The XRP price has seen a sharp rally of over 39% in the past week as on-chain data shows the sharks and whales have been busy accumulating.

XRP Sharks & Whales Now Carry Over 85% Of The Entire Supply

According to data from the on-chain analytics firm Santiment, large XRP investors have been participating in buying for a while now. The indicator of relevance here is the “Supply Distribution,” which keeps track of the total amount of supply that a particular wallet group is currently holding.

The addresses or investors are divided into these cohorts based on the number of tokens they carry in their balance. For instance, the 1 to 10 coins group includes all holders who own between 1 and 10 XRP.

In the context of the current topic, the combined group of sharks and whales is of interest. The sharks and whales are the two largest cohorts in the sector, so their behavior can be worth keeping an eye on, as it may cause ripples in the market. Naturally, the whales are the more influential of the two groups.

Santiment defines the lower bound for the combined sharks and whales group as 100,000 tokens. At the current exchange rate of the cryptocurrency, this is worth around $61,200.

Below is a chart that shows the trend in the XRP Supply Distribution for these sharks and whales over the past few months:

The above graph shows that the XRP sharks and whales have seen their supply rise over the last few months. These large investors now hold around 51.59 billion XRP, equivalent to around 85% of the entire circulating supply of the cryptocurrency.

In terms of the pure balance, the supply of this combined cohort has managed to set a new all-time high (ATH) with the latest increase, while in terms of the percentage, the metric is sitting at an 11-month high.

The accumulation from the sharks and whales has persisted in this period regardless of whether the cryptocurrency’s price has been rallying or plunging. This conviction from these key investors is naturally an optimistic sign for the asset.

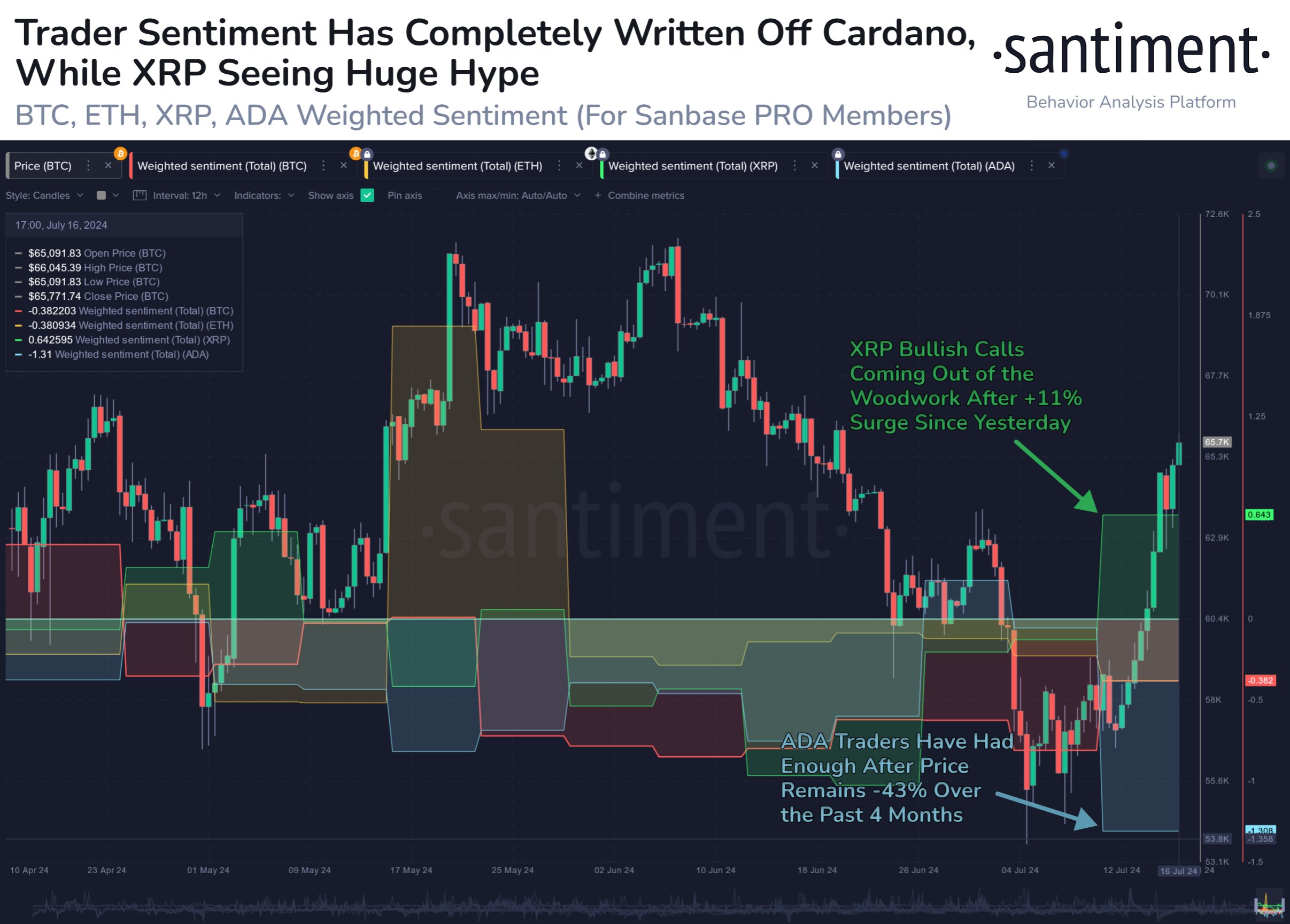

While the coin seems bullish in the long term due to this, another development can be a bearish predictor in the short term. As Santiment has pointed out in another X post, investors have shown hype toward XRP on social media.

As the chart shows, the sentiment towards the asset has shot up into positive territory following its recovery rally. Historically, cryptocurrencies have tended to move opposite to the majority’s expectations, so this FOMO can end up as an obstacle to…

Click Here to Read the Full Original Article at NewsBTC…