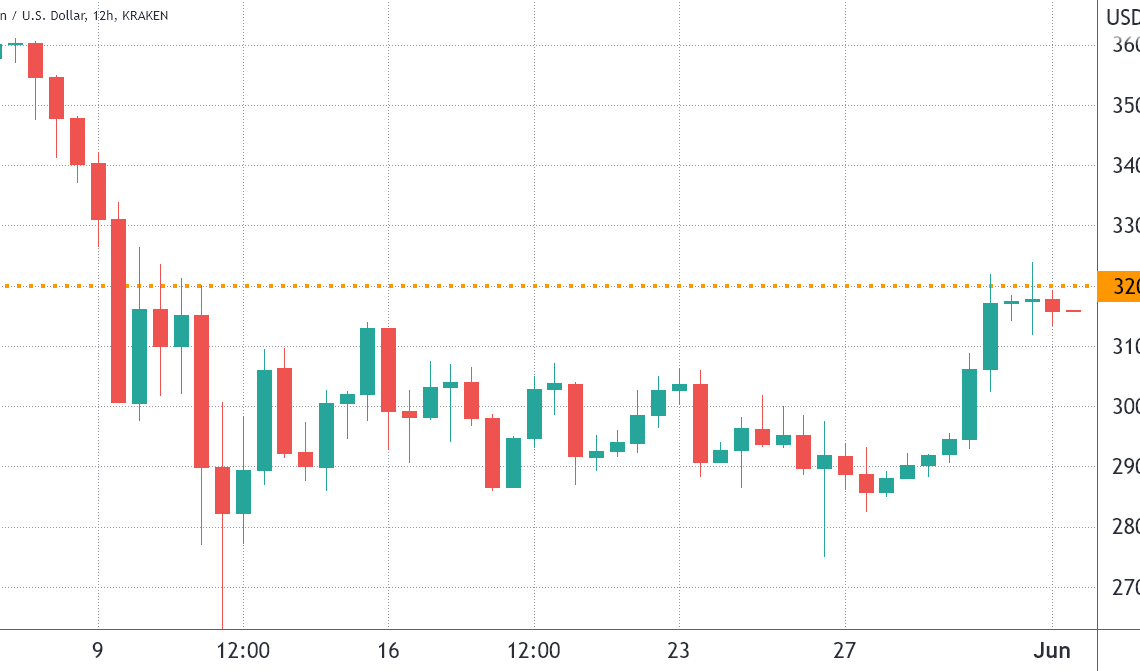

Twenty-three agonizing days have passed since Bitcoin (BTC) last closed above $32,000 and the 10% rally that took place on May 29 and May 30 is currently evaporating as BTC price retraces toward $30,000. The move back to $30,000 simply confirms the strong correlation to traditional assets and in the same period the S&P 500 also retreated 0.6%.

Weaker corporate profits could pressure the stock market due to rising inflation and the upcoming U.S. Federal Reserve interest rate hikes, according to Citi strategist Jamie Fahy. As reported by Yahoo! Finance, Citi’s research note to clients stated:

“Essentially, despite concerns regarding recession, earnings per share expectations for 2022/2023 have barely changed.”

In short, the investment bank is expecting worsening macroeconomic conditions to reduce corporate profits, and in turn, cause investors to reprice the stock market lower.

According to Jeremy Grantham, co-founder and chief investment strategist of GMO, “We should be in some sort of recession fairly quickly, and profit margins from a real peak have a long way that they can decline.”

As the correlation to the S&P 500 remains incredibly high, Bitcoin investors fear that the potential stock market decline will inevitably lead to a retest of the $28,000 level.

The correlation metric ranges from a negative 1, meaning select markets move in opposite directions, to positive 1, which reflects a perfect and symmetrical movement. 0 would show disparity or a lack of relationship between the two assets.

Currently, the S&P 500 and Bitcoin 30-day correlation stands at 0.88, which has been the norm for the past couple of months.

Bearish bets are mostly below $31,000

Bitcoin’s recovery above $31,000 on May 30 took bears by surprise because only 20% of the put (sell) options for June 3 have been placed above such a price level.

Bitcoin bulls may have been…

Click Here to Read the Full Original Article at Cointelegraph.com News…