XRP, the cryptocurrency known for its ties to Ripple, has recently faced a bout of volatility in the market.

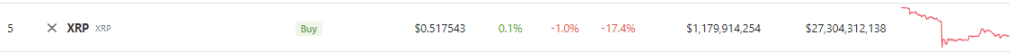

The coin’s value, currently hovering around $0.517 according to CoinGecko, experienced a 1.0% decline in the past 24 hours alone. Over the span of a week, XRP witnessed a significant 17.4% slump, reflecting the ongoing volatility that has come to characterize the cryptocurrency market.

Despite its potential, XRP’s journey to break through the 200 Exponential Moving Average (EMA), a significant technical indicator, has hit a roadblock, casting doubts on its short-term performance.

Understanding XRP’s 200 EMA And Its Impact

The 200 EMA is a widely followed technical indicator that helps traders and analysts gauge the overall trend of a cryptocurrency’s price. It calculates the average price of an asset over a specific time period, giving more weight to recent data points.

Breaking through the 200 EMA is often seen as a bullish sign, suggesting that the cryptocurrency’s price is gaining momentum and may experience upward movement.

However, XRP’s recent struggle to surpass this threshold highlights the challenges it faces in regaining solid footing in the market.

Market observers suggest that the failure to breach the 200 EMA could be attributed to the broader market sentiment, regulatory concerns, and the ongoing lawsuit between the US Securities and Exchange Commission and Ripple.

XRP: Weekend Recovery And Regulatory Complexities

Over the weekend, XRP exhibited signs of recovery, momentarily soothing investor jitters. Notably, this recovery came in the absence of any new regulatory filings from both the SEC and Ripple regarding their ongoing lawsuit.

The lawsuit has played a crucial role in shaping XRP’s price trajectory, causing significant fluctuations based on legal developments.

In the initial stages of the SEC-Ripple lawsuit, the SEC categorized XRP as a “digital asset security,” raising concerns about its regulatory status and potential impact on the broader cryptocurrency landscape.

However, the regulatory body has since shifted its stance, asserting that digital assets lack inherent value and are merely strings of computer code.

This evolving perspective has introduced a layer of complexity to XRP’s regulatory outlook, influencing both investor sentiment and price dynamics.

As the XRP market navigates through these regulatory intricacies and attempts to find stable ground, analysts and traders are keeping a close eye on both…

Click Here to Read the Full Original Article at NewsBTC…