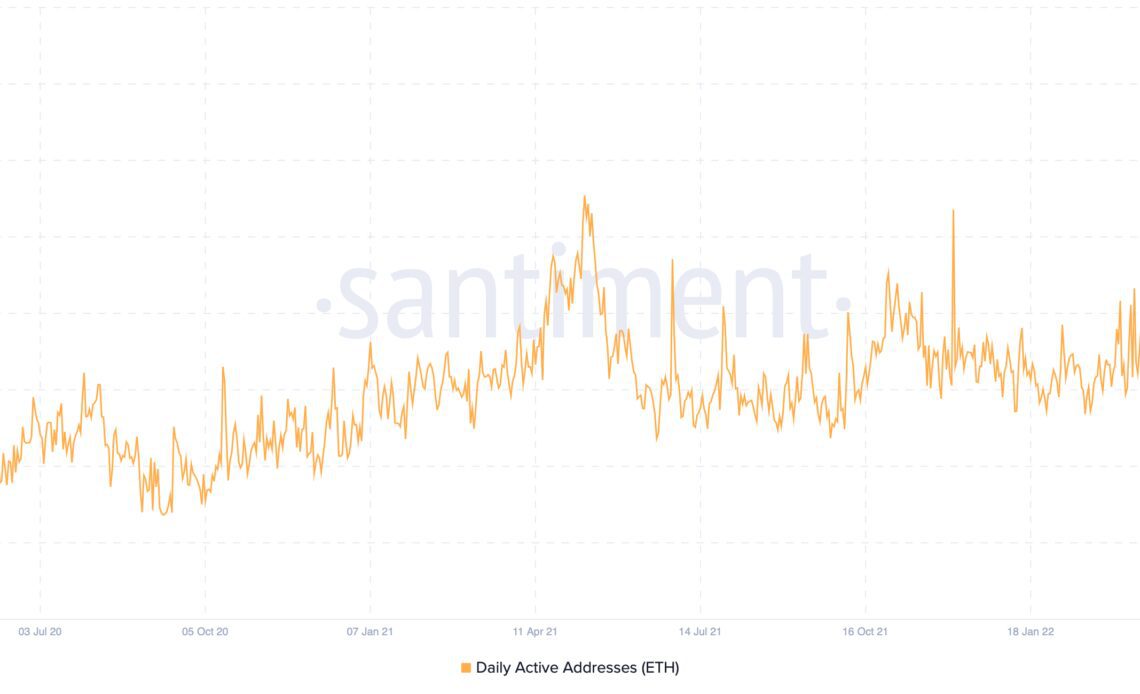

Ethereum has witnessed a substantial drop in its daily active address (DAA) count over the last four months, raising fears about more downside for ETH (ETH) price in the coming weeks.

Stagnant Ethereum price spooks investors

The number of Ether DAA dropped to 152,000 on Oct. 21, its lowest level since June, according to data provided by Santiment. In other words, the plunge showed fewer unique Ethereum addresses interacting with the network.

Interestingly, the drop comes after Ether’s 80%-plus correction from its November 2021 high of around $4,850. This coincidence could mean two things: Ethereum users decided to leave the market and/or paused their interaction with the blockchain network after the market’s downturn.

Santiment analysts blamed the drop on “weak hands,” sentimental traders who drop out of the market during a bearish or stagnant phase, noting:

“Disinterest [is] at a high as [the Ethereum] prices have stagnated.”

Notably, Ether’s price has been trading inside the $1,200-$1,400 range for over a month, accompanied by a drop in weekly trading volumes.

