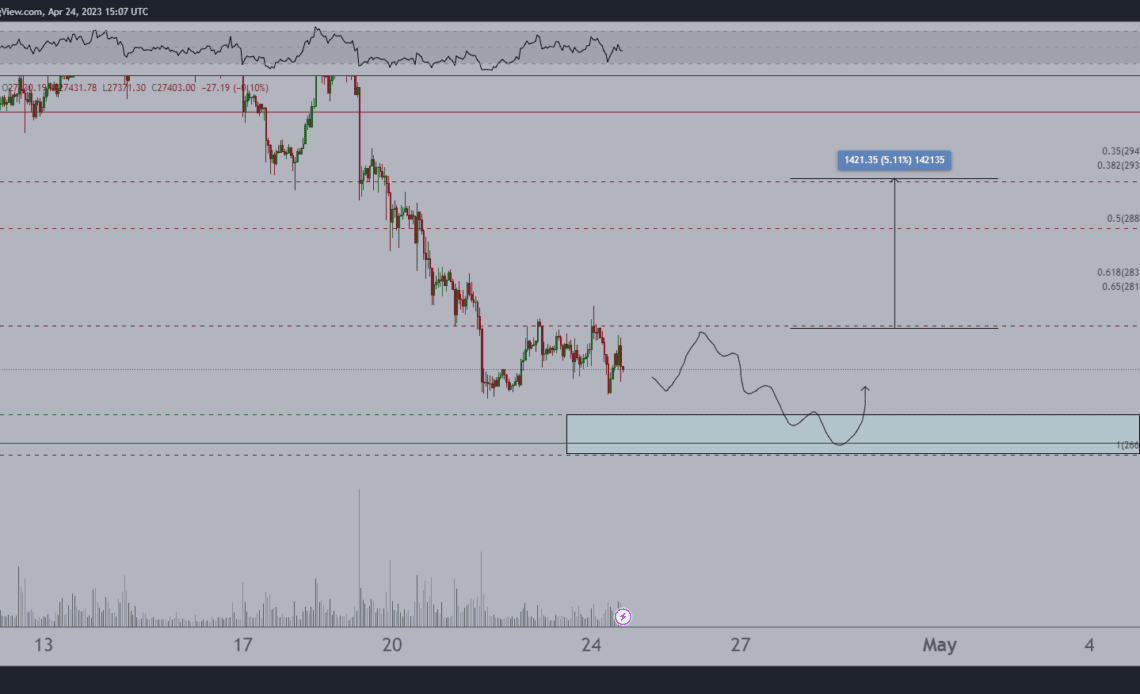

In a new YouTube video, analyst Michaël van de Poppe tells his 163,000 subscribers that he sees Bitcoin retracing to as low as $26,600 before resuming its uptrend.

“Bitcoin is going to look at a level that we need to sustain. In that case, we need to look at anything between $26,600 and $28,000 as potential entry zones. Those need to support itself. If we do, we can just continue (the uptrend), and you know markets take time before they are going to be rallying again.”

According to Van de Poppe, Bitcoin bulls must take out a key resistance level to signal the end of the corrective move.

“Same old, same old for Bitcoin.

Isn’t able to break through $27,800 as resistance point.

Would be looking at a sweep of the lows until we can have a bounce.

However, $27,800 is crucial for a trend reversal, not $28,800.”

At time of writing, Bitcoin is trading for $27,547.

As for Ethereum, Van de Poppe thinks that ETH is still in a macro uptrend as long as it is trading above a crucial support level on the weekly timeframe.

“Based on the weekly timeframe… we are still trending up. Even if we have a corrective move all the way towards the level of $1,800, we could argue that we’re still trending up and that the rally isn’t over.”

At time of writing, Ethereum is worth $1,844.

I

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…