Bitcoin’s shrinking supply: What’s going on?

With less BTC in circulation, experts are bracing for a potential supply shock.

Bitcoin’s hard cap of 21 million coins has always been central to its appeal. However, by 2025, this built-in scarcity is no longer just a theoretical feature; it’s becoming a market reality. 93% of all Bitcoin has already been mined, and since the network’s fourth halving in April, which cut miner rewards in half, fewer new coins are entering circulation each day.

At the same time, long-term holders are sitting tight. A growing share of Bitcoin is now locked in cold storage, tied up in institutional holdings or presumed lost. About 70% of the Bitcoin supply hasn’t moved in at least a year, a sign that liquidity is drying up.

With the addition of increasing demand from spot exchange-traded funds (ETFs), public companies and even sovereign wealth funds, the result is a tightening market that has analysts warning of a potential supply shock, a moment when available Bitcoin (BTC) on exchanges becomes too scarce to meet demand, potentially triggering sharp price moves.

Michael Saylor’s Bitcoin Strategy: Relentless accumulation

Saylor’s Strategy now holds about 3% of all Bitcoin that will ever exist, and he’s not slowing down.

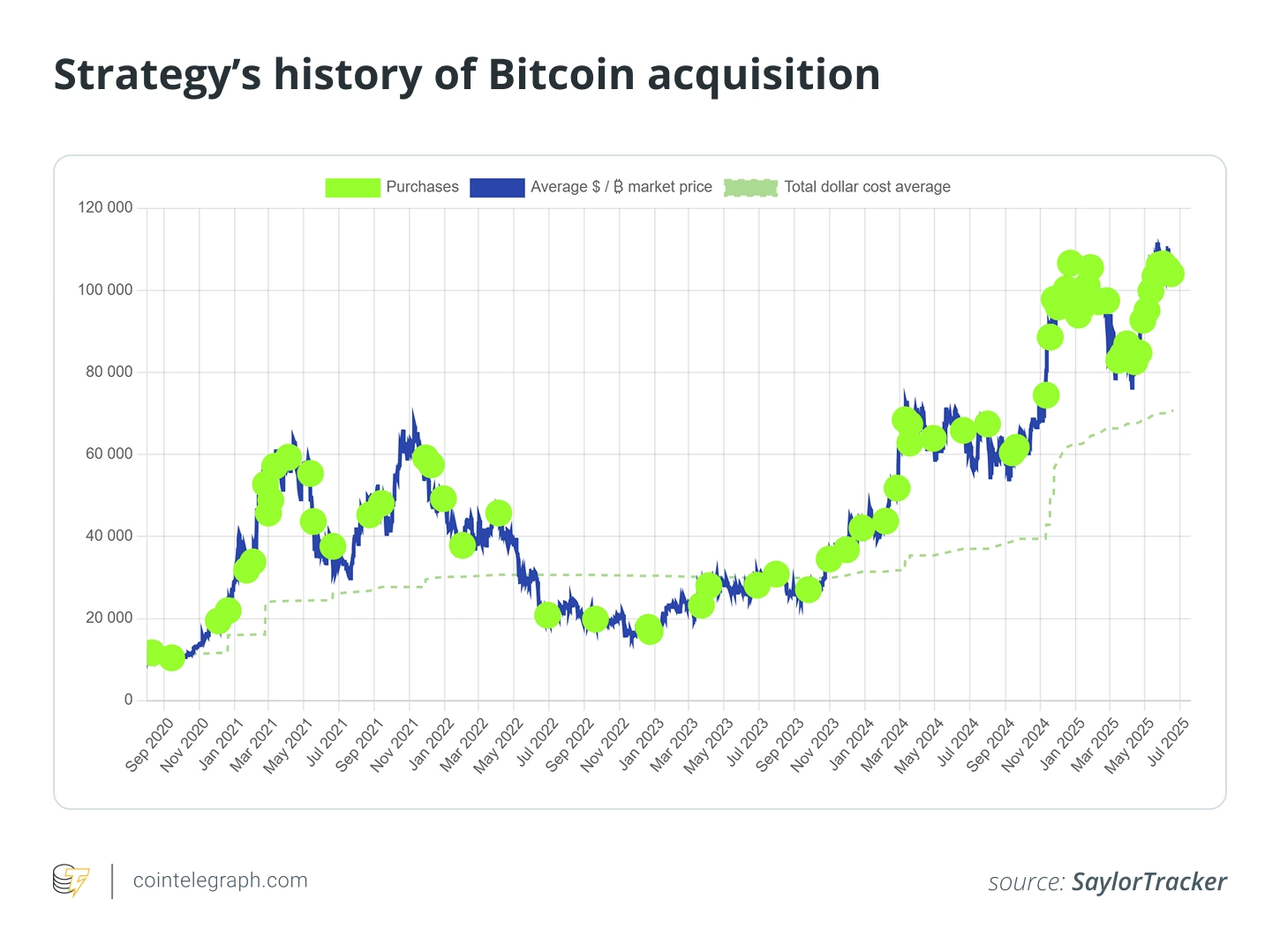

Michael Saylor, executive chairman of Strategy, has made Bitcoin accumulation his life’s mission. Since 2020, he’s turned the software company into a full-blown BTC holding vehicle, borrowing money, issuing stock and spending company cash to buy more Bitcoin.

As of mid-2025, Strategy holds more than 2.75% of the total Bitcoin supply (approximately 582,000 BTC) and continues to buy more every month. This aggressive approach fuels concerns that a BTC supply crisis may be on the horizon. Fewer coins available on exchanges means less liquidity, especially for new entrants or retail traders looking to buy in.

Did you know? Strategy now sits atop the public leaderboard for BTC reserves, holding more coins than the US and Chinese governments combined. Its stash is almost twelvefold larger than that of the next-closest holder, Marathon Digital Holdings.

Bitcoin supply meets institutional demand

Institutions are no longer just watching crypto — they’re buying in…

Click Here to Read the Full Original Article at Cointelegraph.com News…