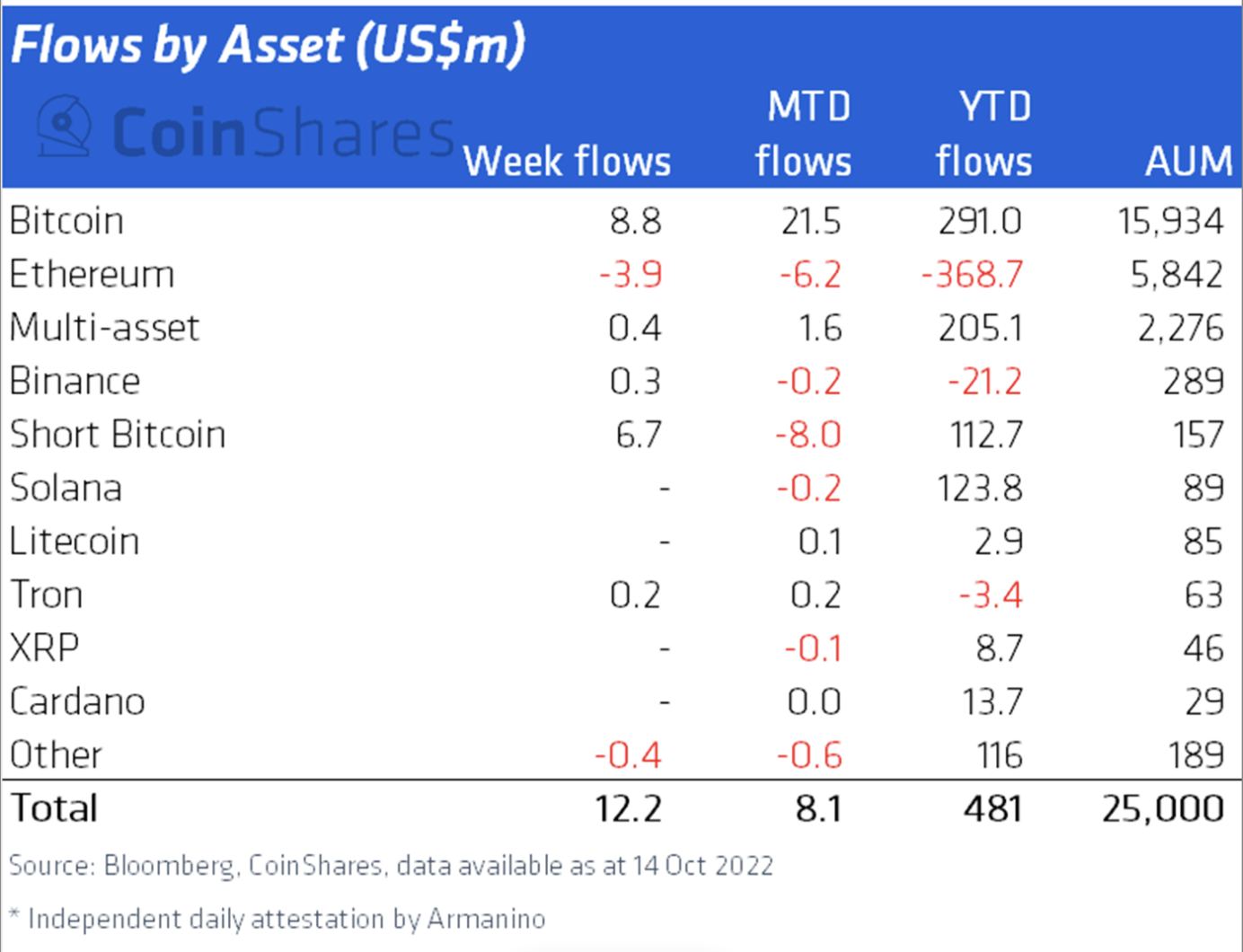

Disinterest among investors is also visible across Ethereum-based investment funds. These funds witnessed outflows worth $3.9 million in the week ending Oct. 14, according to CoinShares’ latest weekly report.

Moreover, these outflows have reached $368.70 million on a year-to-date (YTD) timeframe.

40% ETH price crash in play

Crypto prices have tumbled across 2022 with other riskier assets, brought down by global central banks’ tightening policies to tame rising inflation. However, they risk bearish continuation as inflation remains elevated, prompting more rate hikes in the future.

⚠️BREAKING:

*MAY 2023 FED FUND FUTURES HIT 5.00% AS TRADERS PRICE IN ANOTHER RATE HIKE

— Investing.com (@Investingcom) October 20, 2022

Ethereum could suffer due to

Click Here to Read the Full Original Article at Cointelegraph.com News…