A recent report by Messari sheds light on the state of the XRP Ledger (XRPL) and its notable performance during the fourth quarter (Q4) of 2023.

The report highlights significant milestones, including its native token market capitalization, distribution, burning mechanism, price movement, legal battle, and network activity.

Distribution Of 4 Billion XRP Contributes To Market Cap Growth?

As of Q4 2023, XRP, the native token of the XRPL, emerged as the sixth-largest cryptocurrency by market capitalization, reaching $33.7 billion. The token’s circulating market cap witnessed a substantial 21.2% increase quarter-over-quarter (QoQ) and an impressive 93.6% growth year-over-year (YoY).

According to Messari, the increase in market capitalization was primarily due to the distribution of 4 billion XRP and a significant price spike on November 13, when the token reached as high as $0.7503.

Throughout 2023, 4 billion tokens were distributed, accounting for 8% of the XRP supply from the end of 2022. While this distribution contributed to the increase in market cap, it was overshadowed by the impact of the price spike.

Additionally, the XRPL employs a transaction fee-burning mechanism, applying deflationary pressure to the total supply of 100 billion XRP. However, the low transaction fees on the network have resulted in a relatively low burn rate of approximately 12 million XRP since the inception of the XRP Ledger.

Network Activity Shows Mixed Trends In Q4 2023

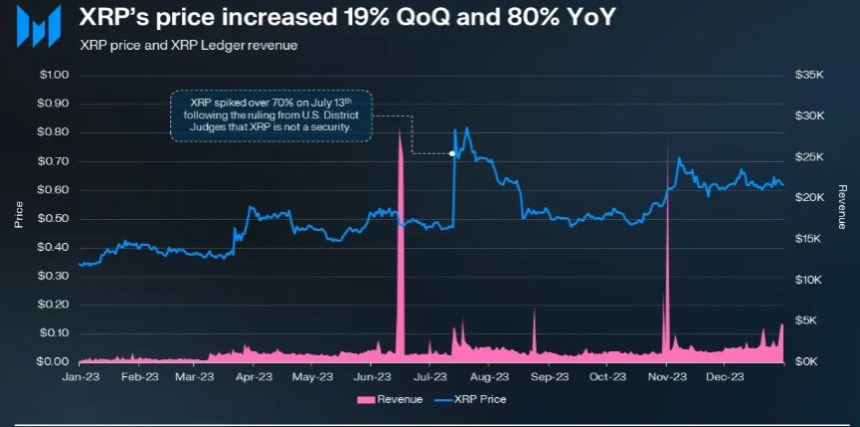

Q4 2023 marked a significant turning point for XRP, concluding a multi-year legal battle with the US Securities and Exchange Commission (SEC). In July 2023, the district court ruled that XRP is not considered an investment contract or a security, distinguishing it from many other blockchain assets.

This ruling triggered a surge in XRP’s price, with an increase of over 70% on July 14 and a peak of $0.82 on July 20. The subsequent relisting of XRP on major cryptocurrency exchanges further bolstered its position.

Network activity on the XRPLedger displayed mixed trends in Q4. While active addresses decreased by 31.3% QoQ, transactions increased by 22.7% QoQ.

Notably, a significant portion of transaction activity originated from a group of accounts sending transactions to a single account for…

Click Here to Read the Full Original Article at NewsBTC…