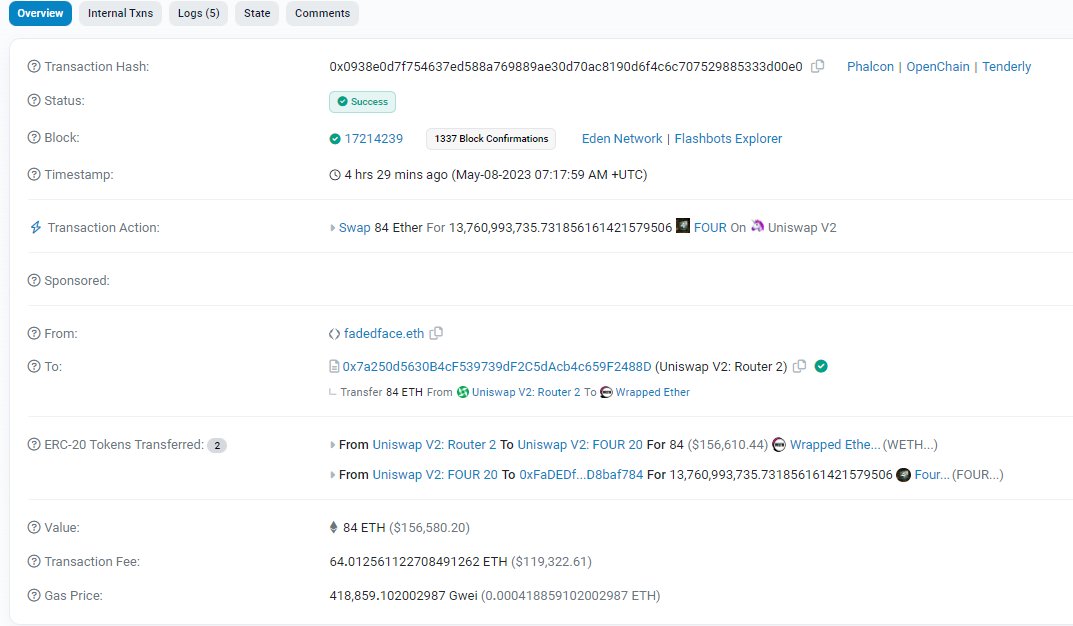

A single trader just spent a staggering 64 Ether — equivalent to $118,000 — in gas fees purchasing $155,000 worth of a memecoin called Four (FOUR).

According to an update from the popular blockchain tracking service ‘Whale Alert’, the lone trader paid an astonishing $119,157 in Ether (ETH) to complete a Unsiwap trade that swapped 84 Wrapped Ether (WETH) for 13.8 billion FOUR tokens.

A fee of 64 #ETH (119,121 USD) has just been paid for a single transaction!https://t.co/3w4UD0AZbw

— Whale Alert (@whale_alert) May 8, 2023

It appears as though the trader voluntarily increased their gas fee to speed up the transaction time to purchase the memecoin. According to pseudonymous Twitter user @FlurETH, the trader in question is sitting on 133 ETH ($245,667) in unrealized profit on their investment in the memecoin.

Gas fees on the Ethereum network have become the subject of debate amongst the crypto community, with a number of prominent Etheruem advocates praising the heightened activity for its revenue generating effects and long-term deflationary pressure on the supply of Ether.

Arbitrum One, an Ethereum layer 2 network, just did more daily fee revenue than Bitcoin.

Not to mention that Ethereum itself did more than 28x the fee revenue of Bitcoin in the same time period. pic.twitter.com/plLEzdynNB

— sassal.eth (@sassal0x) April 20, 2023

Others have leveled criticism at the fees, claiming that unless the network becomes more “affordable” mass adoption will never be achieved.

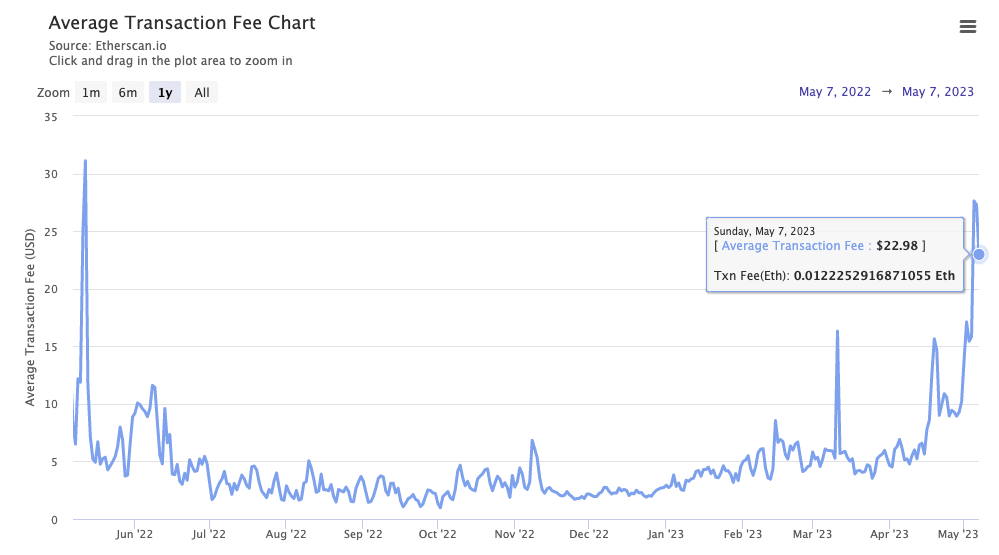

As reported by Cointelegraph, one of the main drivers behind the increase in Ethereum gas fees comes from the recent meme coin hysteria, driven in large part by the frenzied buying of a new memecoin called Pepe (PEPE). At the time of publication, the average Ethereum transaction fee is sitting at $22.98, the highest level recorded since May 12, 2022 where the average fee reached a peak of $31.11.

Click Here to Read the Full Original Article at Cointelegraph.com News…