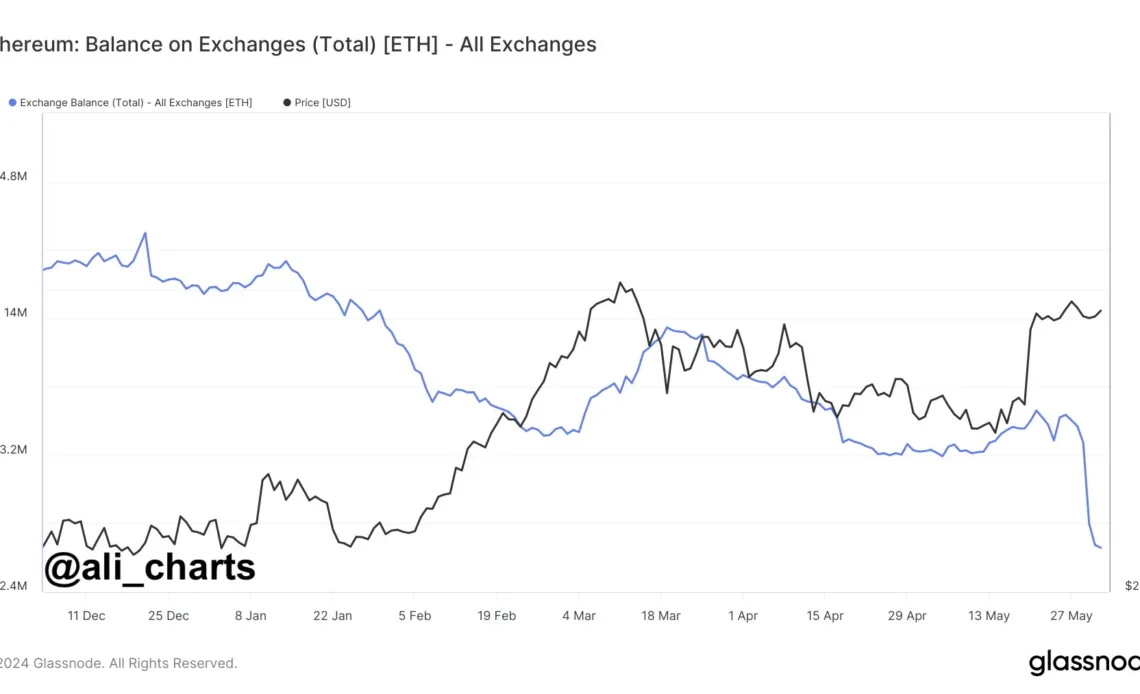

An on-chain analyst and trader says crypto exchanges have been witnessing massive Ethereum outflows since the listing approval of spot ETH exchange-traded funds.

Ali Martinez tells his 63,500 followers on the social media platform X that market participants have taken out 777,000 ETH worth $3 billion from crypto exchanges since the U.S. Securities and Exchange Commission (SEC) green-lighted spot ETH ETFs last month.

At time of writing, Ethereum is trading at $3,776, a fractional decrease in the past day.

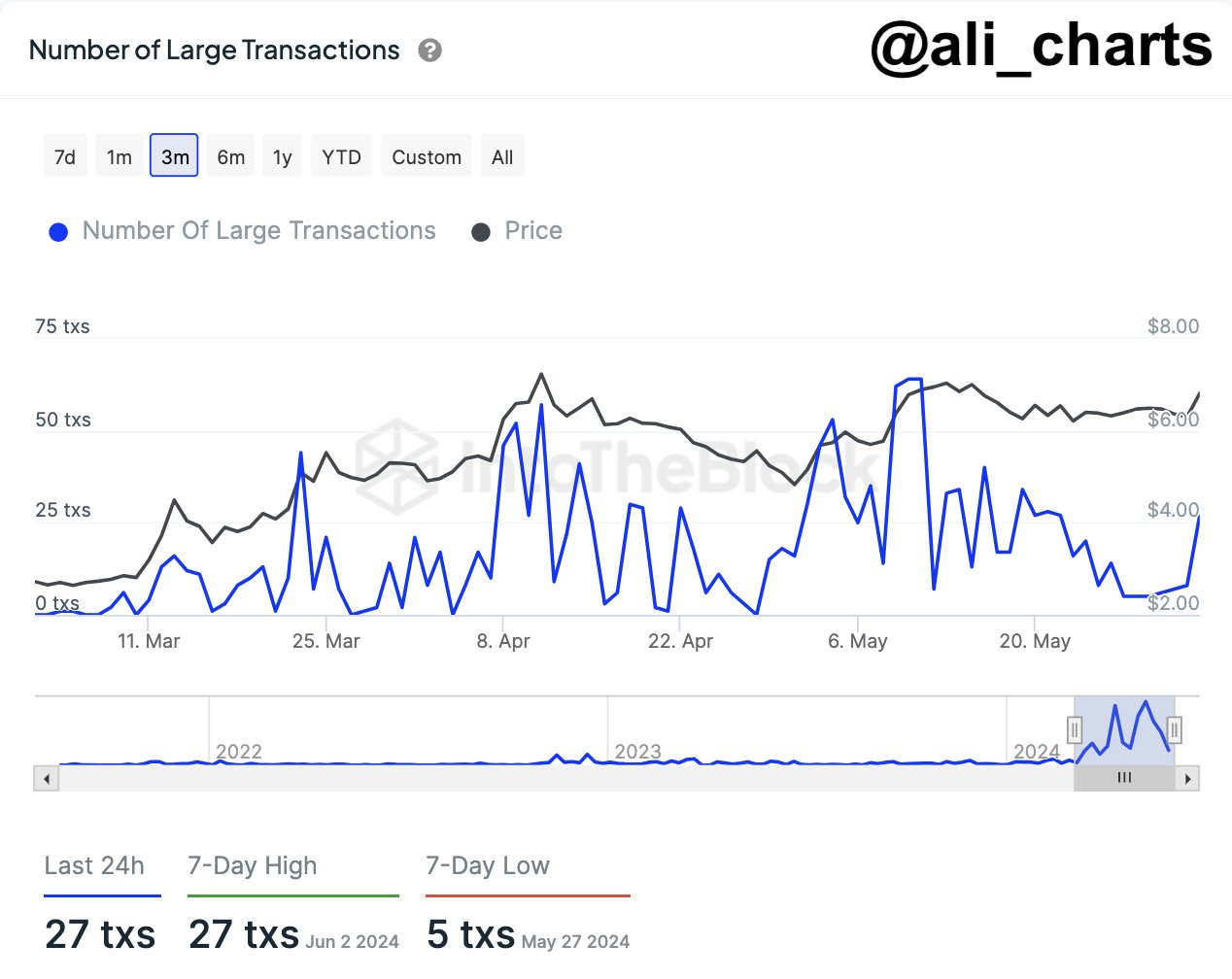

Turning to fellow layer-1 protocol Toncoin (TON), the analyst says deep-pocketed investors have been busy moving the altcoin.

“The number of large Toncoin transactions (over $100,000) has surged by 237.5% in 24 hours!

This significant increase in TON whale activity suggests a strategic shift in their investments and positions.”

At time of writing, TON is trading at $6.81, down 1.24% in the last 24 hours.

Looking at Bitcoin (BTC), Martinez says the crypto king may print a new all-time high if it manages to trade above its diagonal resistance.

“Bitcoin appears to be breaking out from a symmetrical triangle! A sustained close above the $69,330 resistance level could send BTC to $74,400.”

At time of writing, Bitcoin is worth $68,938, up 1.56% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…