The percentage of family offices investing in crypto has grown significantly in the past two years, according to a new report by Wall Street giant Goldman Sachs.

In a new study, the banking titan polled 166 family offices across the globe that operate at an institutional level.

A family office is a specialized firm that offers personalized financial, investment and administrative services to a single family or a small group of related families. These offices manage a variety of assets, including cash, stocks, bonds, real estate and alternative investments. Aside from asset management, they also provide services like tax planning, estate planning and philanthropy.

According to the survey, more than a quarter of the family offices polled are now invested in crypto, representing a notable jump from the figures reported in 2021.

“Within the digital asset ecosystem, opinions on cryptocurrencies seem to have crystallized since our last survey: a greater proportion of family offices are now invested in cryptocurrencies – 26% versus 16% in 2021.”

While family offices “have become more decisive about cryptocurrencies,” the percentage of firms expressing interest in investing in crypto down the road has sharply declined since the 2021 survey.

“However, 62% are not invested and not interested in investing (in cryptocurrencies) in the future, compared with 39% in 2021, and just 12% indicated potential future interest, down from 45% in 2021.”

The report also notes that 32% of the family offices surveyed have exposure to the crypto industry, including investments in blockchain technology, stablecoins, non-fungible tokens (NFTs), decentralized finance (DeFi) and blockchain-focused funds.

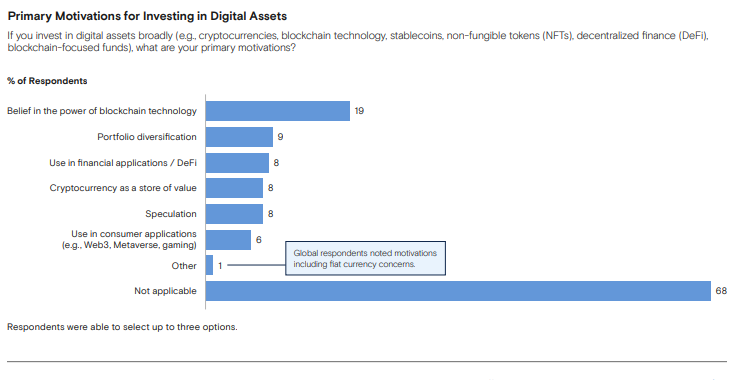

Additionally, the survey finds that among those family offices invested in crypto, 19% were motivated due to their belief in the power of blockchain technology, with 9% citing portfolio diversification and 8% mentioning the financial applications offered by DeFi.

Only 8% invest in crypto due to its potential as a store of value.

You can read the full report here.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk…

Click Here to Read the Full Original Article at The Daily Hodl…