Bitcoin’s big start to the week is triggering a massive amount of liquidations across the crypto markets.

At time of writing, Bitcoin is trading at $53,584 while Ethereum changes hands for $3,152, prices not seen since November of 2021.

According to crypto data aggregator Coinglass, $182.33 million in liquidations have rocked traders on Binance, Bybit, OKX, Huobi and others, the vast majority of which have come from those trying to short BTC in recent hours.

As the price of BTC breaks through the wall of shorts, analysts are speculating on what the next major levels of resistance are.

Glassnode founders Jan Happel and Yann Allemann, who share the Negentropic handle on the social media platform X, say that BTC is gearing up to break out of its multi-week range with an initial target of $57,000 before all-time highs.

“BTC now seems to finally break out from the range it has been in since Feb. 15.

Momentum is moving up strongly. All sails are set.

Next level is 57-58 – before ATH.”

According to the analysts, all-time highs may come sooner than most people expect.

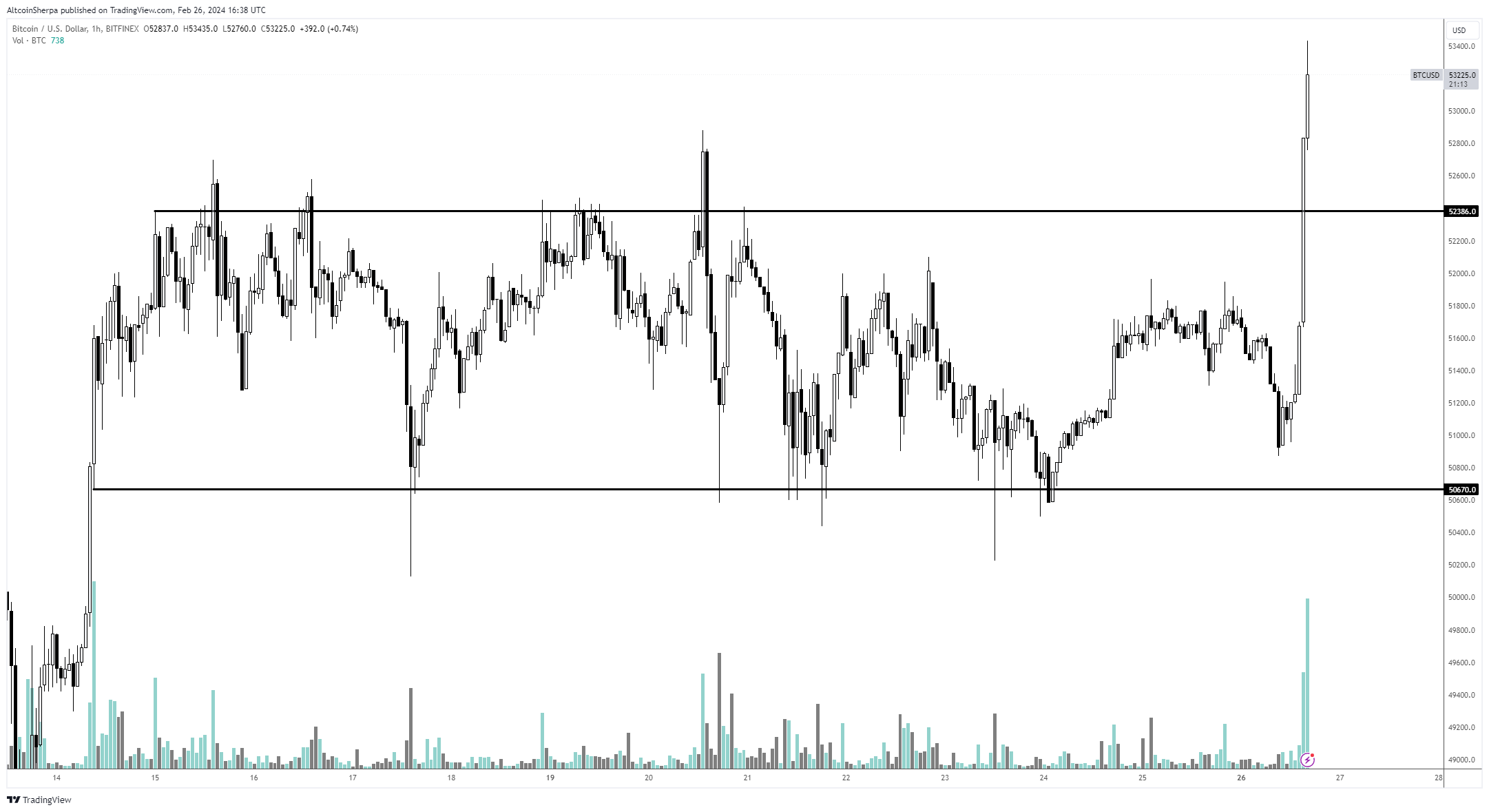

Pseudonymous analyst Altcoin Sherpa shares with his 208,000 followers on X a chart also suggesting that BTC has cleanly broken out of a range between $50,600 and $52,300.

“BTC: I have no idea why we’re pumping but I’m all for it. Expecting BTC to mostly still outperform the majority of altcoins though in the short term.”

In a new interview with SkyBridge Capital founder Anthony Scaramucci on the Wealthion YouTube channel, venture capitalist Dan Tapiero says that he’s not anticipating a significant correction for Bitcoin, and that BTC likely will never go into the $20,000s ever again.

“So if you’re saying do I think we’re going to go back down to the $20,000, $18,000 lows in Bitcoin, I don’t see it at all.

I think we’re in the second inning of this bull market, so I’d be much more concerned and think that there [could be] problems potentially if I felt we were in the seventh inning, the eighth inning. The bullish consensus at 75%-80% – I mean that’s an issue but maybe [it] just means you have a short-term correction.

We’re just getting started here.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…