Bitcoin (BTC) may “take out shorts” to crack $30,000 during the day’s key United States macroeconomic policy updates, analysis says.

As bets pile up over how BTC price will react to the Federal Reserve’s decision on interest rates, $30,000 is in sight — but a drop to below $20,000 is not off the table.

Trader plans $30,000 profit-taking

Bitcoin is hours away from what popular trader Crypto Tony calls “one of the most anticipated” Fed meetings ever.

The Federal Open Market Committee (FOMC) will decide on how to tweak baseline interest rates on March 22, amid suspicions that the ongoing U.S. banking crisis has disrupted policy.

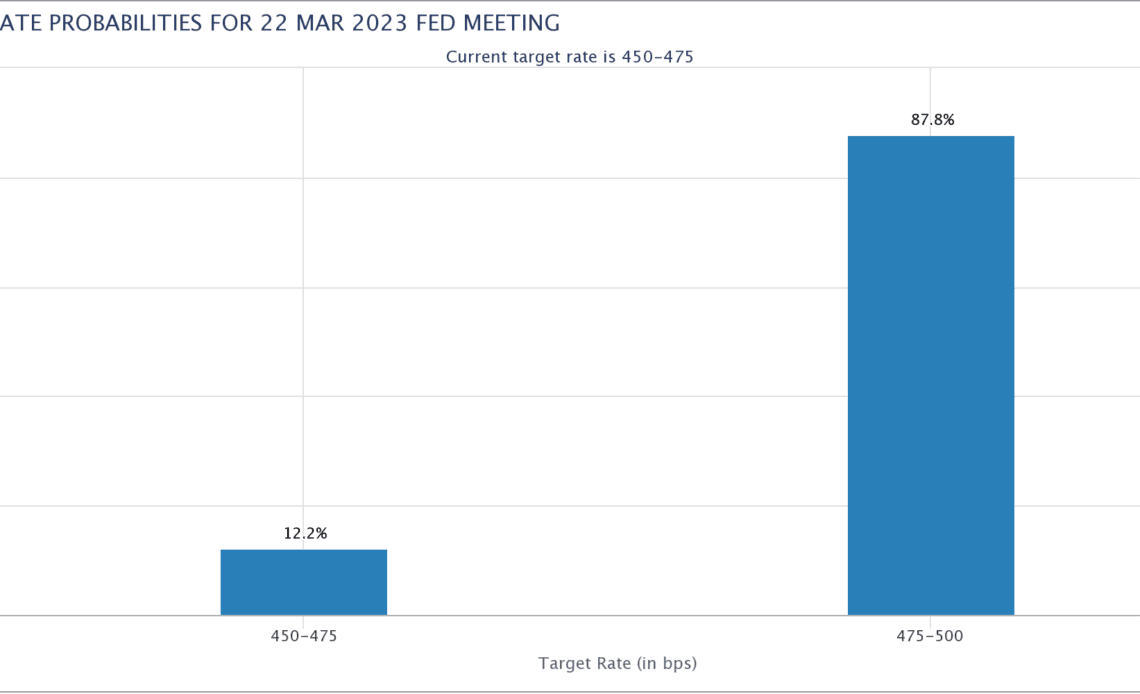

From ongoing rate hikes forecast just last month, markets are now considering the chances that the Fed will pause the cycle, data from CME Group’s FedWatch Tool shows.

This would be a key boon for risk assets, as the Fed would be tacitly implying that the eighteen months it has spent removing liquidity from the economy has not been the silver bullet to recovery.

Liquidity is already on the up thanks to the failure of several banks, Cointelegraph reported, with a chunk of the quantitative tightening (QT) removals undone in a single week.

“So FOMC today which means one thing, VOLATALITY. No doubt we will trend sideways util the meeting, which means tread cautiously,” Crypto Tony told Twitter followers in a brief on the day.

“My main play is to take profit at $30,000 if it comes.”

Markets commentator Tedtalksmacro meanwhile laid out the probabilities of each Fed path and their likely impact on risk assets.

FOMC scenarios.

50bps hike (outlier): short risk assets, bear trend resumes.

25bps hike (most likely): Nothing burger, the dot plot + press conference dictate the market’s move.

