Nonfungible tokens (NFTs) saw a massive surge in popularity in 2021, accompanied by sky-high prices, but the market has since come crashing back to earth, and it’s unclear whether there will be a resurgence.

NFTs are unique digital tokens recorded on a blockchain to certify ownership and authenticity. They can’t be copied or substituted but can be transferred and sold by their owner.

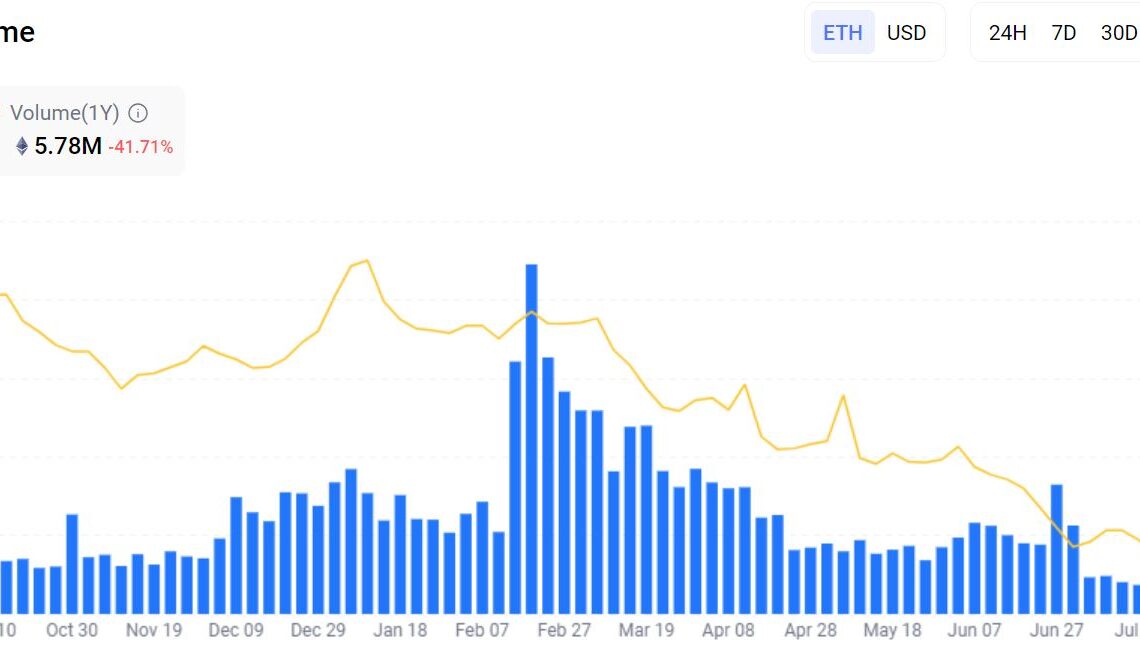

According to analytics platform NFTGo, the NFT market cap valued in Ether (ETH) is down 40.59% over the past year at the time of writing, with trading volume down 40.81%.

The market cap in U.S. dollars is down 41.16%, and its volume has dropped 66.77%. At the same time, market sentiment is ranked 13 out of 100, with an overall rating of “cold.”

Arno Bauer, senior solution architect at BNB Chain, told Cointelegraph that from a utility perspective, NFT projects are increasingly adding value and that this growth in functionality is where the future of NFTs likely lies.

Bauer said the NFT market is showing “promising signs of innovation and creativity,” which holds great potential for the growth and evolution of the tech.

Related: Crypto lawyer about SEC: ‘Problematic to imply all NFTs are securities’

“Market sentiment, cultural shifts towards digital ownership, and the potential for NFTs to be integrated into various aspects of our lives also contribute to a positive outlook for the future of NFTs,” he said.

“While current market conditions might seem subdued, the ongoing innovation and potential for integration with both digital and physical worlds suggest that NFTs have not had their day and that their continued relevance and growth are highly probable,” Bauer added.

NFTs in the long term

As for long-term use cases, Bauer said NFTs will “likely evolve” over time and become increasingly linked to real-world assets, such as property ownership or unique physical goods.

Currently, NFTs have been most successful in the art world, with some selling for tens of millions of dollars.

Digital artist Pak sold an NFT project titled “The Merge” for $91.8 million on Nifty Gateway in 2021, while Mike Winkelmann, also known as Beeple, sold “Everydays: The First 5000 Days” for $69.3 million via Christie’s auction house the same year.

Blockchain games also use NFTs to represent in-game items such as weapons and armor, and there is speculation the tech will make the jump to…

Click Here to Read the Full Original Article at Cointelegraph.com News…