Pause (second most likely): Get very long #Bitcoin

Cut (outlier): Mortgage the house and buy BTC pic.twitter.com/gkrPXfloEc

— tedtalksmacro (@tedtalksmacro) March 21, 2023

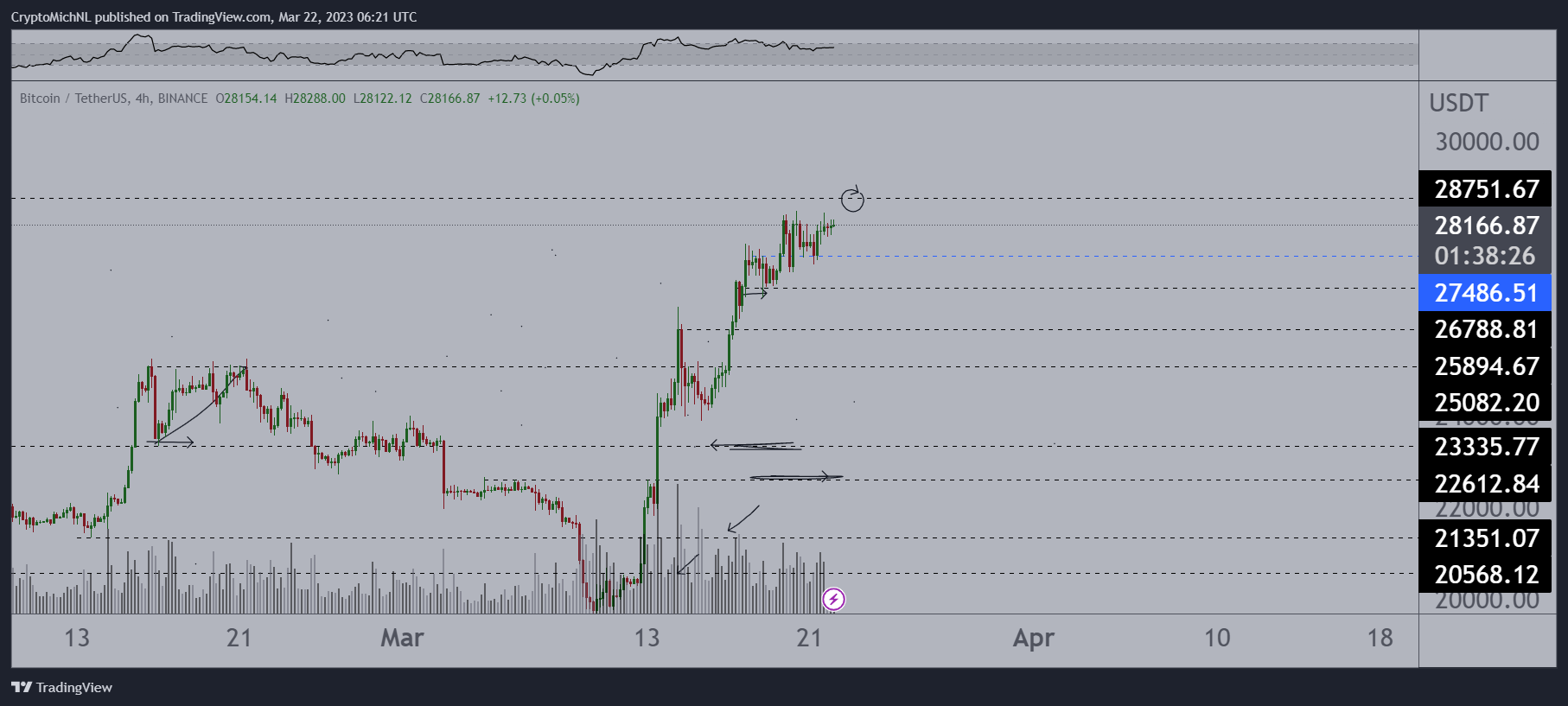

“Slow grind upwards on Bitcoin, which means that my eyes are still focused on $28,700,” Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, continued.

“I’m expecting us to sweep into that high around FOMC and then we’ll have some consolidation. CME gap at $28,700 too.”

Van de Poppe referred to a so-called “gap” on CME Group’s Bitcoin futures markets formed when…

Click Here to Read the Full Original Article at Cointelegraph.com News…